Not Your Average Financial Podcast™

Not Your Average Financial Podcast™

Traditional financial planning is no longer working, and in the new-normal economy, your hosts Mark Willis, CFP® and Holly Bach invite you to join us, as we engage the new and improved steps for establishing financial sanity. Be curious. Be stable. Be sane. This is Not Your Average Financial Podcast. More at https://nyafinancialpodcast.com.

- 35 minutes 27 secondsEpisode 385: How Does Dave Ramsey Not Get Sued for this?

In this episode, we ask:

- How compliant was Mark toward Dave Ramsey’s rules?

- Have you heard Episode 323?

- What about Pamela Yellen’s BankonYourself.com website update?

- What advice did Dave give Thomas?

- Why do so many viewers confuse Dave Ramsey for a financial advisor?

- Did Dave do a thorough needs analysis on Thomas’s situation?

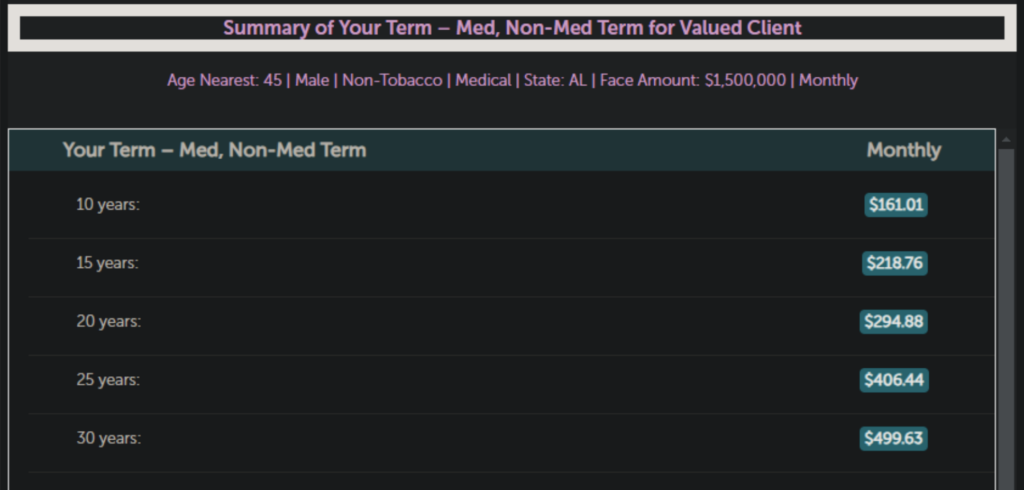

- Is Dave’s claim that whole life insurance costs 20 times the cost of term life insurance true?

- What does the math say?

- What is Dave’s hatred of whole life insurance about?

- Is cash value accessible in the first month of a whole life insurance policy?

- Is it possible that Dave Ramsey could be wrong about something?

- Would you like to listen to Episode 6, Episode 36, Episode 73, Episode 110 and Episode 143?

- Why does Dave talk about an “average rate of return” on life insurance?

- Why does he call life insurance an investment?

- Is life insurance an investment?

- What happens to financial advisors who call life insurance an investment?

