DH Unplugged

Dvorak/Horowitz

Dvorak and Horowitz Unplugged

- 1 hour 4 minutesDHUnplugged #737: Spirited Animals

Trump-o-Nomics here we come.

MemeCoins making s comeback – then fizzling.

Pardons and Executive orders are flying.

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

*** California Clean up - Some thoughts and companies... ****

Warm-Up

- New President - New Leadership

- Pardons flying....Even preemptive ones

- Another short-seller is out of biz...

- Talking bout animal spirits being unlocked as President Trump take officeMarkets

- Coins - on fire (then pull back)

- Markets - Moving after last week's CPI print

- MemeCoins making a comeback

- Pelosi moving stocks** Need a new symbol for the 1st CTP for 2025

PSA - Quick note - Next week's guest on TDI Podcast - Howard Lindzon - Founder of StockTwits

- Follow JCD and AH on Twitter

- Listen to No Agenda every week - double the pleasure on Thursdays and Sundays at 2P (ET)Inauguration

- Any major takeaways?

- Trump wearing a purple tie - that does not seem like an accident

- Significant number of executive orders

First orders of business--- Energy is key area along with DEI, TWO Genders (only), Temporary pause on China tariffs, National emergency at borders, ending EV mandates

- National emergency: Borger, energy

- "That national energy emergency will unlock a variety of different authorities that will enable our nation to quickly build again, to produce more natural resources, to create jobs, to create prosperity and to strengthen our nation's national security"

- Opening up Alaska: "Alaska is so key for our national security, given its geostrategic location, and it's a crucial place from which we could export LNG not only to other parts of the United States, but to our friends and allies in the Asia Pacific region"

- DEI -could now be DOA

- Withdrawing from Paris clime agreement

- - - The incoming administration plans to review and potentially end what the official described as "discriminatory programs," including environmental justice grants and diversity training initiatives.

--- Retaking Panama Canal and plant a flag on Mars

-- Do we want to discuss that President Trump did not put his hand on the bible as he was being sworn in?

----EXTERNAL REVENUE SERVICE: For this purpose, we are establishing the external revenue service to collect all tariffs, duties and revenues. It will be massive amounts of money pouring into our treasury coming from foreign sources, the American dream will soon be back and thriving like never before to restore competence and effectiveness to our federal government

- Vivek Ramaswamy is out as Elon Musk’s co-leader as he is running for Governor of OhioPre-Emtiove Pardons

- President Joe Biden on Monday issued preemptive pardons for several family members, citing concerns that they will be targeted by “baseless and politically motivated investigations.”

- Biden pardoned his brother, James Biden; James’ wife, Sara Jones Biden; his younger sister, Valerie Biden Owens; Owens’ husband, John Owens; and his other brother, Francis Biden.

- “The issuance of these pardons should not be mistaken as an acknowledgment that they engaged in any wrongdoing, nor should acceptance be misconstrued as an admission of guilt for any offense,” Biden said in a press release.

--- AND January 6th "Hostages" pardonedTariffs

- Seems that the squeeze is on - 25% on Mexico (MexAmerica) and Canada (CanAmerica) starting Feb 1st.

- HOT FLASH - 10% on China starting Feb 1Musk - Feelings hurt?

- Removing of EV mandates - not in his best interest.. Right?

- Could it be a swap for more lucrative defense and space contracts?TikTok

- Goes dark for a little while over he weekend (Apple, Google remove app and offline on web)

- Several players are interested in buying the US assets

- Kevin O'Leary, Elon Musk

--- Latest to throw their hat in the ring - Perplexity AI- merger

--- Perplexity is backed by Amazon/Bezos (amongst others)

-- Trump wants to try to give them more time to work things out.... (TikTik CEO attended Inaugural ball)Netflix - POW! (Disclosure- H&C Clients own NFLX)

- Q4 global streaming paid net adds were +18.91 mln vs prior guidance of "higher than Q3's +5.07 mln." Co notes Q4 was the biggest quarter of net adds in company history.

