DH Unplugged

Dvorak/Horowitz

Dvorak and Horowitz Unplugged

- 59 minutes 36 secondsDHUnplugged #699: Flesh Wound

Markets having a tough time and a big week of data is coming.

Got the 5% correction – is there more?

M&A – Another deal dies

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Markets having a tough time

- Happy Passover!

- SHOW 700 coming up!

- Happy belated 420 Day to our fine smoky listeners

- Jumping to Conclusions

- We have a limerick!Market Update

- Big week(s) coming for economics

- Got the 5% correction - is there more?

- M&A - Another deal dies

- Earnings - Tech on deck

- Historic Treasury Auction this week - need to pay the bills since tax receipts not doing it and lots of debt outstandingWho Would think???

- UK - FTSE 100 at all-time high!Recap:

- Microsoft Corp., Meta Platforms Inc., Google parent Alphabet Inc. and Tesla Inc., all of which are among the so-called Magnificent Seven group of tech giants, will report THIS WEEK week.

- Technology stocks are selling off, with the Nasdaq 100 Index registering its biggest weekly drop since November 2022 in the midst of a four-week losing streak, its longest since December 2022.

- Even AI darling Nvidia Corp. is getting hit, plunging 10% on Friday and wiping out $212 billion in market value for its worst day since the Covid pandemic in March 2020.MAG7 Profit Outlook

- But hope is on the horizon. Profits for the Mag Seven — which also includes Apple Inc., Amazon.com Inc. and Nvidia — are forecast to rise 38% in the first quarter from a year ago, dwarfing the overall S&P 500’s 2.4% anticipated year-over-year earnings growth, according to Bloomberg Intelligence data.

- Around 178 S&P 500 companies — representing more than 40% of the index’s market capitalization — will post results next week. But the biggest expectations are for megacap tech firms.

= = Nvidia, which Goldman Sachs Group Inc.’s trading desk dubbed “the most important stock on planet Earth,” doesn’t report its earnings for another month.Tesla

- Stock down a lot - DOWN 43% YTD

- Down 65% from high set November 2021

- Tesla is recalling nearly 3,900 of its Cybertrucks due to an issue with the vehicle's accelerator pedal.

- The recall, announced Wednesday, was prompted by accelerator pedal pads in the trucks that "may dislodge and cause the pedal to become trapped by the interior trim,"

- All of the 3,878 of the 2024 Cybertrucks that Tesla built between Nov. 13 and April 4 are subject to the recall, the electric vehicle maker’s safety recall report said.

- And then: Tesla on Saturday slashed the price of its Full Self-Driving (FSD) driver assistant software to $8,000 from $12,000 in the United States, as CEO Elon Musk reaffirms his commitment to self-driving technology.

- Musk is betting the technology will become a major source of revenue for the world's most valuable automaker. But he has for years failed to achieve the goal of self-driving capability, with the technology under growing regulatory and legal scrutiny.

----- Could be a short squeeze setting up for earnings (Tonight) - READ MORE>>>>>Tesla Earnings

- Tesla misses by $0.04, misses on revs, gross margin down 199 bps yr/yr, reiterates that in 2024, vehicle volume may be notably lower than the growth rate achieved in 2023

- Total GAAP gross margin of 17.4%, down 199 bps yr/yr.

- Operating expenses up 37% yr/yr to $2.53 bln.

- Total Deliveries down 9% to 386,810.

- Outlook: Co states, "Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and we believe the next one will be initiated by advances in autonomy and introduction of new products, including those built on our next generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next generation vehicle and other products. In 2024, the growth rates of energy storage deployments and revenue in our Energy Generation and Storage business should outpace the Automotive business."Salesforce M&A

- One week ago, the Wall Street Journal first reported that CRM was exploring a purchase of INFA and that news did not go over well with either shareholder base.

- In fact, not including Monday'ss moves, CRM and INFA are lower by 8% and 9%, respectively, since that initial story broke on April 15

- Deal DeadPCE Index Report (Friday)

Change From Month One Year Ago February 2024 +2.8% January 2024 +2.9% December 2023 +2.9% November 2023 +3.2%

- The PCE Price Index Excluding Food and Energy, also known as the core PCE price index, is released as part of the monthly Personal Income and Outlays report. The core index makes it easier to see the underlying inflation trend by excluding two categories – food and energy – where prices tend to swing up and down more dramatically and more often than other prices. The core PCE price index is closely watched by the Federal Reserve as it conducts monetary policy.

- Looking for somewhere between 0.3 and 0.4 MoM and there is hope that this stays under 3% YoY -China Playing Hardball

- Apple has removed popular messaging apps like WhatsApp, Telegram and Signal from its iPhone app store in China after the Chinese government ordered the company to do so, The Wall Street Journal reported last Friday.

- Citing a person familiar, the Journal reported that the Cyberspace Administration of China asked Apple to remove Meta-owned WhatsApp and Threads from the App Store "because both contain political content that includes problematic mentions of the Chinese president," but the Apple spokesperson denied that was part of the reasoning.

- This is probably in direct response to the potential for a TikTok ban with the latest legislation making its way through congress.House Bills

- Lots of money approved over the weekend in the HOUSE for Ukraine, Israel and Taiwan

- Also, the bill is paving the way to a possible TikTok ban in the U.S. passed the House of Representatives on Saturday, as part of a legislative package addressing critical national security concerns with China, Russia and Iran.

- It passed overwhelmingly in a 360 to 58 vote.

- Another high-profile component of the measure is the Rebuilding Economic Prosperity and Opportunity (REPO) for Ukrainians Act, which would allow the U.S. government to liquidate seized Russian assets and then give those funds to Ukraine.Here we Go....

- Latest commentary: The Federal Reserve is stuck in a mode of forecasting and public communication that looks increasingly limited, especially as the economy keeps delivering surprises.

- The issue is not the forecasts themselves, though they’ve frequently been wrong. Rather, it’s that the focus on a central projection — such as three interest-rate cuts in 2024 — in an economy still undergoing post-pandemic tremors fails to communicate much about the plausible range of outcomes. The outlook for rates presented just last month now appears outdated amid a fresh wave of inflation.Chapter 11?

- Red Lobster, which has 58 stores in Florida, is considering Chapter 11 bankruptcy to recoup $11 million in losses from its endless shrimp promotion, Bloomberg reported.

- Red Lobster’s “Ultimate Endless Shrimp” promotion last year was intended as a limited-time offer but brought in enough new customers that the chain added it to its permanent menu in June. Customers gobbled it up, and the chain reported fourth-quarter 2023 losses of $12.5 million, the outlet reported.Nike

- Error in their ways - some admission here

-Nike CEO John Donahoe acknowledged Friday that the company moved too far away from wholesale partners like Macy's and DSW in its quest to become a retailer that primarily sells merchandise to shoppers through its own stores and website.

- "We recognize that in our movement toward digital, we had over rotated away from wholesale a little more than we intended,"

- We've corrected that. We're investing heavily with our retail partners. They were all here over the last couple of days; they're very excited about the innovation pipeline."

- So WHAT DOES THIS REALLY MEAN?DJT- Tricky

- Trump Media on Friday warned the CEO of the Nasdaq Stock Market of 'potential market manipulation' of the company's stock by "naked" short selling of shares.

- Company is trying every trick in the book

- They are evenr doing outreach to shareholders to teach then how to minimize short selling by not allowing shares to be loaned out - like the old days

- SEC Reply: On its website notes that a failure to deliver shares as part of a short sale trade, which can land a company on the Reg SHO threshold list, does not necessarily reflect improper trading activity such as naked short selling.

- "There are many justifiable reasons why broker-dealers do not or cannot deliver securities on the settlement date," the SEC notes in a section about Regulation SHO.

- Devon Nunes - President is fighting the shorts - and he will probably lose if the company continues on this trajectoryMichael Saylor

- Evangelist for Bitcoin - on TV tellign everyone that his company - Microstrategy is a leveraged Bitcoin Play and the best way to hold bitcoin

- Meanwhile: Saylor entered into a stock-sale plan with his company last summer that allowed him to unload up to 400,000 shares in the first four months of 2024.

