The Korelin Economics Report

www.kereport.com

The original radio and internet show dealing exclusively with asset-based investing that was listened to by over 2 million people last year.

- Craig Hemke – Gold Strength To Start The Year

Craig Hemke, Editor of TF Metals Report joins us to focus on the strength in the gold market to start the year.

We explore the strength of gold, currently trading close to its all-time highs, and how central bank demand is underpinning these higher prices. Craig explains the shallowness of recent gold corrections and what to watch for in gold futures and spot prices, particularly as contracts shift from February to April and June. We also analyze the role of the dollar index and its impact on gold’s performance, drawing parallels to market behaviors seen in 2016 and 2017.

The discussion shifts to the broader influence of the new administration’s economic policies on precious metals and Craig’s insights on silver’s recent uptrend and future prospects. The conversation takes a closer look at the significance of major gold miners like Newmont and Barrick, highlighting their operational costs, influence on market sentiment, and the importance of their performance for attracting more substantial investment interest in the sector.

To wrap up we delve into the upcoming Fed meeting, the potential surprises that could arise from it, and how changes in interest rates might affect the precious metals market.

22 January 2025, 4:45 pm - Sitka Gold – Updated Resource At RC Gold Project, Yukon: 2.8 Million Ounces (Indicated + Inferred)

Mike Burke, Director and VP of Corporate Development at Sitka Gold (TSX.V:SIG – OTCQB:SITKF – FRE:1RF) joins me to discuss the updated Mineral Resource Estimate (“MRE”) for the RC Gold Project released yesterday, January 21st. The MRE now totals indicated 1.3 million ounces of gold and inferred 1.5 million ounces of gold.

Mike outlines the significant drilling undertaken over the past two years, which have fueled this update, and explains the nuances between indicated and inferred resources. The conversation delves into the incremental increase in cutoff grades (from 0.25 g/t to 0.30 g/t gold), the delineation of higher-grade areas (above 1 g/t), and the strategy moving forward to grow this asset.

Future plans include an extensive 30,000 meters of drilling aimed at expanding current deposits (Blackjack, Eiger, and Saddle Zone) and new discoveries (Rhosgobel and Pukelman).If you have any follow up questions for Mike please email me at [email protected].

Click here visit the Sitka Gold website to learn more about the Company.

22 January 2025, 3:00 pm - Dave Erfle – Fundamental Factors Moving Gold and Gold Stocks, Looking Ahead To More Mergers And Acquisitions In 2025

Dave Erfle, Editor of the Junior Miner Junky, joins us to discuss the fundamental factors moving gold, and gold stocks, as well as the key technical levels to watch. Dave also highlights the breakout in gold after the eight-week consolidation triangle, and that the GDX, GDXJ, SIL, SILJ, and silver are still attempting to break up above resistance levels.

We then shift over to a nuanced discussion around mergers and acquisition transactions; reflecting back on the nature of the kinds of deals and investor reactions to some of the deals we saw in 2024. Wrapping up we look ahead to the kinds of M&A deals that may bring more interest into the precious metals stocks in 2025.

.

Click here to visit the Junior Miner Junky website to learn more about Dave’s investment letter.

21 January 2025, 10:41 pm - Tim Tassoni – 2025 Market Trends: Look To Inflation Sensitive Sectors

Jim Tassoni, CEO of Armor Wealth Strategies, joins us to discuss his 2025 investment themes, mostly focused on inflation staying elevated or sticky.

We start with Jim’s outlook on the persistence of inflation, a stronger U.S. dollar, and cautions toward long-term bonds due to interest rates potential to creep higher. Jim explains how potential trade wars could lead to significant drawdowns in the S&P 500 and the broader market dynamics.

We also focus on gold, with Jim being bullish despite a stronger dollar, while showing preference for the metal over miners. Additionally, Jim shares his perspective on silver, financials, energy sectors, and real estate.

21 January 2025, 8:27 pm - Quetzal Copper – Maiden Drill Program At The Princeton Copper Project, BC, Adjacent To The Copper Mountain Mine

Matt Badiali, President and CEO of Quetzal Copper (TSX.V:Q) joins us to discuss the maiden drill program at the Princeton Copper Project in BC. This Project is adjacent to the Copper Mountain Mine, see the map below.