- Q4 operating margin came in at 22.2% vs 21.6% prior guidance primarily due to higher-than-forecasted revenue; guides to Q1 operating margin of 28.2%.

- Co says revenue was slightly above forecast despite the strengthening of the US dollar vs. most currencies as membership growth and ad sales outpaced the co's forecast.California Fire Clean up

- Companies that may benefit - Clear: United Rentals (URI), Caterpillar (CAT)

- Fire Retardant Paint 3M (MMM)

- Homebuilder - most known in LA area KB Hones (KBH)Earnings

- Target Earnings (not great - not getting much better)

--Target raised its fourth-quarter sales forecast Thursday after more consumers turned to its stores and website for holiday shopping — particularly on days known for deep discounts.

-- The big-box retailer now expects comparable sales in the fiscal fourth quarter to grow by about 1.5%. That's better than its most recent outlook

-- Yet the Minneapolis-based discounter did not lift its profit outlook — an indication that deals motivated shoppers. Target anticipates fourth-quarter earnings per share will range from $1.85 to $2.45 and full-year earnings per share will be between $8.30 and $8.90.CPI

- CPI came mostly as expected or a little hottr than expected

- HOWEVER, Core CPI on MoM and YoY were a little better and that sent market flying

- Stocks had a great week and Bond yields fell

- Seemed a little much considering all of the other data that we have seenCrypto

- Bitcoin hits a new high over the weekend, Ripple on the move

- New MEMECoins - Trump and Melania Coins are out there

- No perceived value, but Trump coin move up sharply into the inauguration

-- Launched ~ 1/17/2025 $TRUMP - up 560% through the inauguration (2 days) - topped out at $10B market cap (After the Inauguration dropped 30%)

--- OH, of you want, the $MELIANA con is also available now. (Down 16% from inception to after the inauguration)Saying goodbye to Hindenburg Research

- Founder Nate Anderson announced that the firm is closing

- He outed Adani in India as well as Nikola, Ichan and other major financial "schemes"

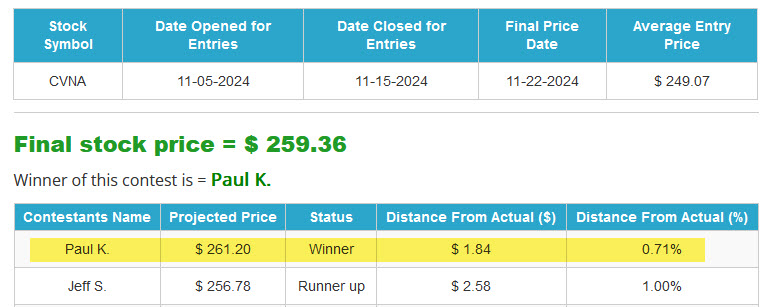

- The most recent report they published was on Carvana

- But seems that they have recently reported their last name to the SEC - some pozi scheme that will eventually come out...Bank Earnings Round Up

- We discussed, but generally good, better margins and investent income solid

- JPM boosts buybacks - even though Dimon says stock is expensive.

- Bank of America on Thursday posted results that topped expectations for profit and revenue on better-than-expected investment banking and interest income. (Investment banking fees surged 44%)

- Morgan Stanley - The bank said that quarterly profit more than doubled to $3.71 billion, or $2.22 a share, from a year earlier, when it had a pair of regulatory charges.More Burning Food

- Genesis Monita, 19, sued Bill Miller Bar-B-Q Enterprises in October 2023 after she had been served sauce that gave her a second-degree burn earlier in the year.

- Took the breakfast taco out of the bag, sauce fell on her leg and got 2nd degree burns.

- How much sauce was on that taco?

- More than $25,000 was paid to her for medical expenses following her injury and $900,000 was for past and future mental anguish, physical pain and impairment.

- The restaurant franchise was found to be "grossly negligent" by the jury, awarding Monita $1.9 million in punitive damages.Pelosi - Still got it!

- TEM (+31%) early strength appears to have evolved into a price squeeze. Initial strength triggered by Nancy Pelosi disclosure of $100K Call option purchase.Love the Show? Then how about a Donation?