--- With the plan more than 90% of the way to completion, Saylor has netted about $370 million from this year's stock sales

- Those assets, equal to about 1% of the total number of bitcoins minted to date, are now worth about $13.6 billion, accounting for the bulk of MicroStrategy's $21.3 billion market cap.AH Jumped to Conclusion - NVDA

- Japanese tech conglomerate SoftBank is looking to develop a "world-class" Japanese-language-specific generative artificial intelligence model, and plans to invest $960 million in the next two years to bolster its computing facilities, according to a Nikkei report.

- So, AH wondered, why is Softbank talking this up and saying that they are planing top purchase chips from NVDA (from anonymous sources)

- Looked and was proven wrong - as of last update Softbank does not own a significant stake in NVDA IN FACT: SoftBank sold its entire 4.9% stake in Nvidia for $3.3B in January 2019NEW HOME SALES!

- New home sales increased 8.8% month-over-month in March to a seasonally adjusted annual rate of 693,000 units (Briefing.com consensus 670,000) from a downwardly revised 637,000 (from 662,000) in February.

- On a year-over-year basis, new home sales were up 8.3%.

- The key takeaway from the report is that new home sales were up in every region, helped in part by another dip in the median sales price, although average prices were up with a pickup in sales of higher-priced homes, particularly in the West region.

- The median sales price decreased 1.9% yr/yr to $430,700 while the average sales price increased 1.0% to $524,800. March marked the seventh consecutive month of a year-over-year decline in the median selling price.

----- New home sales month-over-month/year-over-year by region: Northeast (+27.8%; -13.2%); Midwest (+5.3%; -23.4%); South (+7.7%; -4.5%); and West (+8.6%; +18.8%).

-----At the current sales pace, the supply of new homes for sale stood at 8.3 months, versus 8.8 months in February and 8.1 months in March 2023.

----- The percentage of new homes sold for $399,999 or less accounted for 43% of new homes sold versus 48% in February and 44% one year ago. Homes priced between $400,000 and $749,000 accounted for 43% of new homes sold versus 40% in February. New homes priced at $750,000 or over accounted for 14% of sales in March versus 12% in February.THIS

- Poor environment for M&A

- The U.S. Federal Trade Commission on Monday sued to block Coach parent Tapestry's $8.5 billion deal to buy Michael Kors owner Capri, saying it would eliminate "direct head-to-head competition" between the flagship brands of the two luxury handbag makers.

- "The proposed merger threatens to deprive millions of American consumers of the benefits of Tapestry and Capri's head-to-head competition, which includes competition on price, discounts and promotions, innovation, design, marketing and advertising," the FTC said.Love the Show? Then how about a Donation?

CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

EPISODE 700

In the world of pods, there's a grand show

Hosted by John and Andrew, all know

Episode 70 is their feat,

With tales both wild and sweet,

An epic journey with words that just flow!JCD Score ()

See this week’s stock picks HERE

24 April 2024, 2:14 am - 1 hour 33 secondsDHUnplugged #698: Risk Happens

Risk – happens fast!

Costco Selling ALOT of Gold

April 15th – Tax payment withdrawals

Rates spike, oil moves lower

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Risk Happens FAST

- Costco Selling ALOT of Gold

- April 15th - Tax payment withdrawals

- Fewer students attending 2 0r 4-year collegeMarket Update

- Banks reporting - mixed results

- Rates UP!

- Earnings Season

- Risk off - Missiles Flying

--- WAR escalations concerning investorsRates

- Rates spiked with all of the recent concern that the Fed will not be cutting rates so fast

- Came on on the Iran retaliation worries

- Spike Monday to 4.64% for the 10Yr - starting to get worrisome that could be technical move and disrupt marketsRates in Europe

- European Central Bank President Christine Lagarde on Tuesday said the central bank remains on course to cut interest rates in the near term, subject to any major shocks.

- "We just need to build a bit more confidence in this disinflationary process but if it moves according to our expectations, if we don't have a major shock in development, we are heading towards a moment where we have to moderate the restrictive monetary policy," Lagarde said.

--- Also noted that she is very attentive to the price of oilHA! If you don't like the numbers...

- The Bank of England on Friday announced a “once in a generation” overhaul of its inflation forecasting following a long-awaited review by former Federal Reserve Chair Ben Bernanke.

- The review was initiated in response to criticism over shortcomings in the bank’s recent policymaking.

- It sets out 12 recommendations — including scrapping the bank’s “fan chart” forecasting system — which BOE Governor Andrew Bailey said the bank was committed to implementing.Inflation Spots

And then at 1:30PM Tuesday

- Fed Chairman Jerome Powell at Canadian forum says recent data shows lack of progress on returning to 2% inflation goal; says US economic performance has been quite strong.

- Markets were not pleased -

---- Begs the question: - what is the point of this at a time with such global stress having these types of comments?

---- WSJ's Nick Timiraos says Fed Chairman Jerome Powell "dialed back" rate reduction expectations at Canadian forum amid new inflation uncertaintySafe-haven?

- Bitcoin and other cryptos PLUNGE when Iran sent misses and drones

- How is that digital gold or store of value?

- Simply trades like a speculative risk asset and starting to hear that phrase quite a lot.

- Tried to rally on Sunday when Iran said that is all they are doing- but sold off again MondayEarnings This Week

- Plenty of banks and financials (BAC, GS etc) also Netflix Thursday after the close

- Proctor and Gamble on Friday

- Problem is that they come right as risk elevated.Goldman Sachs Earnings

- Goldman Sachs on Monday posted first-quarter profit and revenue that topped analysts’ expectations, fueled by a surge in trading and investment banking revenue.

- The bank said profit jumped 28% to $4.13 billion, or $11.58 per share, from the year earlier period, thanks to a rebound in capital markets activities

- Goldman shares climbed more than 4% in the days trading Monday.JPM Earnings

- The bank said first-quarter profit rose 6% to $13.42 billion, or $4.44 per share, from a year earlier, boosted by its takeover last year of First Republic during the regional banking crisis.

- But in guidance for 2024, the bank said it expected net interest income of around $90 billion, which is essentially unchanged from its previous forecast.

- That appeared to disappoint investors, some of whom expected JPMorgan to raise its guidance by $2 billion to $3 billion for the year.

- Shares of JPMorgan fell more than 6%.BAC Earnings

- Bank of America on Tuesday reported first-quarter earnings that topped analysts’ estimates for profit and revenue on better-than-expected interest income and investment banking.

- The bank said profit fell 18% to $6.67 billion, or 76 cents a share; excluding a $700 million FDIC assessment, profit was 83 cents a share.

- Revenue slipped 1.6% to $25.98 billion as net interest income declined from a year earlier. (that should turn a bot as rates increasing)China - AMD and Intel

- Shares of Advanced Micro Devices and Intel dipped on Friday after The Wall Street Journal reported that China is ordering the country's largest telecommunications carriers to cease use of foreign chips.

- Chinese officials issued the directive earlier this year for the telecom systems to replace non-Chinese core processors by 2027

- Both stocks traded down as much as 4% on Friday morning.

- Why? China accounted for 27% of Intel's revenue in 2023, making it the company's biggest market. AMD generated 15% of sales from China, including Hong Kong, last year.Salesforce Acquiring

- Salesforce Inc., the top maker of customer relations software, is in advanced talks to acquire Informatica Inc., the Wall Street Journal reported, citing people familiar with the discussions.

- $11 BILLION

- Informatica Inc. is an enterprise cloud data management company. The Company provides artificial intelligence (AI)-powered Intelligent Data Management Cloud (IDMC) platform, which connects, manages and unifies data across any multi-cloud, hybrid system, empowering enterprises to advance their data strategies. The Company’s platform enables enterprises to create a single source of truth for their data, allowing them to create compelling 360-degree customer experiences.Follow Up

- Chickens and Hot Dogs!

- Now Gold

- Wells Fargo expect revenue "may now be running at" $100 million to $200 million a month, a rapid acceleration since bullion hit the warehouse club late in the summer of 2023.

- Costco is selling one-ounce bars made of nearly pure 24-karat gold. While the price is not disclosed online to nonmembers, it's estimated that the product generally sells for about 2% above the spot price

- There are a few catches: Sales are limited to five per customer (up from two previously)

- Not really profitable - 2% markup, but you get back the 2% for executive members

- BUT adds 3% to general merchandise sales but not much profit.