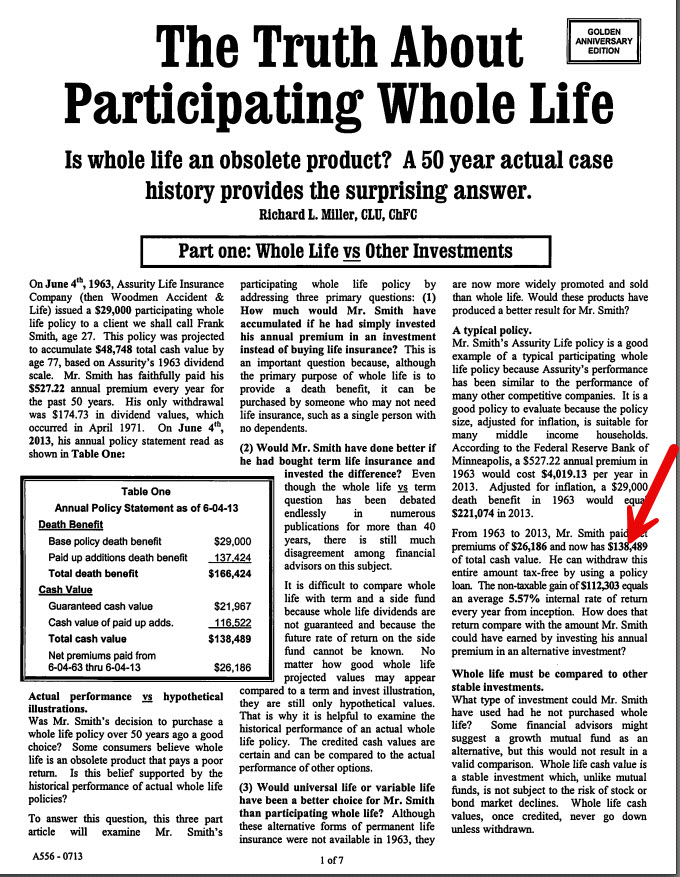

- What about the case study?

- What about the money market accounts?

- What about Dave’s term insurance ads on his show?

- Is it reasonable to expect 12% returns on mutual funds?

- What are the real returns before taxes are considered?

- What about uninterrupted compounding?

- Who invented the phrase “buy term and invest the rest”?

- Is it true that insurers confiscate the cash value when you die?

- Is that how equity contracts work?

- How about an example?

- What about life insurance?

- Would you like to see Pamela’s policy statement?

- Is this just ignorance?

- Is it more profitable to sell advice than to take it?

- What have you discovered in your research? Let us know in the FREE Not Your Average Financial Community!

17 January 2025, 6:00 am - 20 minutes 37 secondsEpisode 384: Leverage Your Life Insurance Policy with Sarry Ibrahim

In this episode, we ask:

- Have you faced threats?

- How might you bring greater benefit to you and your family?

- Have you heard Sarry Ibrahim’s podcast, Thinking Like a Bank, Episode 123?

- What did Sarry’s client ask?

- What is the story with A.L. Williams?

- Has that worked? Would it work now?