Matt outlines the Company’s journey from its listing on the TSX Venture Exchange to the commencement of drilling. He provides an overview of Quetzal’s projects, including the previous drilling in Mexico and current efforts in Princeton, and discusses the logistical advantages and key target areas for the drill program.

Key exploration targets include Bud South and Knob Hill, prioritized based on historical data, geophysical anomalies, and surface indications of copper and gold mineralization. Matt also emphasizes the Company’s approach of balancing risk and potential reward while providing details on the planned drilling activities and goals.

Please email me with any follow up questions you have for Matt. My email address is [email protected].

Click here to visit the Quetzal Copper website.

Figure 1: Location of Princeton Project Claims and Targets

21 January 2025, 7:03 pm

21 January 2025, 7:03 pm - Banyan Gold – High Grade Gold Drill Results From Powerline, AurMac Project

Tara Christie, President and CEO of Banyan Gold (TSX.V:BYN – OTCQB:BYAGF) joins me live from the floor of the Vancouver Resource Investment Conference (VRIC) to recap the Company’s last two news releases reporting drill results from the Powerlive Deposit on the AurMac Project in the Yukon.

We begin by discussing the sentiment at the recent and ongoing conferences in Vancouver. We then delve into recent drill results at the Powerline deposit, which exceeded expectations in terms of grade. Tara also shares detailed insights into the geology and higher-grade gold zones of the Powerline deposit and upcoming drill results from the Airstrip deposit.

We discuss the Company’s focus on demonstrating the project’s economics, the timeline for resource updates, and the forthcoming Preliminary Economic Assessment (PEA). The conversation covers future drilling plans, potential synergies with adjacent assets, and the company’s cash position to carry out work this year. Additionally, Tara provides updates on the permitting landscape in the Yukon and addresses questions that have been sent to me regarding the shares Victoria Gold holds in Banyan.

If you have any follow up questions for Tara please email me at [email protected].

20 January 2025, 5:07 pm - Weekend Show – Marc Chandler & Dan Steffens – Market & Commodities Recap: Oil, Nat Gas, Gold and Markets All Higher, Inflation Data Recap

Welcome to the KE Report Weekend Show! This weekend we recap recent US inflation data, discuss what could come from Trump’s inauguration on Monday, and discuss the move higher in energy (oil and natural gas), gold and US markets. The second half of the show is very much focused on what’s driving oil and nat gas higher and the opportunities in the underlying equities.

Shad and I will be at the Metals Investor Forum (MIF) on Saturday and Vancouver Resource Conference (VRIC) on Sunday and Monday in Vancouver. If you are in town and would like to meet up please email us at [email protected] and [email protected].

- Segment 1 & 2 – Marc Chandler, Managing Partner at Bannockburn Global ForEx and Editor of Marc To Market kicks off the show recapping significant market moves and economic data, including the latest US inflation figures and their implications for Fed policy. We also discuss upcoming central bank meetings and the inauguration of President Trump, along with potential impacts on the markets. Marc provides a detailed analysis of the US economy, inflation trends, energy prices, and their potential influences on future inflation data. Additionally, we delve into the rising trends in gold and cryptocurrencies, particularly Bitcoin.

- Segment 3 and 4 – Dan Steffens, President of the Energy Prospectus Group wraps up the show by shifting our focus to the energy sector with a dive into oil and natural gas markets. We discuss the recent rise in natural gas and oil prices, driven by a combination of colder weather, diminishing storage surpluses, and increased LNG exports. Dan covers specific companies poised to benefit from higher natural gas prices, such as Antero Resources and Crescent Energy, and explores the broader market dynamics, including pipeline limitations and international factors. Additionally, the conversation touches on oil market trends, potential political impacts under a Trump administration, and promising opportunities in oil services and pipeline companies. We wrap up with an analysis of Kolibri Global Energy’s (KGEI) growth prospects.

-

Click here to visit the Energy Prospectus Group website for more energy market and stock analysis.

Marc Chandler Dan Steffens18 January 2025, 11:00 am - Kootenay Silver – Drill Results From The Columba Project: F-Vein, D-Vein and B-Vein Corridor

Jim McDonald, President and CEO of Kootenay Silver (TSX.V:KTN – OTC:KOOYF) joins us to recap the drill results from the Columba Project, in Mexico, released on January 16th, 2025.