--- Just looked and not available again - sells out quicklyCHINA

- Fitch cut its outlook on China's sovereign credit rating to negative on Wednesday, citing risks to public finances as the economy faces increasing uncertainty in its shift to new growth models.

- The outlook downgrade follows a similar move by Moody's in December and comes as Beijing ratchets up efforts to spur a feeble post-COVID recovery in the world's second-largest economy with fiscal and monetary support.Japan

- Japanese workers' real wages fell in February for a 23rd consecutive month, data showed on Monday, suggesting higher prices kept up pressure on consumers' spending appetite.

- How is this possible with little to no inflation????

- Inflation-adjusted real wages, a barometer of consumer purchasing power, fell 1.3% in February from a year earlier, down for 23 straight months, data from the labor ministry showed. It followed a revised decline of 1.1% in January.Disney

- Nelson Pelz looses Disney bid - Lost but won

- 5th largest investor - owns more than $3.5BILLION in Disney Stock

- The outcome has been positive, he added, noting that Disney's stock is up roughly 50% since October, when his firm began to re-engage with Disney, and is the best performer on the Dow Jones Industrial Average this year.Chick-fil-A

- Chick-fil-A announced it is allowing certain antibiotics in its chicken, overturning a commitment it made in 2014.

- The company said in a recent statement posted on its website that the change will take effect in spring 2024, and is intended "to maintain supply of the high-quality chicken you expect from us."

- The statement, which was also sent as a notification to the chain's app users, said the antibiotics that will be allowed are not important to human health, and are only administered "if the animal and those around it were to become sick."Trend?

- For the second year in a row, the number of students earning a bachelor's or associate degree declined, according to a recent report by the National Student Clearinghouse Research Center.

- Overall, undergraduate degree earners fell nearly 3% in the 2022-23 academic year — the steepest decline ever recorded, the report found, while bachelor's degree earners sank to the lowest level in nearly a decade after notching a one-year loss of almost 100,000 graduates.

- Meanwhile, the number of students earning a certificate hit a 10-year high, largely due to the growth in vocational programs.Tesla

- Bad news keeps on coming

- Jobs cuts

- Lowering prices on cars

- bad numbers in China

- More Cybertruck issues

- Many now saying they are OUT of the Mag7Oh Canada!

- Canada will raise capital gains taxes on businesses and wealthy individuals to help pay for tens of billions in new spending aimed at making housing more affordable and improving the lives of young people.

- Finance Minister Chrystia Freeland said the government will tax Canadian companies on two-thirds of their capital gains, up from half currently. That change will also apply to individual taxpayers when they have gains over C$250,000 ($181,000) in a year, though people will still be able to sell the homes they live in tax-free.Love the Show? Then how about a Donation?

ANNOUNCING - A NEW CTP

FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

17 April 2024, 2:28 am - 59 minutes 24 secondsDHUnplugged #697: YesNo Rate Cuts

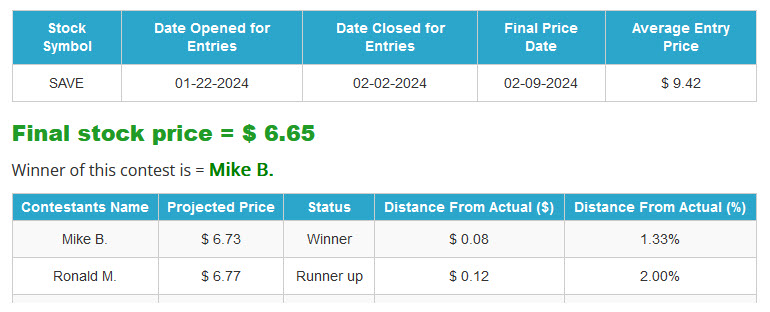

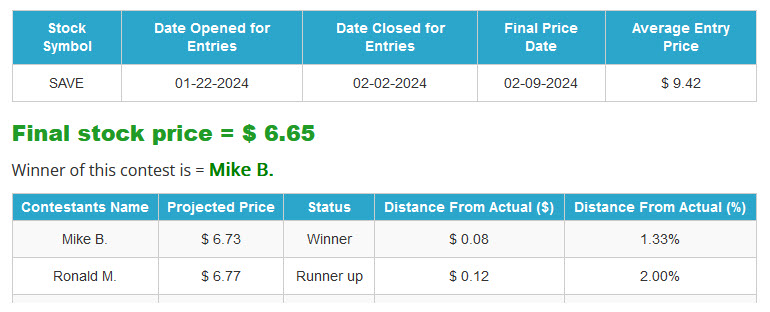

A WINNER – CTP for Rumble

A new CTP to announce!

Club 72 Thank You

Solar Eclipse

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- A WINNER - CTP for Rumble

- A new CTP to announce!

- Club 72

- Solar EclipseMarket Update

- Boeing issues continue

- Oil market on fire

- Yellen - talking tariffs again

- Kashkari and others on cuts

- Earnings season starts this weekLucky CLUB 72

Jonathan Farris

Mark Studebaker

William Palmer

Susan Erickson

Terrence Cleary

Anonymous (2)Fed Walking All Back

- Minneapolis Federal Reserve Bank President Neel Kashkari said on Thursday that at the U.S. central bank's meeting last month he penciled in two interest rate cuts this year but if inflation continues to stall, none may be required by year end.

- "If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all," Kashkari said during an interview with Pensions & Investments. "There's a lot of momentum in the economy right now."Walking Forward

- Federal Reserve Governor Michelle Bowman said Friday that it's possible interest rates may have to move higher to control inflation, rather than the cuts her fellow officials have indicated are likely and that the market is expecting.

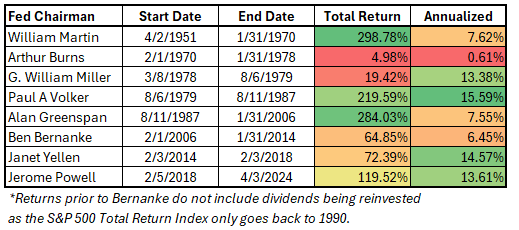

- "While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse,"Who is the best?

-If you were wondering about the track record of the Fed Chair's performance over time, it's worth delving into the historical data.

- Overall, the track record of Fed Chairs over time reflects the challenges and complexities of managing monetary policy in a dynamic and ever-changing economic environment. Each Chair has faced unique circumstances and challenges during their tenure, and their actions have had far-reaching implications for financial markets and the economy as a whole.

Whispers

- Hearing that the car business - used and new having one of the worst years on record (from selective car salespeople)

- Same as above on lower end boat business (sales)

- U.S. small-business confidence slipped to the lowest level in more than 11 years in March amid rising concerns about inflation, according to a survey on Tuesday.

- The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 0.9 point to 88.5 last month, the lowest level since December 2012. It was the 27th straight month the index was below the 50-year average of 98.

- - Twenty-five percent of owners reported inflation was their single most important problem in operating their business, reflecting higher input and labor costs, up 2 points from February. The share of businesses raising average selling prices rose 7 points from the prior month.Inflation Data and ECO

- CPI and PPI this week

- CPI expectations are 0.4% MoM for March

--- Many are sahing that this is a clean month without odd seasonal factors - so something to watch

- - 10 Yr at 4.378%

----------- FOMC minutes at 2:00 Wednesday

-- Last week - Employment situation continues to be strong - 3.8% Unemployment rate 300k added to payrolls (Wage growth was okay)Earnings Season - Banks in Focus

- Banks are expected to see some decline in earnings over the period

- Focus on net interest margin as well as credit deterioration (and days outstanding)

- However, YoY - earnings growth for some look pretty good

- - - - Property & Casualty Insurance (87%), Reinsurance (62%), Life & Health Insurance (12%), and Multi-line Insurance (12%).REMOTE WORK on the sea

- Virgin Voyages is targeting a new type of traveler: remote workers.

- In March, the Miami-based cruise line owned by Sir Richard Branson introduced a month-long cruise called the “Scarlet Summer Season Pass.” It’s essentially four week-long cruises packaged together to appeal to remote workers who want to spend a month at sea in southern Europe.

- Starlink WiFI included

-Europe and other locations

- $9,900 for 2 people!DNUT Follow up

- Krispy Cream stock - we flagged something weird after big jump last week with McDonalds news (2026+ completion???)