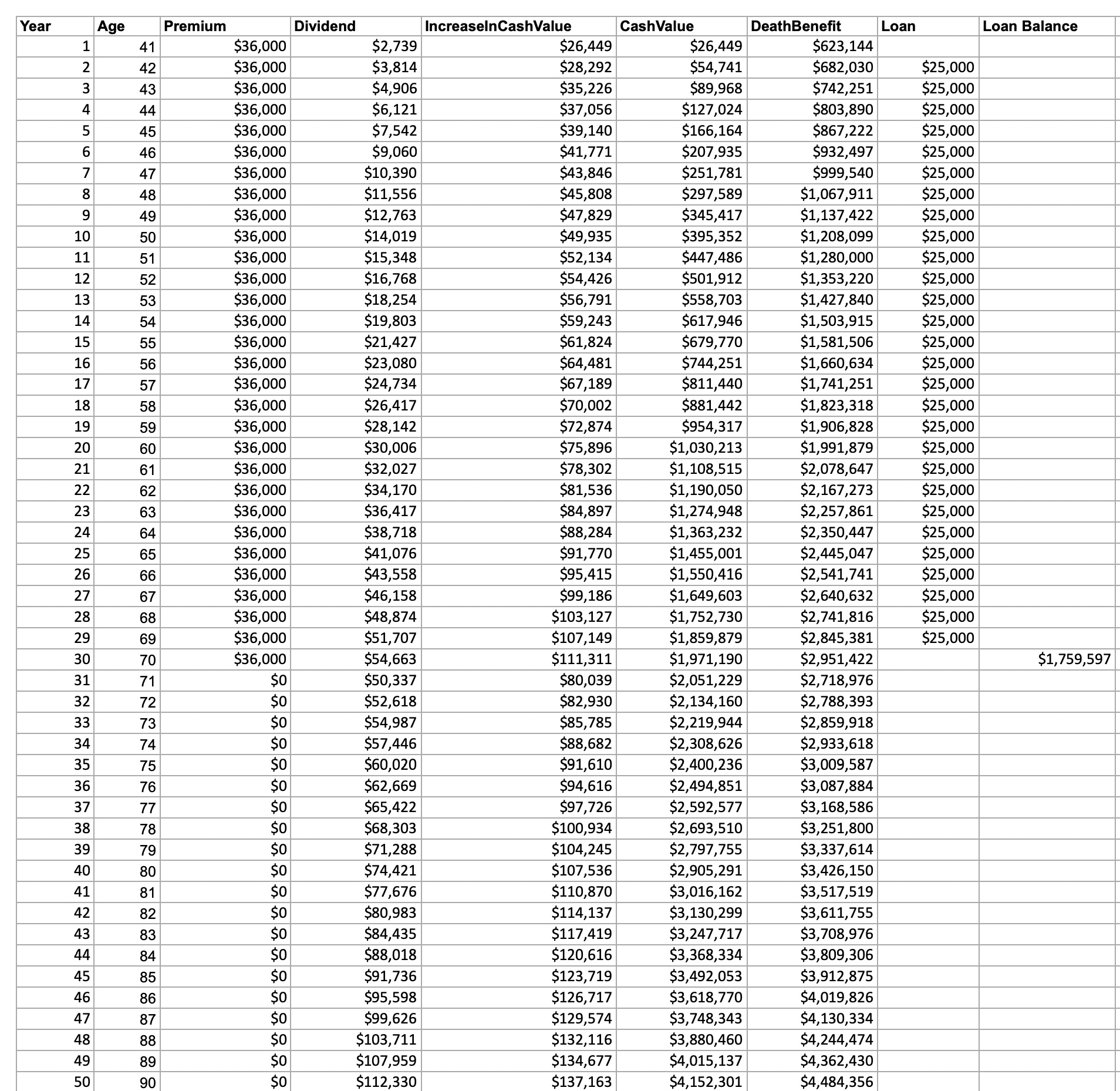

- What about the whole life policy spreadsheet?

- What are some options / hyptothetical scenarios?

- What if there was $36,000 dollars to allocate each year for 30 years? ($3K/month)

- What about investing $34,383 at a hypothetical 8% return, with a 1% compounding fee ever year for 30 years? What about purchasing a term policy with $1,616 for $600K death benefit for the 30 years?

- How about purchasing a whole life insurance policy only? What happens at year 30?

- What about purchasing a whole life insurance policy, taking a policy loan against the policy, investing the money and paying off the policy loan with the growth (hopefully) from the investment?

- What is possible, considering volatility?

- What are the better ways to do this?

- What if it is just a death benefit?

- What about investing the difference?

- Why would whole life insurance be a better fit?

- What are the takeaways?

The topics presented in this podcast are

general information only

and not for the purposes of providing legal, accounting or investment advice. On such matters, please consult a professional

who knows your specific situation. Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.

Sarry Ibrahim, CFP®, EA, MBA, is located in Chicagoland and works with clients across the United States. As the founder of Financial Asset Protection, Sarry helps clients safely accumulate wealth without sacrificing liquidity.When Sarry is not working with clients, he hosts episodes on the Thinking Like a Bank Podcast, and he enjoys spending time with his wife and son.

Connect with Sarry (rhymes with Larry) at

https://thinkinglikeabank.com/

https://www.youtube.com/@sarryibrahim4241

https://www.linkedin.com/in/sarry-ibrahim-mba-ltcp-bank-on-you10 January 2025, 6:00 am - 23 minutes 32 secondsEpisode 383: The 9 Steps to Secure Your Family’s Future

In this episode, we ask:

- Are you ready?

- What are the risks you take, just to live your life?

- What am I interested in now?

- How do you reach your financial milestones without taking unnecessary risks?

- What happens when risk goes up?

- What about outcomes?

- Who is determined to fail?

- What about speculating?

- Who is Tim Austin?

- What are the 9 steps?

- Where are you today?

- Did you know you can reach your financial milestones?

- Will you take an inventory of what’s working and what’s not working?

- Are you ready to review the inventory? What are some proposed solutions?

- Can you forgive yourself for all past and future financial missteps?

- What will you decide?

- What solutions will you implement?

- What needs review and what adjustments are needed?

- Who else needs help?

- How about listening?

- What’s working? What’s not working?

- What are the biggest aha moments?

- What might happen if….?

- Do you believe you have a bigger future within you?

- What is the After Action Review?

