Living With Money

Tim Mullooly

Tim and Tom Mullooly from Mullooly Asset Management bring you "Living With Money". Tim and Tom will walk you through your financial life step by step. From the very basics of personal finance to in-depth financial planning and investing methods, you will truly learn how to live with money. With years of experience spanning multiple generations, Tim and Tom bring a unique perspective to your financial life, whether you're just starting out, or getting close to retirement. Through educational episodes, and interviews with guests from a number of industries, "Living With Money" will help you tackle topics like cash flow management, college planning, student loans, online banking, investing, retirement planning, estate planning, insurance needs, workplace retirement accounts, taxes, overall financial planning, and so much more. Let's get started.

- 40 minutes 46 seconds115 - Henry Daas - FQ: Financial Intelligence

In Ep. 115, Tim interviews Henry Daas. Henry is an entrepreneur, a business coach, and the author of FQ: Financial Intelligence. Henry offers insight for small business owners to help them weather the storm of the coronavirus. He also reminds listeners of personal finance areas not to overlook during tough times. He shares personal money lessons learned the hard way, the importance of having a unique vision for your business, and more!

2 April 2020, 8:30 am - 29 minutes 25 seconds114 - What's Your Game Plan?

In Ep. 114, Tim addresses the question of making a game plan moving forward in these challenging financial times. He clips in a conversation from the Mullooly Asset Podcast between himself, Tom, and Brendan where they discuss questions from clients, messages relayed to clients, their feelings as advisors during this time, and what people should consider when making decisions regarding their investments in this environment.

26 March 2020, 8:30 am - 31 minutes 7 seconds113 - Emergency Plans: Coronavirus Edition

In Ep. 113, Tim addresses concerns surrounding the coronavirus. He emphasizes the importance of having, and sticking with, your financial plan during times like this. He talks about why this is a perfect example of the need to have an emergency fund, and to keep it SAFE when times are good. You never know what's going to happen. He also shares insights about how, as humans, we can all get through this together.

19 March 2020, 8:30 am - 50 minutes 4 seconds112 - Stephanie Bousley - Buy the Avocado Toast

In Ep. 112, Tim talks with Stephanie Bousley - author of the upcoming book "Buy the Avocado Toast: A Guide to Crushing Student Debt, Making More $$$, & Living Your Best Life". They discuss Stephanie's journey with student debt, how she paid it down using unconventional methods, and how the book helps readers do the same. They also discuss the intertwined nature of someone's self-worth and net worth, and how they can work on improving both at the same time!

12 March 2020, 2:56 pm - 48 minutes 50 seconds111 - Bryan Hasling, CFP® - Millennial Planners

In Ep. 111, Tim talks with Bryan Hasling. Bryan is a CFP, and a financial planner at JW Harrison. Bryan also blogs over at MillennialPlanners.com, and they discuss how Bryan got started in the financial planning industry, the importance of the CFP designation, and much more. They talk about how financial planning firms can retain their young employees and grow even bigger, and how identifying client needs is paramount to retaining your clients for the long-term.

5 March 2020, 9:00 am - 35 minutes 14 seconds110 - Conor Richardson, CPA - The Millennial Financial Landscape

In Ep. 110, Conor Richardson joins the show once again making him the first 3-time guest on the show. We briefly talk about his book, Millennial Money Makeover, and also discuss a report published by the US Government Accountability Office that outlines the difficult financial landscape Millennials have entered. We talk about how Millennials can navigate this landscape and still have their chance at living the American dream!

27 February 2020, 9:00 am - 38 minutes 42 seconds109 - Brendan Mullooly, CFP® - Your Brain On Stocks

In Ep. 109, Tim's brother Brendan Mullooly joins the podcast for the second time. Brendan is a CFP at Mullooly Asset Management, building financial plans and investment portfolios for clients. He also blogs over at Your Brain On Stocks about different behavioral biases we all have in regards to finance, and ties them in to our every day lives. Brendan sheds light on a few of these biases in ways everyone can understand.

20 February 2020, 1:24 pm - 31 minutes 46 seconds108 - The 10-Year High School Reunion Episode

In Ep. 108, Tim talks to those, like him, getting ready for their 10-year high school reunion. Being 27-28 years old is an extremely interesting and important time financially for people. He talks about ways to get your financial life on track if needed, and what some financial scenarios Millennials are going through at this age. The episode wraps up with great advice for younger investors from past guests of the show.

13 February 2020, 9:30 am - 41 minutes 41 seconds107 - Ande Frazier - Financially Free

In Ep. 107, Tim interviews Ande Frazier - CEO of myWorth LLC, and author of the upcoming book "Fin(anci)ally Free: 11 Conversations to Have With Yourself About Life, Money, and Worth". They talk about Ande's mission to fix the way financial media speaks to women about their finances, and how the book is meant to start conversations about WHY we have the financial habits and goals we do. She also talks about how improving women's sense of self-worth can improve their financial situation and more!

6 February 2020, 9:30 am - 36 minutes 27 seconds106 - Dr. Jeff Anzalone - Debt Free Doctor

In Ep. 106, Tim talks with Dr. Jeff Anzalone. Jeff is a full-time periodontist and the creator of the website and blog "Debt Free Doctor". Jeff helps other doctors, and those in the medical field, manage and dig their way out of debt. He also provides valuable information about real estate investing, specifically apartment syndication investing, and other forms of passive income. Enjoy!

30 January 2020, 9:00 am - 21 minutes 9 seconds105 - 2019 Tax Tips

In Ep. 105, Tom walks the listeners through a letter from his accountant. The letter lays out tips for how to get your 2019 taxes done in a timely, simple fashion. There have been a handful of changes to the tax code over the last few years, so it's important to stay up to date. The letter also illustrates how to make your tax preparer's life easier by having everything organized. Enjoy!

23 January 2020, 9:00 am - More Episodes? Get the App

Your feedback is valuable to us. Should you encounter any bugs, glitches, lack of functionality or other problems, please email us on [email protected] or join Moon.FM Telegram Group where you can talk directly to the dev team who are happy to answer any queries.

Money Savage

Money Savage

All About Your Benjamins

All About Your Benjamins

The NewRetirement Podcast

The NewRetirement Podcast

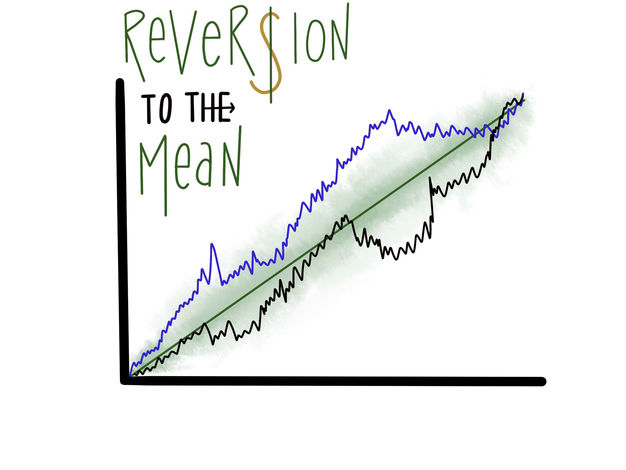

Reversion To The Mean

Reversion To The Mean

Mullooly Asset Management

Mullooly Asset Management