- Stock moved up and now got shot down....3PM Monday - Solar Eclipse

- Starting at 1Pm warnings that volume could dry up from 3PM - 4PM as eclipse is more interesting than trading stocks

- Volume did dry up a bit as most were out with their pinhole glassesBack to this...

- U.S. Treasury Secretary Janet Yellen on Monday said she would not rule out any measures, including potential tariffs, on China's green energy exports.

- Yellen not too happy as China providing industry incentives to local companies

- WHY? Didn't we just pass a multi-billion dollar chips act?

- Don't we have tax incentives and other government handouts to companies?Boeing

- A Southwest Airlines flight had to make an emergency stop after an engine part fell off during takeoff from Denver International Airport on Sunday morning.

- The airline said that they lost "approximately $160 million" in their first quarter.

- Boeing pays Alaska Airlines $160 million in cash in 'initial payment' following mid-air blowoutSpirit Airlines

- Spirit Airlines said on Monday it has reached a deal with Airbus to delay all aircraft deliveries scheduled from the second quarter of 2025 through 2026 and intends to furlough about 260 pilots, as the U.S. carrier looks to save cash.

- The agreement with Airbus would improve Spirit's liquidity by about $340 million over the next two years, the carrier said, adding that there were no changes to its orders scheduled to be delivered during 2027-2029.Oil Mexico

- Mexico's state energy company, Pemex, is planning to cut at least 330,000 barrels per day (bpd) of crude exports in May, leaving customers in the United States, Europe and Asia with a third less supply, two sources said.

- As they require more domestically - Pemex has no option other than applying monthly cuts to exports after its crude production in February fell to the lowest level in 45 years and the country's refineries, including a new facility in the port of Dos Bocas, began taking in more crude oil.Powerball

- A ticket sold in Oregon has won Powerball jackpot of more than $1.3 billion, the eighth largest in U.S. history.

- Powerball drew the numbers early on Sunday and the winning numbers were white balls 22, 27, 44, 52, 69 and red Powerball 9. The drawing is the 41st since the last Powerball winner hit the jackpot on New Year's Day.

- The winner matched the correct six double-digit numbers on a $2 ticket. The chances of that happening are one in 292.2 millionEV Trends

- Hybrids are the thing

- Ford Motor is delaying production of a new all-electric three row vehicle, as it shifts to offer hybrid options across its entire North American lineup, the company said last Thursday.Amazon - Just Walk Out: Cancelled

- Removing from its Fresh stores

- However, unbeknownst to many, the Just Walk Out technology was relying on more than 1000 workers in India who were watching the footage to ensure the checkouts were accurate. The Information alleges that over 70% of sales relied on these human video reviewers.

- WAIT - what?Love the Show? Then how about a Donation?

ANNOUNCING - THE WINNER

for RUMBLE

ANNOUNCING - A NEW CTP

FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

10 April 2024, 2:09 am - 1 hour 3 minutesDHUnplugged #696: Bloom Fade

All of a sudden – mood swing

The bloom is off the Rate-Cut-Rose

Leaking Data – Another breach

More AI – lots of $$ committed to this…

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- All of a sudden - mood swing

- Bloom is off the Rate Cut Rose

- Leaking Data - Another breach

- More AI - lots of $$ committed to this...Market Update

- Oil prices moving through key resistance

- Apple back to Oct 2023 support -watch out below?

- Gold/Silver Soaring - into higher rates and higher USD???

- Oil on the riseCTP for Rumble Update

- Marcus G - In the top spot right now....

- - Thatch House dudeHCD: Donations - Need a new Shirt Prize and Design - Plus Contracted Devs prices inflation.

Analyzing Apple's Chart

- Key levels of support

- Down-trendPowell on Good Friday

- PCE report (on day the markets are closed for Good Friday)

-- Showed 2.8% YoY and 0.3% MoM

- Powell tried to talk down market expectations for rate cuts like several other recent speakers

- - Market still hoping for MAYBE 3 - but it looks like June is off the table.Stronger Economy than Thought

- ISM comes in above 50 for the first time in nearly 18 months

- Economic strength + good employment + Inflation = Rate CUT?????

- Market is finally getting the hint

--- 10-Yr rate spiked to 4.38% todayGlobal Economic Trends

- China finally saw its manufacturing number gain some traction last month

--- China's manufacturing activity expanded at the fastest pace in 13 months in March, with business confidence hitting an 11-month high, driven by growing new orders from customers at home and abroad, a private survey showed on Monday.

- South Korea - Sticky inflation (Consumer prices advanced 3.1% in March from a year earlier)Commodities on the rise

- Cocoa futures for May delivery were up 3.9% at $10,030 per metric ton, marking the first time the commodity breaks above the $10,000 mark. Cocoa has been on a tear this year, soaring nearly 39%.

- Ivory Coast, the biggest coca producer in the world, is facing hotter-than-normal temperatures — which have led to dryer-than-usual conditions and crop yields.TSLA

- Q1 deliveries declined by 8.5% yr/yr to 433,000, representing TSLA's first yr/yr decline since the pandemic-impacted year of 2020. Importantly, that decrease is partly due to extraordinary events that were out of TSLA's control.

-- Berlin fire factory shutdown, Red Sea passage issues etch.

- Competition in China is really heating up and cost of EVs from many Chinese manufacturers are much lower.M&A - Amazon

- Amazon.com Inc. says it’s investing an additional $2.75 billion into Anthropic, an artificial intelligence startup.

- The infusion brings Amazon’s total investment in the company, a well-regarded builder of so-called generative AI tools able to generate text and analysis, to $4 billion, following an earlier investment announced in September.

- As part of that deal, Amazon had the right to contribute the additional funds in the form of a convertible note, provided it did so before the end of March.AI NEWS

- Microsoft and OpenAI are in discussions regarding Stargate, a new AI super-computer data center project to be headquartered in the U.S. may cost over $115 billion and is planned for launch in 2028.

- $$$$$$115 BILLION

- That is like 115,000 $1,000,000 homes....

- Stargate’s power requirements, estimated to be several gigawatts (5) may require Microsoft and OpenAI to explore alternative power sources, like nuclear power. Enough to power 3,750,000 for a year!!!!!!!!!!!!!!!!!

----- Hoover Dam X2Meanwhile

- Microsoft will sell its chat and video app Teams separately from its Office product globally, the U.S. tech giant said on Monday, six months after it unbundled the two products in Europe in a bid to avert a possible EU antitrust fine.

- The European Commission has been investigating Microsoft's tying of Office and Teams since a 2020 complaint by Salesforce-owned competing workspace messaging app Slack.AT&T Leak/Breach

- Over the weekend - snuck it in there...

- AT&T has revealed that it has suffered a massive data breach, including the personal data of a combined 73 million current and former customers.

- The data appeared on the dark web approximately two weeks ago, AT&T says, adding that it appears to be “from 2019 or earlier.” It is “not yet known whether the data in those fields originated from AT&T or one of its vendors,” the company adds.

--- ??? So, since it is from 2019 or ealier it does not matter?

- How about this: The good news is that it “does not contain personal financial information or call history.” The bad news is that it does include customer names, home addresses, phone numbers, dates of birth, Social Security numbers and encrypted passcodes.

- The 7.6 million current customers impacted have had their passcodes reset, the company said, though obviously there’s less it can do for data lifted and used for identity theft.POWERBALL?

- The Powerball jackpot has ballooned to a tremendous $1.09 billion after yet another lottery drawing yielded no top winner Monday night.

- Monday’s winning numbers were: 19, 24, 40, 42, 56 and Powerball 23.

- The next drawing will be held Wednesday night. If a player finally snags the jackpot, they could choose the annuitized option, with an initial payment and the remainder spread over 29 years, or the lump-sum option of $527.3 million, both before taxes.

- The jackpot is the fourth-largest in Powerball’s history and could soon close in on the $1.13 billion Mega Millions prize won by a ticket in New Jersey last week.DJT Stock

- Shares of Donald Trump's social media company plunged 21% on Monday, wiping out the gains from its debut last week, after disclosing millions in losses and saying it would struggle to meet its financial liabilities going forward.

- Trump Media & Technology Group lost more than $58 million in 2023, it said in a filing, sending shares reeling less than a week after the Truth Social parent went public through a high-profile blank-check merger.