- What’s helping? What’s hurting?

- How might a third-party perspective bring value?

- What’s possible?

- What about self-doubt and self-forgiveness?

- What about implementation?

- Who are we grateful for?

- What about solutions and ongoing adjustments?

- Is there such a thing as a permanent financial plan?

- What if you lose your job?

- What if you move across the country?

- Humbly, what adjustments are needed?

- Who do you know who you want to feel the same way?

- What’s it like to send a simple email introduction?

- What did William Arthur Ward say?

- Would you like to meet with Mark?

3 January 2025, 6:00 am

3 January 2025, 6:00 am - 33 minutes 59 secondsEpisode 382: Lapsed! The Universal Life Insurance Whistleblower with Elan Moas, Part 2

In this episode, we ask:

- What does it mean to lapse a policy?

- Were you able to hear Part 1 with Elan Moas?

- How many universal life insurance policies will pay out?

- What about Bank on Yourself-type Whole Life Insurance Policies?

- What are the problems with universal life insurance policies (that many purchased in the 90s)?

- How could a trillion dollar industry be wrong?

- What is an irrational product?

- What is the net amount at risk?

- What happens when the cost rises?

- What happens in the later years of one of these policies?

- What is target funding?

- What is the compensation problem?

- What is the likelihood of having success in these policies?

- How does one get an in-force illustration?

- What about the universal life lawsuits?

- What about the state warnings?

- What does every advisor need to hear?

- What happened in 2015?

- Who owns a universal life policy, an indexed universal life policy or a variable universal life policy?

- Would you like to see Elan’s scorecard in his book, Lapsed, The Universal Life Insurance Whistleblower?

- Would you like to hear Les Himel on the fine print in policies on Episode 311 and Episode 312?

- What about asking for the exact allocation given to you at the point of sale?

- Would you like to watch the video where Elan talks through how to ask for an in-force illustration?

- What are the takeaways?

- Would you like to speak with Mark?

- What about the regulatory changes in this space?

- What about evaluating your policy’s sustainability?

- Who needs to hear this?

- What about a whole life insurance policy an alternative?

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.As the author of “Lapsed, The Universal Life Insurance Whistleblower,” Elan has scrutinized over 5,000 individual policies, uncovering structural flaws that have led to significant regulatory attention. His work includes submitting four SEC Whistleblower tips from 2016 to 2024, highlighting the high “lapse” rates and inherent issues within universal life insurance policies, particularly at major insurers like MetLife.

Through Moas Consulting, Elan provides ethical life insurance guidance, training for professionals, university lectures, and expert witness testimony. He has also shared his insights on various podcasts, becoming a sought-after voice on matters of financial integrity and consumer protection.

27 December 2024, 6:00 am - Episode 381: Exposed! Lapsed Universal Life Policies with Elan Moas, Part 1

In this episode, we ask:

- What do you think of when you think of tried and true products?

- What if I told you of a product that failed 90% of the time?

- What about life insurance?

- Where is the scandal?

- Where is the front page news?

- Who is Elan Moas?

- What is Elan’s experience?

- What happened during the subprime mortgage crash?

- What flaws did Elan discover in universal life insurance?

- What does a “lapsed policy” mean?

- What was happening to 9 out of 10 of these universal life policies?

- What about dividends?

- What is getting wiped out?

- How many in-force illustrations did Elan run on the software?

- What happened with updated interest rates?

- To whom did Elan reach out?

- Would you like to read the book Lapsed, The Universal Life Insurance Whistleblower?

- Is an in-force illustration holy?

- What are the takeaways?

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.

Elan Moas, a seasoned financial advisor with over fifteen years in the industry, leverages his extensive experience and regulatory acumen to navigate the intricate world of universal life insurance. Holding multiple licenses including Series 6, 7, 63, 65, 2-15, and 2-20, Elan is a recognized advocate for ethical practices in financial advisory.As the author of “Lapsed, The Universal Life Insurance Whistleblower,” Elan has scrutinized over 5,000 individual policies, uncovering structural flaws that have led to significant regulatory attention. His work includes submitting four SEC Whistleblower tips from 2016 to 2024, highlighting the high “lapse” rates and inherent issues within universal life insurance policies, particularly at major insurers like MetLife.