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

22 January 2025, 3:31 am - 1 hour 6 minutesDHUnplugged #736: The One-Two Punch

People are catching on – Fed has no clue

Investors are nervous – lots of intraday volatility

Correction – could it be?

USA- Going DEEPER into debt

DOGE – already making excuses

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm-Up

- People are catching on - Fed has no clue

- Investors are nervous - lots of intraday volatility

- Correction - could it be?

- USA- Going DEEPER into debt

- DOGE - already making excuses

- Next Monday - Market Holiday and Inauguration dayMarkets

- No happy - inflation and jobs (A 1-2 Punch for markets)

- CPI and PPI this week - make it or break it?

- Rates hitting key resistance

- Oil spikes - multi-month highAll of a sudden..

- Microsoft, Facebook and other companies are cutting staff again

- Talk of tough year ahead... What is up?If they don't cooperate?

- Cut their pay!

- China is set to slash pay for staff at its top three financial regulators, including the central bank, by about half, as part of a regulatory revamp unveiled in 2023 to bring their salaries in line with other civil servants

- Starting from this month, staff at the People's Bank of China (PBOC), National Financial Regulatory Administration (NFRA) and China Securities Regulatory Commission (CSRC) will see total income slashed by about half.More China - Pull Forward

- China’s trade data in December beat expectations by a large margin, with exporters continuing to frontload shipments as worries over additional tariffs mount, while the country’s stimulus measures appear to be supporting demand in the industrial sector.

- Can it last?Let's Talk Turkey

- Fed has no idea what is going on

- They simply can move markets, (equity and fixed income) by liquefying markets

- HOPE that they have the general trend and can regulate the flow so not overheat or overcool

- In reality, their forecasting tools are crap

--- BUT, focus on what they do, not what they say or their outlookEmployment Numbers

- Summary: Nonfarm payrolls increased by a stronger-than-expected 256,000, the unemployment rate slipped to 4.1% from 4.2%, average hourly earnings growth year-over-year was a sturdy 3.9%, and more people were employed.

- Much better than anticipated !

- Unemployment rate drops

- So, we see higher prices and better employment - markets spooked that Fed out of touch

- One-Two punch for equitiesResult

- Steepening yield curveMarket Sell-off

- NASDAQ 100 off 6% from the highs

- Big names down more (NVDA 13%, Tesla 18%, Apple 10%, NFLX 10%)

- SOOOO - Big Cap Tech is in a correction and dragging down markets

- Markets are in the RED for the year and unchanged/under the pre-election day move.

- More speculative (runners) stocks are down even more...Quantum Stocks

- DUH!

- Sell-off deepened as Zuck cautioned that the potential is still years (and years) away (on Joe Rogan Show)

--- Zuck looking like he wants to follow in Elon's footsteps

More Zuck

- Bashing Apple...

- No innovation, random rules

- "So how are they making more money as a company? Well, they do it by basically, like, squeezing people, and, like you're saying, having this 30% tax on developers by getting you to buy more peripherals and things that plug into it," Zuckerberg said. "You know, they build stuff like Air Pods, which are cool, but they've just thoroughly hamstrung the ability for anyone else to build something that can connect to the iPhone in the same way."Oh - and this...

- Meta on Friday told employees that its plans to end a number of internal programs designed to increase the company's hiring of diverse candidates, the latest dramatic change ahead of President-elect Donald Trump's second White House term.

- Among the changes, Meta is ending the company's "Diverse Slate Approach" of considering qualified candidates from underrepresented groups for its open roles. The company is also putting an end to its diversity supplier program and its equity and inclusion training programs.Light at the End of the Tunnel?

- Cleveland Cliffs is partnering with rival Nucor in a potential bid for U.S. Steel, whose takeover by Japan's Nippon Steel was just blocked by the White House earlier this month, sources tell CNBC's David Faber.

- Cleveland-Cliffs would purchase all of U.S. Steel for all cash and then sell off the Big River Steel subsidiary to Nucor, the sources said. The offer would be in the high $30s a share.