- Trump owns 78.75 million shares, which could result in a big windfall for the former president, depending on their value. At the stock's peak last week, his stake would have been more than $6 billion, but after the selloff it would be valued at about $3.8 billion.

- Why not do this with all political fundraising - $ for massesLondon and Bridges

- Insurance claims for damage to the bridge alone could reach $1.2 billion, the bank said in a note, predicting further potential liabilities of $350 million to $700 million for wrongful deaths and yet-to-be-determined amounts for business interruptions while access to the city’s port is blocked.

- Lloyds seemed to have been a big insurer and on the hook for a chunk

- Insurance costs going up again due to these crazy or big natural disasters

- Closure of one of the US' biggest ports while the bridge is repaired could also cost millions of dollars, Barclays' analysts said.

-------- The Port of Baltimore is the 14th largest in the US. In 2023, 52.3 million tonnes of foreign cargo, worth $80.8bn, passed through Baltimore, according to data from the state of Maryland.Healthy!

- McDonald's is planning to sell Krispy Kreme doughnuts at its restaurants nationwide by the end of 2026, the chains announced Tuesday.

- The rollout will start in the second half of this year, but it will take roughly two and a half years as Krispy Kreme more than doubles its distribution to satisfy the partnership. For the duration of the agreement, McDonald's will be the exclusive fast-food partner for Krispy Kreme in the U.S.

- Why announce something that is going to take until 2026?

- A cardiologist's dreamBoeing

- Boeing CEO Dave Calhoun will step down at the end of 2024 in part of a broad management shakeup for the embattled aerospace giant.

- Chairman of the board Larry Kellner is also resigning and will leave the board at Boeing's annual meeting in May. He has been replaced as chair by Steve Mollenkopf, who has been a Boeing director since 2020.

- And Stan Deal, president and CEO of Boeing Commercial Airplanes, is leaving the company effective immediately.FedUp

- United Parcel Service said on Monday it will become the United States Postal Service's (USPS) primary air cargo provider, as rival FedEx announced an end to its more than 20-year partnership with the postal service provider.

- USPS was the largest customer for FedEx's air-based Express segment, even as payments declined after the postal service shifted letters and packages from planes to more economical trucks as part of an operational revamp.Love the Show? Then how about a Donation?

ANNOUNCING - THE CTP for RUMBLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

3 April 2024, 2:22 am - 1 hour 5 minutesDHUnplugged #695: Fresh Frenzy

Fed in Focus – FOMC Rate Decision Wednesday.

Reddit IPO Frenzy!

Inflation – definitely not going away.

Announcing – A New Closest to The Pin

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- A New CTP Announced

- No Show Next week - business meetings out of town

- A not so surprising result in the Russian Elections

- An important change to stock trade settlements is comingMarket Update

- Fed in Focus - FOMC Rate Decision Wednesday

- Reddit IPO Frenzy

- Inflation - definitely not going away

- AI Frenzy - Culd Call This DHAI Unplugged - so much AI news to discuss

- Yield FrenzyPPI Release

- After a HOT CPI, PPI Comes in Hotter

- 0.6% on the core - but only 1.6% YoY

- The Producer Price Index for final demand rose 0.6 percent in February.

- Prices for final demand goods advanced 1.2 percent, and the index for final demand services moved up 0.3 percent.

- Prices for final demand advanced 1.6 percent for the 12 months ended in February.

- Markets didn't know what to do with this on Friday.Company Stats - Recession?

- According to FactSet: During Dec-March earnings calls, 47 cited the term “recession” during their earnings calls for the fourth quarter.

-- This number is below the 5-year average of 85 and below the 10-year average of 61.

- This quarter will mark the lowest number of S&P 500 companies citing “recession” on earnings calls for a quarter since Q4 2021Reddit

- IPO slated to be live sometime this week (March 21)

- 5X Oversubscribed

- Reddit began sending invitations to users to participate in the IPO based on one of two measurements of engagement on the site: either the number of actions they’ve taken as a moderator of a forum on the platform (also known as a “subreddit”) or their “karma” score, a figure that indicates a user’s contributions and reputation among other users on the site.

- Reddit plans to list 22 million shares at a price between $31 and $34, according to the latest version of the IPO prospectus it filed Monday with the Securities and Exchange Commission. The company stands to take in between $473.6 million and $519.4 million from the sale of roughly 15.3 million shares.

- Valuation > $6 billion

- Question???? Is Reddit profitable? NO - However, the company has been substantially growing revenue in the past few years.

---- Reddit's total revenue in 2023 was $804 million, up 21% from $666 million in 2022.

----- Reddit's net loss for 2023 narrowed to $90.8 million.Yields - 10 YR

- Highest level of 2024

- technically breaking out - if Fed moves a bot more hawkish - 4.50% is next testJapan Yields

- The Bank of Japan is set to raise its key interest rate for the first time in 17 years on Tuesday following its two-day monetary policy meeting, Kyodo reported.

- The BOJ will raise the short-term rate to the 0%-0.1% range, the report said. The development reflects growing confidence among policymakers that a virtuous cycle of wage growth and price hikes is in motion following this year’s labor-management pay negotiations

- RAISING TO ZERO!Global Rates - Who Will CUT First?

ELON

- Increasing prices on Model Y by $1,000

--- Stock moves up by 6%

- Goldman Downgrades - Perhaps this is why stock moved up - another bug downgrade - stock in the toilet - nowhere else to go

--- SpaceX is building a network of hundreds of spy satellites under a classified contract with a U.S. intelligence agency, five sources familiar with the program said, demonstrating deepening ties between billionaire entrepreneur Elon Musk's space company and national security agencies.Elon - Ketamine

- A video, which was posted Monday on X, Musk said the drug helps him manage a "negative chemical state" similar to depression. He argued that investors should not worry about his drug use so long as his companies continue to perform.

"From the standpoint of Wall Street, what matters is execution," said Musk, who helms three corporations including the electric vehicle maker, the rocket company SpaceX and the social media company X. Musk stated that Tesla was worth as much as the rest of the car industry combined.

"For investors, if there's something I'm taking, I should keep taking it," he added.Fake Meat Update

- Beyond Meat files $250 mln mixed shelf securities offering6% No More

- The National Association of Realtors (NAR) is set to pay up $418 million in damages and eliminate commission rules in a landmark deal experts say will significantly shake up the real estate industry.

- The NAR agreed to settle after a series of lawsuits accused the organization of conspiring to artificially inflate home sale commissions.

- However, recent lawsuits argued the NAR stifled competition among real estate brokers and violated antitrust laws by requiring the seller’s agent to make an offer of payment to the buyer’s agent and implementing rules that led to steep standard commission fees.

- This settlement means the NAR can no longer set any rules that would allow a seller’s agent to set compensation for a buyer’s agent. The association’s Multiple Listing Service (MLS) — which buyers and sellers use to view for-sale properties — will no longer feature any fields offering broker compensation either.

- Zillow and Compass smoked on the ruling

- How does this work? How do buyers find agents that have no idea what they will be paid?Insider Selling

- Peter Thiel sold some of his $3.4 billion stake in Palantir Technologies Inc. for the first time in more than two years as shares of the software and analysis company soar on artificial intelligence optimism.

- Thiel sold more than 7 million shares worth roughly $175 million Tuesday, according to a filing. He still owns about 7% of the Denver-based company, the largest asset in his $10.5 billion fortune,AI Chip Frenzy

- NVIDIA today announced its next-generation AI supercomputer — the NVIDIA DGX SuperPOD™ powered by NVIDIA GB200 Grace Blackwell Superchips — for processing trillion-parameter models with constant uptime for superscale generative AI training and inference workloads.

- 25X less money and less energy cost to operate

- The Blackwell GPU architecture features six transformative technologies for accelerated computing, which will help unlock breakthroughs in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AIAI and Energy

- Concern is rising about the energy use of AI chips etc

- More than 7,000 people are headed to Houston this week to attend CERAWeek by S&P Global with a key question in mind: How to meet increasing demand for power amid the transition to clean energy.

---- Some are very concered about the consumption with the high energy

- Yergin, who wrote the Pulitzer Prize-winning book The Prize: The Epic Quest for Oil, Money & Power, will be the voice of the conference and lead more than two dozen panels featuring heavyweights from government, the oil and gas sectors and tech.Doctors - AI

- Doctors can now spend more time with patients.