Through Moas Consulting, Elan provides ethical life insurance guidance, training for professionals, university lectures, and expert witness testimony. He has also shared his insights on various podcasts, becoming a sought-after voice on matters of financial integrity and consumer protection.

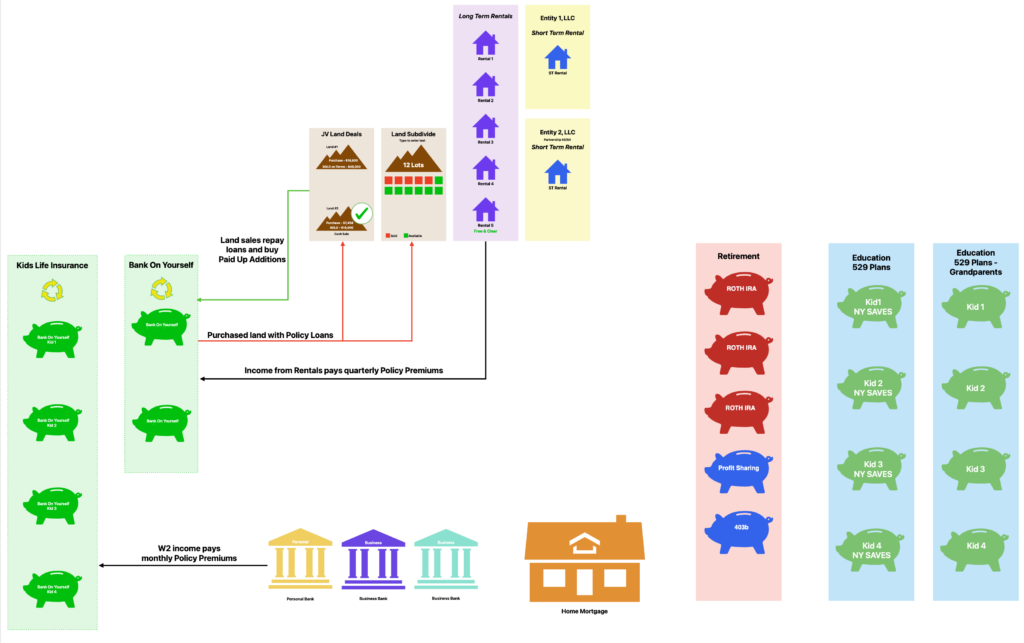

20 December 2024, 6:00 am - 37 minutes 42 secondsEpisode 380:[Client Spotlight] Mastering Real Estate and Bank On Yourself® with Brian Claus

In this episode, we ask:

- How about balancing family life, ministry and real estate?

- Who is Brian Claus?

- Have you heard about UnBound Now?

- What’s Brian’s earliest memory with money?

- What did Brian’s Dad do to incentivize saving?

- What’s Brian’s story?

- What happened in 2018?

- What are the benefits of running real estate through policies instead of banks?

- What about Dave Ramsey’s thinking?

- What about due diligence?

- What about selling the house?

- What was the benefit of putting the proceeds into a policy?

- What about the down payment for the new house?

- What about the pool?

- What happened with the land deal?

- What about the other deals?

- How did Brian access the money?

- Would you like to view Brian’s financial map?

- How else does Brian use these policies?

- What about paying taxes?

- What about the ministry through Brian’s church?

- Would you like to visit UnBound Now?

- Would you like to email or message Brian on the FREE Not Your Average Financial Community?

- What are the takeaways?

Brian Claus balances family life with a career in diverse real estate ventures, from long-term rentals to Airbnbs and land sales. For over a decade, he’s worked with Unbound Now, a dedicated anti-human trafficking organization, where he’s made a meaningful impact.13 December 2024, 6:00 am

Brian Claus balances family life with a career in diverse real estate ventures, from long-term rentals to Airbnbs and land sales. For over a decade, he’s worked with Unbound Now, a dedicated anti-human trafficking organization, where he’s made a meaningful impact.13 December 2024, 6:00 am - 22 minutes 21 secondsEpisode 379: From Coma to Financial Independence with Nick Prefontaine

In this episode, we ask:

- Have you ever faced a challenge so big, it just seemed insurmountable?

- Have you turned a setback into a comeback?