We dive into seven drill holes from the F, D, and B veins, highlighting the standout Hole 183 at the F vein, which returned over 1,400 g/t silver and 3.1% lead-zinc over 0.79meters.

Jim elaborates on the significance of consistent high-grade intersections, particularly noting wide intercepts that can lower mining costs. We also have Jim provide a ranking of each vein in terms of overall size and top drill results. This includes a discussion on the B-Vein corridor’s potential.

We also discuss the Company strategy around the ATM (at-the-market) equity distribution program to maintain financial health.

We culminate in a discussion about the broader valuation of Kootenay Silver, examining its various projects; La Cigarra, Prometario, and La Negra, and setting expectations for a maiden resource possibly by the end of Q1.

If you have any follow up questions for Jim please email us at [email protected] or [email protected].

17 January 2025, 3:00 pm - Thor Explorations – Q4 And 2024 Financials and Operations Update At The Segilola Mine, Ongoing Exploration And Derisking At The Douta Project Building Towards A PFS In Q1 2025

Segun Lawson, President and CEO of Thor Explorations (TSX.V: THX) (AIM: THX) (OTC: THXPF), joins us to review the Q4 and full year financials and operations from the Segilola Mine, as well as exploration activities around both Segilola in Nigeria. We discuss further drill results from the ongoing 2024 exploration program at the Douta Gold Project, in Senegal, as it builds towards a PFS. We also discuss the recent acquisition of the Guitry Gold Project and exploration portfolio in Cote D’Ivoire.

Segun outlined that the gold poured at the Segilola Mine for the full year of 2024 totaled 85,057 ounces (“oz”), which met guidance, and the 2025 guidance is for 85,000 – 95,000 ounces of gold production. Full year 2025 All-in Sustaining Cost (“AISC”) guidance has been set in a range of $800 to $1,000 / oz, providing solid margins at current gold prices. We also noted the key company milestone in Q4 of the final and full repayment of the senior debt facility with Africa Finance Corporation (“AFC”). The Company now has no senior debt and has a net cash position moving into 2025. The Company is exploring offering a return to shareholders via a dividend later this year.

Q4 Highlights:

- 24,662 oz poured during the fourth quarter 2024

- Gold sales in Q4 2024 of 24,936 oz at an average realized price of US$2,497 resulting in unaudited revenue of approximately $62 million

- Gold produced from 247,075 tonnes (“t”) milled at an average grade of 3.08 grammes per tonne (“g/t”) of gold (“Au”)

- Mine production of 383,699 t at an average grade of 2.30g/t of Au for 28,411oz

We reviewed that the priority of the Company’s exploration strategy at Segilola is extending the mine life through delineation of potential additional underground resources, as well as additional geochemical sampling continued at near mine open pit targets. After the 12-hole proof-of-concept deeper drilling program in 2024 was successful, the next phased of Segilola underground drilling will consist of 7,500 meters of drilling commencing imminently.

Transitioning over to the Douta Project, the RC drilling program was focused last year on increasing the percentage of oxide resources at the Makosa East Prospect, which runs parallel to the main Makosa mineralised trend and is ongoing. Additional infill drilling was completed at the Makosa North, Mansa and Maka prospects. Remaining Pre-Feasibility Study (“PFS”) and Mineral Resource Estimate update workstreams are being completed, with a target completion in Q1 2025, as a major milestone for the company this year.

Wrapping up we discussed the signing of a binding agreement last year with Endeavour Mining Corporation to acquire a 100% interest in the Guitry Gold Project in Cote D’Ivoire. The exploration portfolio at the Guitry and Boundiali licenses will be getting a fair bit of exploration work this year, with the continuation of geochemical work programs and an initial drill program on identified targets.

If you have any questions for Segun regarding Thor Explorations, then please email them into me at [email protected] , and we’ll get those submitted to management or discussed in future interviews.

*In full disclosure, Shad is a shareholder of Thor Explorations at the time of this interview.

.