- This technology allows doctors to consensually record their visits with patients.

- The conversations are automatically transformed into clinical notes and summaries using artificial intelligence.

- Companies like Microsoft's Nuance Communications, Abridge and Suki have developed solutions with these capabilities, which they argue will help reduce doctors' administrative workloads and prioritize meaningful connections with patients.

- Doctors will get better case notes - well organized that will help them when they review and then provide appropriate treatment etc.

--- Doctors will be able to listen to patients and be present with discussions in exam rooms.OMG - 32 Hour Workweek? HORRIFYING

- Sen. Bernie Sanders and Senate Democrats cited advances in artificial intelligence and automation Thursday as they argued for a new bill that would mandate a 32-hour federal workweek.

- Employers would have to pay overtime compensation to non-exempt employees of 1.5 times the hourly rate for every hour worked past eight hours in a single day, and two times the hourly rate for every hour worked past 12 hours.

- The bill also would guarantee that total weekly wages would not be cut as a result of the reduction in total hours worked.

- The bills come months after business leaders such as JPMorgan Chase CEO Jamie Dimon and Microsoft co-founder Bill Gates predicted that people could within decades work as little as three days a week due to innovations in AI, and automation.

- Sanders and Democrats at Thursday's hearing said that reducing the workweek would allow people to spend more time with family and on hobbies.SouthWest

- Southwest Airlines said Tuesday that it will have to trim its capacity plans and reevaluate its financial forecasts for the year because of aircraft delivery delays from Boeing, its sole supplier of airplanes.

- The Dallas-based airline said Boeing informed Southwest's leaders that it should expect 46 Boeing 737 Max 8 planes this year, down from 58. Southwest had expected Boeing to deliver 79 Max planes, including some of the smallest model, the Max 7, which hasn't yet won certification from the Federal Aviation Administration.Oprah - Weight Loss Special

- Did anyone watch this?

--- Oprah - Weight Watchers step down and divest/donate of all shares (Down ~ 80% since she joined board)T+1

- Starting May 28, 2024, the trade settlement period for U.S. and Canadian securities traded on U.S. exchanges will be shortened to one day after the trade date (T+1). Currently, the settlement period is two days after the trade date (T+2).Love the Show? Then how about a Donation?

ANNOUNCING - THE CTP for RUMBLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

20 March 2024, 2:19 am - 1 hour 4 minutesDHUnplugged #694: Lots of China

Volatility is back and Bitcoin mania is here again.

Need a new CTP Stock!

China stocks on a run…

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Volatility is back

- Bitcoin mania

- Need a new CTP Stock!

- LSD - making an interesting comebackMarket Update

- NVDA had 2 down days!

- Markets still want to go higher - not matter what the data

- Yields move up with CPI

- Big rebound for NVDA - not letting it go down too much...CPI Release

- Total CPI increased by 0.4% month-over-month, meeting expectations, while core CPI (excluding food and energy) also rose by 0.4% month-over-month (0.3%).

- On a year-over-year basis, total CPI was up 3.2%, compared to 3.1% in January, and core CPI increased by 3.8%, versus 3.9% in January.

- Excluding shelter, CPI rose by a more modest 1.8% year-over-year.

- Despite the headline disappointment for core CPI, the market seems optimistic about the future, anticipating a reduction in the isolated impact of the shelter index in the coming months due to an expected moderation in rent prices. (in other words, thinking the Fed's PCE will not be so hot next time and the Fed will still cut sometime this year)CPI Report key takeaways:

- The food index showed no change month-over-month and increased by 2.2% year-over-year.

- The energy index rose by 2.3% month-over-month and declined by 1.9% year-over-year.

- Used cars and trucks saw a 0.5% increase month-over-month and a 1.8% decrease year-over-year.

- The apparel index was up 0.6% month-over-month and unchanged year-over-year.

- The all items index, excluding food, shelter, and energy, increased by 0.3% month-over-month and 2.2% year-over-year.Layoffs - Does not fit the narrative

- Layoff announcements in February hit their highest level for the month since the global financial crisis, according to outplacement firm Challenger, Gray & Christmas.

- The total of 84,638 planned cuts showed an increase of 3% from January and 9% from the same month a year ago, with technology and finance companies at the forefront.

- From a historical perspective, this was the worst February since 2009, which saw 186,350 announcements as the worst of the financial crisis was seemingly coming to an end.

- Here is where it gets interesting: The layoff numbers, however, are not feeding through to weekly jobless claims, suggesting that unemployment is short-lived and workers are able to find new positions.Powell

- On one hand he stated that the Fed is watching and not ready yet to cut rates - data dependent

- A couple days later he indicated that interest rate cuts may not be too far off if inflation signals cooperate.

- In remarks to the Senate Banking Committee, the central bank leader didn't provide a precise timetable of when he sees easing happening, but noted that the day could be coming soon.Mnuchin to the Rescue?

-NYCB had bad month - and got worse

- Lost 7% of deposits

- Bond rating cut

- Investment firm lead by Steve Mnuchin swooped in with a cool $1 billion rescue package

- Remember NYCD bought Signature Bank - obviously so much crap in that portfolio it helped poison NYCBOracle Earnings

- New ATH

- Reports Q3 (Feb) earnings of $1.41 per share, excluding non-recurring items, $0.03 better than the FactSet Consensus of $1.38; revenues rose 7.1% year/year to $13.28 bln vs the $13.29 bln FactSet Consensus.- Q3 Total Remaining Performance Obligations up 29% to $80 billion.

- Q3 Cloud Revenue (IaaS plus SaaS) $5.1 billion, up 25% in USD, up 24% in constant currency.

- Q3 Cloud Infrastructure (IaaS) Revenue $1.8 billion, up 49% in both USD and constant currency.

- Q3 Cloud Application (SaaS) Revenue $3.3 billion, up 14% in both USD and constant currency

- Q3 Fusion Cloud ERP (SaaS) Revenue $0.8 billion, up 18% in both USD and constant currency.

- Q3 NetSuite Cloud ERP (SaaS) Revenue $0.8 billion, up 21% in USD, up 20% in constant currency.China

- China stocks moving up nicely

--- Breaking out from rounded bottom

---- Now people talking about the value propositionMore China

- Chinese smartphone company Xiaomi announced Tuesday it would formally launch its long-awaited electric car on March 28.

- The company claimed in a social media post its SU7 electric car "would be delivered as soon as it is launched," according to CNBC's translation of the post written in Chinese.

- Complete with Tesla and Porche

- 668 km (415 mi) (CLTC) 800 km (497 mi) (CLTC, SU7 Max)Even More China

- China is testing an AI assistant for neurosurgeons at seven hospitals in Beijing and other cities in coming months, one of many initiatives the government is backing to try and harness the technology.

- The Hong Kong-based Center for Artificial Intelligence and Robotics employed about 100 graphics processor units to train its healthcare-focused model, split evenly between Nvidia Corp.’s A100 high-end chips and Huawei Technologies Co.’s Ascend 910B, researchers told reporters Monday.

- -ABBY NORMAL???Over to Japan

- Somehow - revisions to last week's numbers came out and now Japan is no longer in a recession

- Japan's gross domestic product expanded 0.4% in the fourth quarter compared with a year earlier. Provisional data last month had showed GDP contracting 0.4%. This is after a revised 3.3% slump in the July-September period.

- Japan yields came up - Yen Rallied - Market sold off (worst in months)Meanwhile - Apple Cancelling Car

- Apple will wind down its team working on electric cars, called Special Projects Group, according to Bloomberg.

- The news signals that Apple will cease its secretive effort to build a car to rival Tesla. The program employed thousands of employees, but never fit with Apple's core business of electronics and online services, and raised questions about what companies Apple would tap to manufacture a car.Crypto

- 3 Pillars???

--- Store of Value, Currency, Speculative Investment

- - Was once this culture changing investment for the people, by the people, of the people

-- Now even the hardcore maximalists are just talking about it as an investment.

--- Making shit up as they go...Happy Birthday - 25 Years

- QQQ is officially 25 years old and what a run it has hadHmmmmm

- Boeing whistleblower

- A whistleblower who was at war with Boeing died last week -- and investigators say it appears he took his own life, this while he was embroiled in a lawsuit against the company.