- Who is Nick Prefontaine?

- What is the S.T.E.P. system?

- What happened to Nick on the mountain?

- What happened during recovery?

- What has Nick done with his policy?

- What about upgrading your health rating?

- What is Nick really happy about?

- Would you like to hear Episode 260?

- Would you like to listen to Episode 75?

- Would you like to revisit Episode 361?

- How would you fill in this sentence? Because of my Bank on Yourself policy, ___________.

- Would you like to visit Nick’s website to download the S.T.E.P. system for FREE?

- Would you like to learn more about and implement Support, Trust, Energy and Persistence?

- What are the takeaways?

Nick Prefontaine is a 3x best selling author and was named a top motivational speaker of 2022 in Yahoo Finance. He’s a Speaker, Founder and CEO of Common Goal.

Nick Prefontaine is a 3x best selling author and was named a top motivational speaker of 2022 in Yahoo Finance. He’s a Speaker, Founder and CEO of Common Goal. Using the S.T.E.P. system he is able to lead clients through their trauma. Once they make it through, that is where their limitless potential lies. Nick has been featured in Brainz Media, Swaay and Authority Magazine.

6 December 2024, 6:30 am - 27 minutes 17 secondsEpisode 378: Inflation: Stocks vs. Bank on Yourself®

In this episode, we ask:

- Are you shocked about how everything keeps going up in price?

- Are you surprised about how so many things are shrinking?

- Who has debt on the balance sheet?

- What about companies?

- What about customers?

- What about the stock prices?

- What about interest rates?

- What happens in a recession?

- What vaporizes compounding?

- What happened to the S&P from 2000-2022?

- What are the stated returns?

- What is the real return?

- What about the investment fees?

- Is inflation higher than what is being reported?

- What does the Fed believe?

- …Would you fire him?

- What about insurance companies?

- Who came first, insurance companies or the Federal Reserve?

- What about bonds?

- What about mutually owned life insurance companies?

- What about dividends?

- How does inflation affect cash value whole life insurance?

- What is guaranteed to grow, regardless of any calamity or market crash?

- What if they went through hard times… what happens then?

- How is this difference from term insurance?

- How about an example?

- Are premiums fixed for life?

- What happens to premiums with inflation?

- What about the impact of inflation on stocks?

- What about the impact of inflation on whole life insurance contracts?

- When do you see the change in dividends?

- What is a steady growth vehicle, regardless of inflation?

- When do I want my money growing at its most efficient?

- Is now a good time to take my chips off the table?

- Would you like to join our FREE Not Your Average Community?

29 November 2024, 6:00 am

29 November 2024, 6:00 am - 45 minutes 8 secondsEpisode 377: Real World Tips for Selling Your Business with David C. Barnett

In this episode, we ask:

- What percentage of businesses successfully sell at all?

- Who is David C. Barnett?

- Would you like to hear David on Episode 154?

- How about a story?

- What are some of the hazards that new business owners run into all of the time?

- How did David get started?

- What did David learn as a business broker?

- What does David do now?

- What needs to happen for a fair deal to occur?

- What are the reasons people need to sell businesses?

- What do most sellers fail to realize?

- What is aspirational pricing?

- How has the internet changed the way buyers conduct research and due diligence?

- What happens when you are excited and energetic about your business?

- What happens when you start to feel fed up, have pressures or health issues?

- What creates a whole series of red flags for buyers?

- What mindsets, skillsets or strategies can one employ to prepare to sell the business?

- How can you increase your earnings or reduce your own capital tied up in the business?

- How is real estate different from an operating business?

- How is a business actually a system?

- Would you like to read David C. Barnett’s new book, Buying vs. Starting a Small Business: A Guide to Keep You From Going Broke?

- Who would benefit from this book?

- How does one empathize with the potential buyer?

- What is the give and take required in this relationship?

- What about seller financing?

- What about the need for the buyer to be successful?

- What’s it like to work with David?

- What are the action items?