- Not a great deal as the Nippon offer was at $55Meanwhile...

- The Committee on Foreign Investment in the United States approved an extension of the deadline for Nippon Steel Corp. to abandon its $14.1 billion takeover of United States Steel Corp., according to a statement by US Steel.

- The deadline will be extended to June 18 from Feb. 2 originally, following President Joe Biden’s order to halt the deal earlier this month. A Nippon Steel spokesperson confirmed the extension to Bloomberg News. The new deadline is also the date the two companies had set for completing the merger.Trouble in Consumerville?

- Abercrombie & Fitch (DOWN -18%) loses much of its appeal today despite raising its Q4 (Jan) sales outlook following upbeat holiday spending trends.

- The clothing retailer focused on a younger demographic lifted its Q4 net sales forecast to +7-8% from +5-7%, pushing its FY25 revenue growth guidance to around +15% compared to its previous +14-15% forecast.

- Additionally, ANF reiterated its operating margin projections for the quarter and full year, anticipating around 16% and 15%, respectively.

- According to Briefing.com: Shares are lower because ANF's sales trends weakened this year compared to the previous holiday season.

----In 2023, ANF raised its Q4 net sales growth outlook to a high teens percentage from low double-digits, suggesting around a 5-9 pt bump due to a robust holiday shopping season.

-----A similar development is unfolding for rival American Eagle (AEO), whose total revenue is tracking around 5% lower for Q4 compared to a low double-digit jump during the year-ago period.

- (Disclosure: Core holding for H&C Clients)Takes a Turn

- Southwest Airlines is pausing corporate hiring and promotions, suspending most of its summer internships and going without some employee team-building events that date back to the 1980s in order to cut costs and improve margins, CEO Bob Jordan told staff Monday.

- As part of the cost cuts, Southwest is pausing its employee "rallies," a company team-building tradition that dates back to 1985 in which staff hear from the airline's leaders about the year's goals and are treated to food and entertainment.

- Pushed by activist Elliot Management, the airline last year charted out a plan to increase profits that includes ditching its more than 50-year-old open seating model in favor of assigned seats and creating a section with extra legroom, flying overnight flights and more aggressively cutting back unprofitable routes.Deep in Debt

- Rising financing costs along with continued spending growth and declining tax receipts have combined to send deficits spiraling and have pushed the national debt past the $36 trillion mark.

- The three-month fiscal year 2025 deficit rose to $710.9 billion, some $200 billion more than the comparable period in the prior year, or 39.4%.

- Rising financing costs along with continued spending growth and declining tax receipts have combined to send deficits spiraling, pushing the national debt past the $36 trillion mark.

- Though short-term Treasury yields have held fairly steady over the past month, rates at the far end of the duration curve have surged. The benchmark 10-year note most recently yielded close to 4.8%, or about 0.4 percentage point above where it was a month ago.Robinhood - Hand Slap

- $45 million penalty

- The violations by Robinhood Securities LLC and Robinhood Financial LLC related to failures to report suspicious trading in a timely manner, failing to implement adequate identity theft protections, and failing to adequately address unauthorized access to Robinhood computer systems, the SEC said Monday.

- Stick up 8% on the day...More bad actors

- Capital One is being sued by the US government’s consumer watchdog agency for “cheating millions of consumers” and not paying more than $2 billion in interest to holders of its high-interest savings accounts.

- Stock up 2% on the day...Hmmmm

- Eli Lilly struggles to meet sky-high expectations as Q4 Mounjaro and Zepbound sales fall short

- STRONG, just not what was expected...

- Also, some talk about weight loss pill by LLY (next year)

- Stock down 7% on the day....DOGE - Dogged

- Tech billionaire Elon Musk said Wednesday that his budget-cutting effort on behalf of President-elect Donald Trump would most likely not find $2 trillion in savings, backtracking on a goal he set earlier as co-head of a new advisory body, the Department of Government Efficiency, or DOGE.

- Musk told political strategist Mark Penn in an interview broadcast on X that the $2 trillion figure was a "best-case outcome" and that he thought there was only a "good shot" at cutting half that.