- John Barnett was discovered dead on Saturday out in Charleston, NC -- where cops say his body was found in his truck in a hotel parking lot ... with him suffering an apparent self-inflicted gunshot wound. No word on if foul play is suspected -- but police are investigating.

- His lawyer is insisting that "Alleged" comes in front of suicide.Weight Watchers

- Stock has been on a wild ride since Oprah got involved.

-Now, she is leaving the board

- Company got way away from roots and started to focus on diet drugs (GLP-1 etc)

- Stock down 90% since 2001Spending Season

- With Presidential race underway - spending and tax cuts are on the top of the list

- Biden presenting $7 trillion budget and spending plan

-- Biden

- Trump back to lower taxes and other ways to prop up economy

- No matter, big spending ad bigger debt is on the horizonThe Year of Drugs - Could be interesting times ahead

- A clinical trial’s encouraging results won US Food and Drug Administration breakthrough therapy status for an LSD formulation to treat generalized anxiety disorder, Mind Medicine Inc. announced Thursday. The biopharmaceutical company is developing the drug.

- “A breakthrough designation is a recognition that a drug has demonstrated evidence of clinical efficacy in meeting an unmet medical need with morbidity and mortality associated with it,” said Dr. Daniel Karlin, assistant professor of psychiatry at Tufts University School of Medicine in Boston and chief medical officer for MindMed.And in closing

- In Japan - Male office workers at a telecoms firm in Tokyo have experienced simulated menstrual pain to help them become more sympathetic toward female colleagues ahead of International Women's Day on Friday.

- workers winced at a company event on Thursday as a "perionoid" device sent electric signals via pads placed below the navel to stimulate the lower stomach muscle and induce a cramping sensation.

- EXEO said it wants to create an environment where its more than 90% male workforce can be more supportive of female peers, including when it comes to taking menstrual leave.

-Love the Show? Then how about a Donation?

CTP for Spirit Airlines

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

13 March 2024, 2:29 am - 1 hour 1 minuteDHUnplugged #693: Best of DHU (2)

All sorts of good stuff in this episode.

Some good laughs and fun throughout the year.

Thanks to Ryan Rediske for all the help in putting this together!

DHUnplugged is streaming live – with listener chat. Click on link on the right sidebar for access.

Love the Show?

Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

6 March 2024, 3:00 am - 1 hour 4 minutesDHUnplugged #692: Froth-A-Bubble

TECH on fire – Bulls overjoyed!

Hedge Funds – Making some moves – Surprising

Year of Pharma?

To The Moon – Crypto Style

Valuations getting frothy?PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Pays to Follow Pelosi!

- Landing on the Moon - then falling over

- Japan - something not kosher

- New See-through laptop screensMarket Update

- TECH on fire - Bulls overjoyed!

- Hedge Funds - Making some moves - Surprising

- Year of Pharma?

- To The Moon - Crypto Style

- Valuations getting frothyFroth-a-Bubble- Icous?

- There is some concern at Apollo regarding a bubble in S&P 500

- The top 10 companies in the S&P 500 today are more overvalued than the top 10 companies were during the tech bubble in the mid-1990s, see chart below.

- Different makeup back in 1999 - but still of interest asa the S&P500 reaches levels (P/E) at the high end of the ranges.

- SEE LINKSmart Money?

- Hedge funds piled into tech stocks in the weeks before Nvidia Corp. earnings. Now, they’re cashing out and selling at the fastest pace in seven months.

- Professional managers offloaded their positions for four straight sessions last week, including Thursday, the day after Nvidia posted results, according to data from Goldman Sachs Group Inc.’s prime-brokerage unit. The intensity of the selling ranks in the 98th

- he data suggests traders are booking profits on their tech wagers after a six-week buying streak and putting that extra cash into less volatile stocks, such as consumer staples.

- SEE LINKNancy!

- NEWS MONDAY: PANW - Palo Alto Networks shares higher by 9% after Rep. Nancy Pelosi reported Friday afternoon the purchase of 70 call options (purchases made 2/12 and 2/21)

- Stock moved down 27% after earnings last week

- In fairness, the purchases on 2/12 are very underwater

- AH picked this for the game right after post-earnings slumpEarnings - Zoom

- Zoom shares rose as much as 13% in extended trading on Monday after the video chat software vendor announced fiscal fourth-quarter results that topped analysts' expectations.

- Here's how the company did, compared with consensus among analysts polled by LSEG:

- -- - Earnings per share: $1.22, adjusted vs. $1.15 expected

- - - -Revenue: $1.15 billion vs. $1.13 billion expectedDisney

-Walt Disneyshareholder Blackwells Capital is calling for it to come up with an artificial intelligence (AI) strategy, saying that this could lift the U.S. media and entertainment conglomerate's stock price by as much as 129%.

Blackwells is one of two activist investors pushing for board seatsWhat Goes Up...

- Intuitive Machines Inc. shares sink Monday, after the spacecraft company said its lander, which successfully touched down on the moon last week, likely landed on its side.

- The landing was touted as the first by a private-sector company to reach the moon intact, as well as the first US spacecraft to reach the moon’s surface since 1972.

- In a Monday update, the company wrote that “flight controllers intend to collect data until the lander’s solar panels are no longer exposed to light,” and that “based on Earth and Moon positioning, we believe flight controllers will continue to communicate with Odysseus until Tuesday morning.”

- Stock down 33% on this newsJapan

- Markets at new highs

- Yen weak weak weak

- Government keeps ultra-loose monetary policy

- Recession official

- Something is not right over thereMore Japan

- Federal prosecutors in New York on Wednesday said they had charged a Japanese Yakuza leader with conspiring to traffic nuclear materials from Burma to other countries.

- Prosecutors said the accused gangster Takeshi Ebisawa "and his confederates showed samples of nuclear materials in Thailand" to an undercover agent from the U.S. Drug Enforcement Administration.

- "A U.S. nuclear forensic laboratory later analyzed the samples and confirmed that the samples contain uranium and weapons-grade plutonium," the statement said.Lenovo See-Through

- Chinese tech giant Lenovo showed off a prototype laptop on Monday that has a see-through screen, underscoring how the world's largest PC maker is trying to innovate after a brutal couple of years for the market.

- Seems like it can be used for VR / AR - Put something behind it (architect designing house can put house behind ?)

- Any thoughts?Out of Favor - Pharma?

- Pharmaceutical companies last year launched new U.S. drugs at prices 35% higher than in 2022, reflecting in part the industry's embrace of expensive therapies for rare diseases like muscular dystrophy, a Reuters analysis found.

- The median annual list price for a new drug was $300,000 in 2023, according to the Reuters analysis of 47 medicines, up from $222,000 a year earlier. In 2021, the median annual price was $180,000, for the 30 drugs first marketed through mid-July, according to a study published in JAMA.

- Will Pharma be a sector to invest in - especially if AI will help shave costs for industry?? (XLV, XBI, IBB)Crypto Fever

- Bitcoin hit a two-year high on Tuesday, on track for its biggest two-day rally this year, on signs large players were buying the cryptocurrency, while smaller rival ether topped $3,200 for the first time since 2022.

- Bitcoin has rallied more than 10% in two sessions, helped by Monday's disclosure from crypto investor and software firm MicroStrategy that it had recently purchased about 3,000 bitcoins for an outlay of $155 million.

11 Granolas

- FANG + Mag7 Euope Style

- The momentum of this group — which comprises GSK, Roche, ASML, Nestle, Novartis, Novo Nordisk, L'Oreal, LVMH, AstraZeneca, SAP and Sanofi — has drawn comparisons to the "Magnificent Seven" U.S. tech giants and evoked similar concerns about concentration risks in European equity markets.

- Together, the GRANOLAS account for around a quarter of the total Stoxx 600 market cap, and Goldman analysts in a note last week highlighted that they exhibit qualities that are expected to thrive in the current cycle, such as solid earnings growth, high and stable margins and strong balance sheets.US Government Shutdown?

- Funding is due to run out on March 1 for some federal agencies, including the Department of Transportation, while others like the Defense Department face a March 8 deadline.