- Would you like a business valuation? Book a Meeting

David C. Barnett has been working with small businesses for over 20 years. He’s helped them grow, he’s helped entrepreneurs buy and sell them, he’s helped people finance them. David is the author of 8 books about small business transactions and local investing. He’s the host of a YouTube channel with hundreds of videos about buying, selling, financing and managing SMEs and can be found anytime at his blog site www.DavidCBarnett.com22 November 2024, 6:00 am

David C. Barnett has been working with small businesses for over 20 years. He’s helped them grow, he’s helped entrepreneurs buy and sell them, he’s helped people finance them. David is the author of 8 books about small business transactions and local investing. He’s the host of a YouTube channel with hundreds of videos about buying, selling, financing and managing SMEs and can be found anytime at his blog site www.DavidCBarnett.com22 November 2024, 6:00 am - 42 minutes 5 secondsEpisode 376: [Client Spotlight] Due Diligence and the Income Snowball with Tanisha Souza

In this episode, we ask:

- Did you have a Game Genie or similar childhood thrill?

- Do you remember the Choose Your Own Adventure books?

- What is the income snowball?

- How does one generate passive income?

- Who is Tanisha Souza, J.D.?

- What about due diligence?

- How about a story?

- What does Tardus Wealth Strategies do?

- What is wealth coaching, and how is it different from financial advising?

- What is the income snowball?

- What is Tanisha’s background?

- How does the income snowball work?

- What are some examples of people on the income snowball?

- What about a passive income strategy?

- What’s the difference between an accumulation strategy and a passive income strategy?

- What about replacing living expenses?

- How about leverage?

- Why leverage Bank on Yourself type whole life insurance policies with the income snowball?

- Would you like to read Tanisha Souza’s book, Creating Your Income Snowball?

- What are the benefits of shorter terms?

- What are the risks?

- What’s a slow burning fuel?

- What’s a fast burning fuel?

- What’s the risk tolerance?

- Would you like to visit creatingyourincomesnowball.com?

- What are the takeaways?

Tanisha Souza, J.D., is an author, patent-holder, professional speaker, wealth and passive income coach, and entrepreneur. She has a passion for teaching people how to live their dreams by quickly building passive income without risk. Tanisha quit the practice of law after replacing her income with passive income from real estate, and she launched Tardus Wealth Strategies, a full-service wealth and passive income coaching firm. Tanisha studied and obtained her bachelor’s degree at U.C. Berkeley and obtained her juris doctorate from the U.S.C. Law School.15 November 2024, 6:00 am

Tanisha Souza, J.D., is an author, patent-holder, professional speaker, wealth and passive income coach, and entrepreneur. She has a passion for teaching people how to live their dreams by quickly building passive income without risk. Tanisha quit the practice of law after replacing her income with passive income from real estate, and she launched Tardus Wealth Strategies, a full-service wealth and passive income coaching firm. Tanisha studied and obtained her bachelor’s degree at U.C. Berkeley and obtained her juris doctorate from the U.S.C. Law School.15 November 2024, 6:00 am - 20 minutes 32 secondsEpisode 375: Get Off the X! No Decision is Still a Decision

In this episode, we ask:

- When does your training kick in?

- What about a broader mindset of adaptability and resilience?

- Does what saved you in the morning kill you in the evening?

- What is riskier or now outdated?

- What about wealth stability?

- Who is standing right on the X?

- What is the darling of everyone’s stock portfolio… until it’s not?

- Who knows?

- Who is stuck in analysis paralysis?

- Would you like to hear Episode 342?

- Is this really a safe stop?

- What about a case study?

- What about showing leadership with yourself?

- What about the example of the Israelites?

- Is not making a decision, still making a decision?

- Am I doing what I’m doing right now, only because I’ve done it before?

- What are some action steps?

- What financial vulnerabilities need attention?

- Who are the other members of your squad?

- What did Dan say?

- How about a story?

- Do you have a chance to move off the X?

- Would you like to meet with Mark or one of Mark’s associates?

8 November 2024, 6:00 am

8 November 2024, 6:00 am - More Episodes? Get the App

Your feedback is valuable to us. Should you encounter any bugs, glitches, lack of functionality or other problems, please email us on [email protected] or join Moon.FM Telegram Group where you can talk directly to the dev team who are happy to answer any queries.

How to Lose Money

How to Lose Money

Grandma's Wealth Wisdom

Grandma's Wealth Wisdom

Living Wealthy Radio

Living Wealthy Radio

Money Time

Money Time