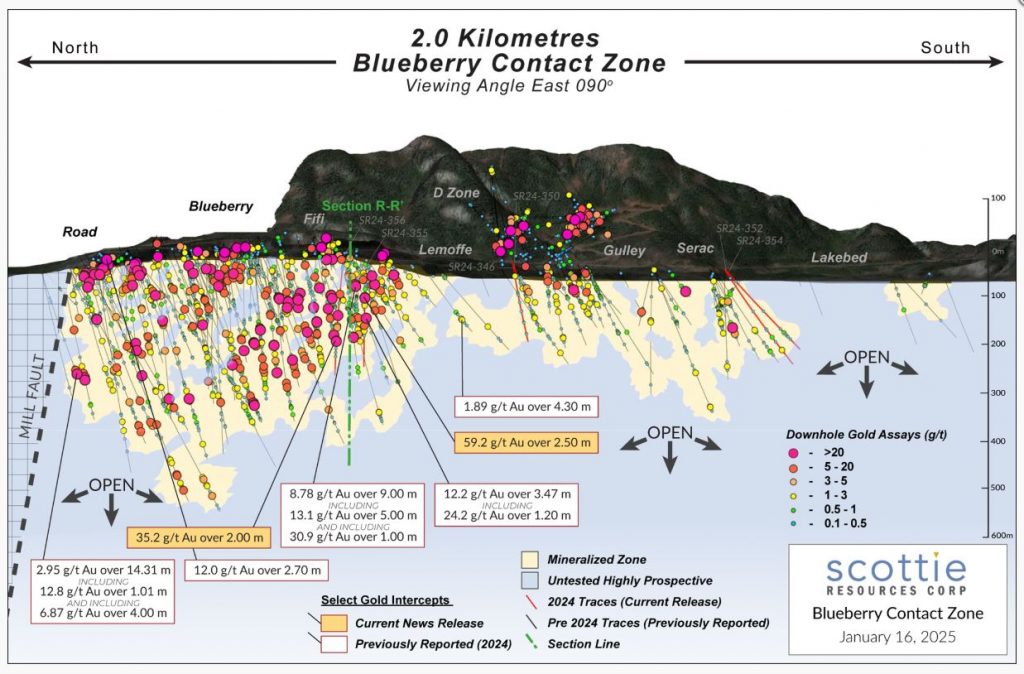

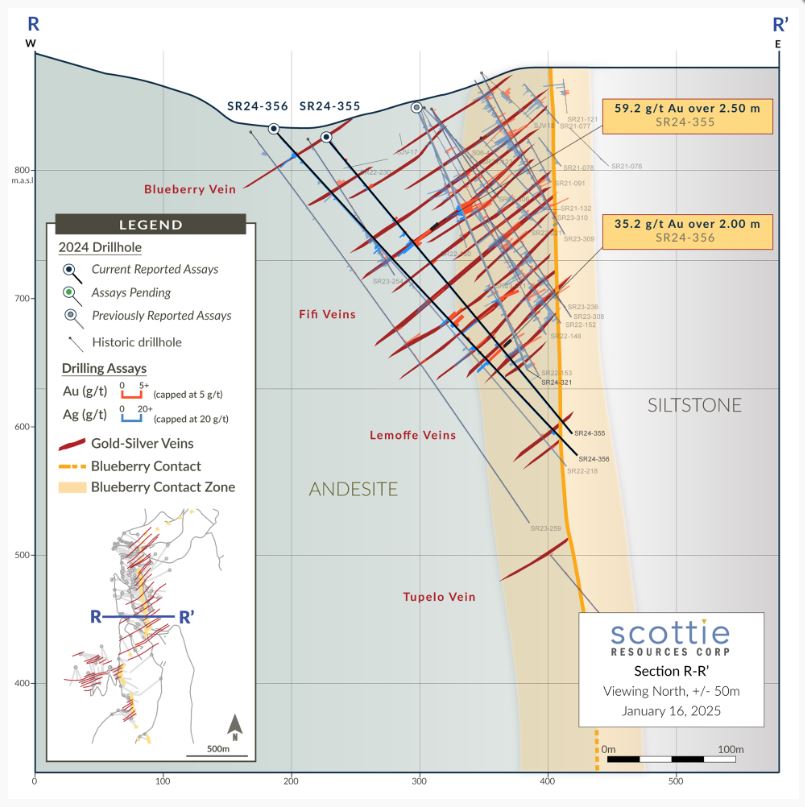

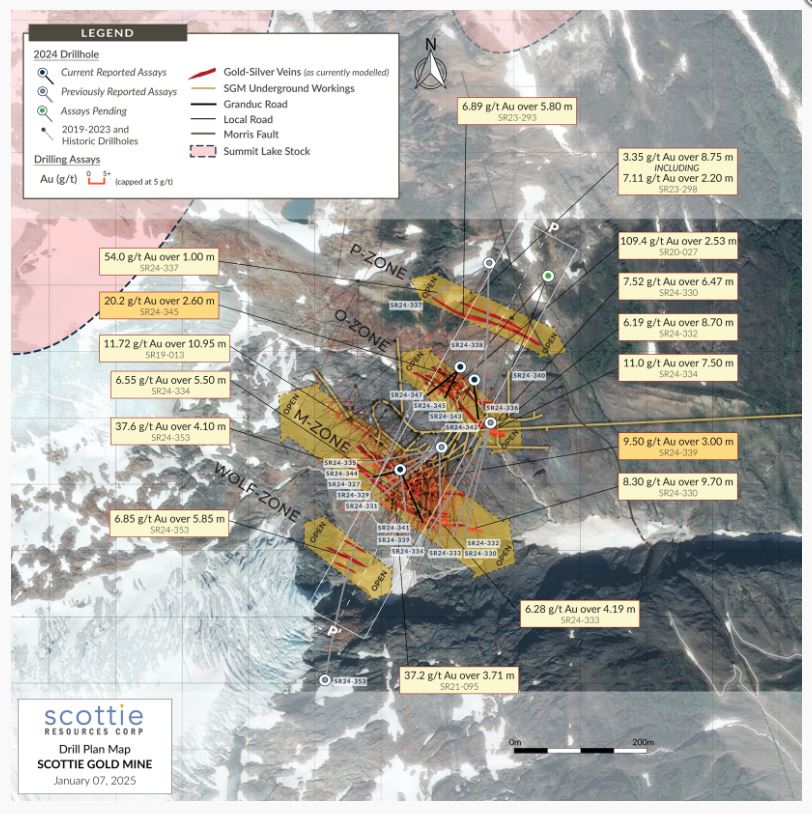

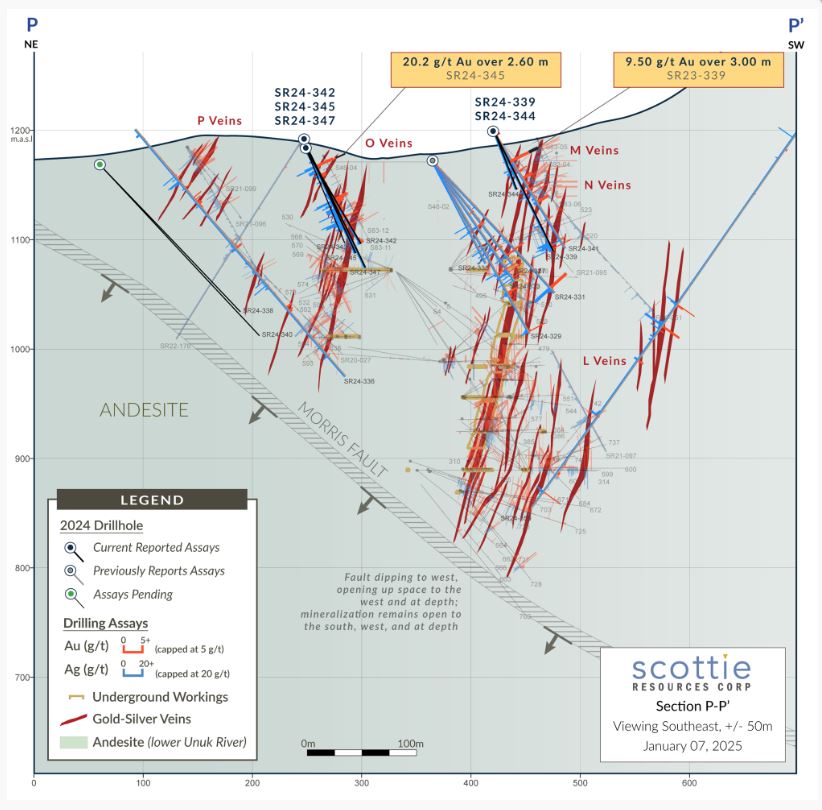

17 January 2025, 3:57 am - Scottie Resources – High-grade Assays At The Blueberry Contact Zone Return Intercepts Of 59.2 g/t Gold Over 2.50 Meters and 35.2 g/t Gold over 2.00 Meters

Brad Rourke, President and CEO of Scottie Resources (TSX.V:SCOT – OTCQB:SCTSF), joins us to review the recent assay results at the Blueberry Contact Zone and around the Scottie Gold Mine area, from this year’s 10,000 meter drill program located in the Golden Triangle of British Columbia. We also discuss the larger Company strategy of consolidating much of the prior drilling to date along with this year’s drilling all building towards a Maiden Resource Estimate that is targeted to be out by the end of Q1.