- Special meeting today - "Good Outcome" - (not definitive deal)

- No One Cares Anymore... About any of this...Beyond Stupid - Look for these words

- Beyond Meat reports Q4 (Dec) results, beats on revs; guides FY24 revs in-line

- Beyond Meats - Reports Q4 (Dec) GAAP loss of ($2.40) per share, may not be comparable to the FactSet Consensus of ($0.89); revenues fell 7.8% year/year to $73.68 mln vs the $66.66 mln FactSet Consensus.

- Adjusted EBITDA was a loss of $125.1 million, or -169.9% of net revenues, compared to an Adjusted EBITDA loss of $56.5 million, or -70.7% of net revenues, in the year-ago period.

- Co issues in-line guidance for FY24, sees FY24 revs of $315-345 mln vs. $344.43 mln FactSet Consensus.

- Co added, "Our 2024 plan includes taking steps to steeply reduce operating expense and cash use; pricing actions and the right-sizing of our production footprint, both in support of margin expansion; a years-in-the-making core platform renovation in Beyond IV that delivers superior health benefits and taste; and, following the announcement and initiation of our Global Operations Review, taking certain non-cash charges pertaining to inventory and assets that are no longer consistent with our path to profitability."

- Stock up 80% after hoursRICH

- ATT outage last week - cell service down for hours

- some people getting $5 for inconvenienceReddit IPO

- Never turned a profit since inception

- Social media company Reddit filed its IPO prospectus with the Securities and Exchange Commission on Thursday after a yearslong run-up. The company plans to trade on the New York Stock Exchange under the ticker symbol “RDDT.”

- $10 billion valuation

- Google on Thursday announced an expanded partnership with Reddit that will give the search giant access to the company’s data to, among other uses, train its AI models.AI

- Google to pause Gemini AI model's image generation of people due to inaccuracies

- Google started offering image generation through its Gemini AI models earlier this month, but over the past few days some users on social media had flagged that the model returns historical images which are sometimes inaccurate.

- Founding fathers were Asian and other...If AI not bad enough...

- A patient implanted with Neuralink's brain technology can now control a computer mouse just by thinking, the company's founder Elon Musk said.

- "(The) patient seems to have made a full recovery with no ill effects that we are aware of and is able to control the mouse, move the mouse around the screen just by thinking," Musk said in a Spaces session on X.

-Love the Show? Then how about a Donation?

CTP for Spirit Airlines

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

28 February 2024, 3:26 am - 58 minutes 32 secondsDHUnplugged #691: Lying Flat

Japan makes surprise crypto move.

AI dating coaches are coming

– Markets plunge – then rebound nicely

– AI Buying AI stuff

– Cure for Frostbite?PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- AI dating coaches are coming

- Markets plunge - then rebound nicely

- AI Buying AI stuff

- Cure for Frostbite?

- AMAZING AMAZONMarket Update

- Japan - really pumping the risk assets

- China government making $$ moves

- China: Latest Problem: Lying Flat

- Whoops - What is an extra ZERO anyway?Follow Up----

- USA CPI came out HOT!

- January PPI increased by 0.3% (Briefing.com consensus 0.1%), with the previous figure revised to -0.1% from -0.2%. Meanwhile, January Core PPI rose by 0.5% (Briefing.com consensus 0.1%), and the prior number was revised to -0.1% from 0.0%.

- The significant message from the report aligns with the conclusion drawn from the unexpectedly high January CPI report: whether the market opts to overlook this data due to seasonal adjustments, the Federal Reserve is unlikely to dismiss it.

- The Fed is likely to perceive it as a reason to maintain a patient approach in terms of potential rate cuts.Market Hysteria

- The Russell 2000, sank 4% on Tuesday, but ultimately settled 1.1% higher on the week. The market-cap weighted S&P 500 declined 0.4% this week, but the equal-weighted S&P 500 jumped 0.7%.

- The Russell was DOWN 4% on Tuesday after the hotter than expected CPI report.

- In addition to the hot CPI reading, market participants also digested a below-consensus Retail Sales report for January, an unexpected drop in jobless claims to 212,000, and a hotter-than-expected PPI report for January.

-The 2-yr note yield settled 15 basis points higher this week to 4.65% in response to this week's data and the 10-yr note yield rose 11 basis points this week to 4.30%. (Briefing.com)Japan Crypto News

- Japan inched closer to allowing venture capital firms and other investment funds to hold digital assets directly, after Prime Minister Fumio Kishida’s administration agreed to submit a revised bill to implement the change.

- His cabinet approved the text of a bill on Feb. 16 that seeks to partially amend the country’s industrial competitiveness enhancement act, according to a statement published on the Ministry of Economy, Trade and Industry’s website. The bill states that “measures will be taken to add cryptoassets to the list of assets that can be acquired and held by investment limited partnerships,” referring to a vehicle used by venture capital firms to secure capital for investments.China

- China’s southern province of Hainan moved to cut down-payment ratio for first-time homebuyers, the latest region in the country to ease mortgage policies to boost slumping home sales.

- Minimum down payment for first homes was cut to 20% from 25%, according to a Monday report by Hainan Daily. The ratio for second homes remains unchanged at 30%, the outlet reported, citing a government notice without saying when the measure would go into effect.More China

- China's market opened after the long Lunar New Year break with a thud.

- China looks to be still buying directly into markets to prop up

- Reports about pre-pandemic level spending on goods and travel, especially during the Lunar New Year did not lift the mood muchChina's Newest Concern: Lie Flat

- "lie flat", a Chinese term used to describe people who work just enough to afford to spend their time on what they enjoy.

---- Not like Japan Inc of the 1980's

- Although there is no data on how many young Chinese are opting out of corporate jobs that they traditionally would have taken, the youth jobless rate rose to a record high of 21.3% in June 2023 amid an economy still struggling to return to pre-pandemic growth levels,Meanwhile

- As markets hit or move closet to all-time-highs

-The UK and Japan both fell into recession at the end of last year, marked by two consecutive quarters of contracting activity.

--- Now Germany is #3 biggest economy (Moves ahed of Japan)

- While the euro area is expected to avoid a downturn, the European Commission still sees the bloc growing slower than initially forecast this year. And in Australia, the unemployment rate climbed to the highest level in two years, consistent with expectations for its

- US still has a pretty economic story it is tellingWith that...

- Goldman Sachs lifting their year end target for the S&P 500 to 5,200 (5% upside)

- Previously projected 5,100 in January

- Before that projected 4,700 in December

----- SO, they have no idea what is going on, no ability to project out more than a month or so, just keeping tight to current levels

------ THEREFORE, why would anyone believe these predictions?New SEC Rules

- US regulators will begin requiring hedge funds to confidentially share more information about their investment strategies.

- New rules approved on Thursday will require firms to provide more details to watchdogs, including on investments, borrowing and counter-party exposure. The Securities and Exchange Commission and Commodity Futures Trading Commission described the new regulations, which were proposed in 2022, as a way to better keepShall We? AI News

- AI dating services are already making their way into the hand of millions of single people

- OpenAI and other apps helping people write/craft their conversations with - so I asked ChatGPT:Input: Write a text message to someone named John to let them know that I am really interested in getting to know them more and maybe a casual date.

Example: Hey John! ? I've enjoyed our chats and would love to get to know you better. How about grabbing coffee or doing something casual together? Let me know! ?

More AI Dating

- YourMove.AI, an AI dating tool that offers a range of services such as drafting messages, analyzing conversations and evaluating users' dating app profiles

- Rizz, an AI dating assistant

- Amori uses AI to analyze a user's entire WhatsApp or iMessage chat history with any person in their contacts list, Weitzman said. The chatbot, which is built atop OpenAI's models, uses the chat logs to rank the relationship in areas like compatibility, communication, "sexiness" and more, even going so far as to guess each person's attachment style.

- The problem with these AI messages or conversations is: What happens when you actually meet?Airlines - Late Friday Announcement

- Carl Ichan - won seats on Jetblue Board of directors

- 88 years old and still kicking it!

- TWO directors

- Icahn Enterprises bought 10% of company

- Icahn said in disclosing his JetBlue stake that he believes the shares are undervalued.

- Stock up 5% A/H FridaySMART JEFF!

- Bezos selling lots of stock lately

- Now that he moved to Florida - no state tax on the sales