We start off noting that the Blueberry Contact drillhole SR24-355 intersected 59.2 grams per tonne (g/t) gold over 2.50 meters (m) at the Fifi vein zone. Then Blueberry Contact drillhole SR24-356 intersected 35.2 g/t gold over 2.00 m at the Lemoffe vein zone, and 2.27 g/t gold over 8.60 m at the at the Fifi vein zone. These high-grade gold intercepts over mineable widths helped fill in remaining gaps in mineralized data and will support the calculation of Scottie’s maiden resource estimate for the Scottie Gold Mine Project.

Next we discussed more recent drill intercepts from Scottie Gold Mine area, where drillhole SR24-345 intersected 20.2 (g/t) gold over 2.60 (m) at the O Zone, and where drillhole SR24-339 intersected 9.50 g/t gold over 3.00 m at the M Zone, and 4.50 g/t gold over 4.00 m at the N Zone, including 16.7 g/t gold over 1.00 m. These O Zone, M Zone, and N Zone results will also factor into the upcoming Maiden Resource Estimate.

Brad points out that they anticipate around a million ounces of gold in their first resource estimate, but that there are still results from multiple veins and around the Blueberry Contact Zone and the Scottie Gold Mine area, along with the C and D Veins, the Golden Buckle Zone, and the Domino area that are not going to be included in the resource, because they still need more drilling density. This means there is definite upside to the mineralized inventory beyond what will show up in the first pass resource report, and those growing areas will be the focus of future drill programs. The strategy is simply to get out a study on the lowest hanging fruit for the resources thus far, and then wrap some earlier stage economics around the project with a Preliminary Economic Assessment later in the year.

If you have any questions for Brad regarding Scottie Resources, then please email them in to us at [email protected] or [email protected].

- In full disclosure, Shad is a shareholder of Scottie Resources at the time of this recording.

.

Click here to follow the latest news from Scottie Resources

.

.

16 January 2025, 10:44 pm

16 January 2025, 10:44 pm - Newcore Gold – 10,000 Drill Program At Enchi Gold Project Update: Results Recap, Over 1.7Million Oz Gold Resource Overview, Future News Outlook

Luke Alexander, President and CEO of Newcore Gold (TSX.V:NCAU – OTCQX:NCAUF) joins me for an update on the ongoing 10,000 meter drill program at the Enchi Gold Project in Ghana.

We dive into various aspects of the drill program, aimed at converting inferred resources to indicated and ultimately transitioning the project from a Preliminary Economic Assessment (PEA) to a Pre-Feasibility Study (PFS). Luke elaborates on the drilling strategy, targeting the significant Boin and Sewum deposits, which form the core of the project’s over 1.7million oz gold resource.

Key achievements include the drill results announced since October, particularly high-grade intercepts over what is in the current resource, that suggest potential for resource expansion beyond current pit constraints. The discussion also covers broader project de-risking activities such as metallurgical, hydrological, and geotech work, all feeding into the upcoming PFS expected in the first half of next year. Furthermore, Luke outlines future exploration plans, highlighting numerous greenfield targets and the Company’s strategy to optimize shareholder value.

If you have any follow up questions for Luke please email me at [email protected].

16 January 2025, 5:30 pm - More Episodes? Get the App

- http://www.kereport.com

- en-US

Your feedback is valuable to us. Should you encounter any bugs, glitches, lack of functionality or other problems, please email us on [email protected] or join Moon.FM Telegram Group where you can talk directly to the dev team who are happy to answer any queries.

Proven and Probable

Proven and Probable

Gold Newsletter Podcast

Gold Newsletter Podcast

GOLDSEEK RADIO

GOLDSEEK RADIO

Turning Hard Times into Good Times

Turning Hard Times into Good Times

TheDailyGold Podcast

TheDailyGold Podcast