- Next goal?? $420 Billion?Cracks in the AI $$ game

- Alibaba is cutting prices on its large language models by up to 85%, the Chinese tech giant announced Tuesday.Love the Show? Then how about a Donation?

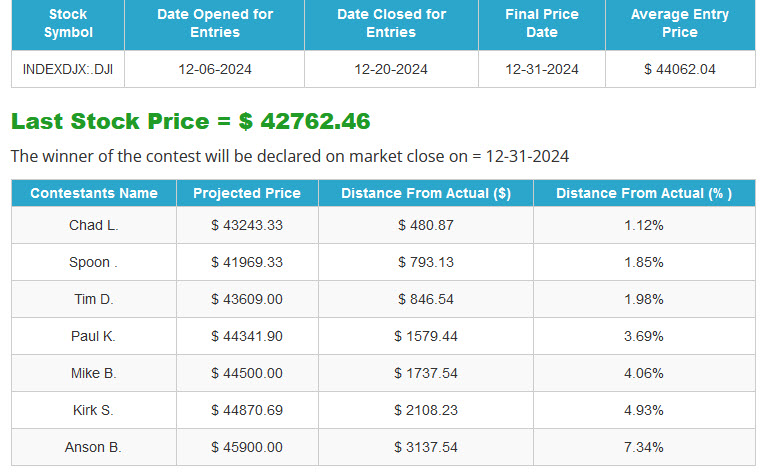

2024 - DH Closest to The Pin Cup - FINAL

(ERIC)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

15 January 2025, 3:18 am - 1 hour 3 minutesDHUnplugged #735: Grinchly Ending

Grinch Ending …. No Santa Rally

CTP Results are IN! Close race

Cocktails -> Cancerous now

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm-Up

- Grinch Ending .... No Santa Rally

- CTP Results are IN! Close race

- Cocktails -> Cancerous now

- New rules for medical bill deadbeats- Markets

- Poor end of year - hard hit by Grinch - killed Santa Rally

- Gym parking Lots - Resolutions for January

- Yields starting to becom a problem

- CME Fed Funds Futures --> No CUT MAN!Market Update

- DecemberJanuary Markets

- As expected, the start of the year is typically a time when people make resolutions they hope to keep.

- In the finance world, we often hear about returning to discipline, cutting losers, adding to winners, and adhering to all the fundamental rules.

- Additionally, at this time of year, investors may consider becoming more aggressive, less aggressive, more diversified, or investing in last year's winning stocks.

- These thoughts and actions contribute to market volatility, which usually fades away within a couple of months when resolutions are forgotten

---- Much like how the parking lots at local gyms are packed every January, but plenty of spots open up by March.Big Issue

- The big issue we need to focus on now is the continuing increase in rates as the 10-year Treasury yield has now breached a key resistance level of 4.6%, which is significant.

- There are several reasons for this move, but the simple facts are that the economy is still growing and prices are on the rise.ISM Report - Not Helping (From Briefing.com)

- The ISM Services PMI increased to 54.1% in December (Briefing.com consensus 53.0%) from 52.1% in November. The dividing line between expansion and contraction is 50.0%, so the December reading reflects services sector activity accelerating from November.

- The key takeaway from the report is that it was a double-whammy for rate cut expectations in that the expansion in services sector activity accelerated while the prices index picked up noticeably, printing its first reading above 60.0% since January 2024.• The Business Activity/Production Index increased to 58.2% from 53.7%.

• The New Orders Index bumped up to 54.2% from 53.7%.

• The Employment Index dipped to 51.4% from 51.5%.

• The Prices Index jumped to 64.4% from 58.2%.

• The Supplier Deliveries Index rose to 52.5% from 49.5%.

• The Backlog of Orders Index fell to 44.3% from 47.1%.No Cuts for A While

- With prices on the rise and the economy in good shape...Nat Gas!

- Natural gas futures prices surged last Monday, hitting a new 52-week high following reports of a colder-than-usual temperature outlook for January.

- Natural gas February futures rose around 15% during the session after an updated outlook by The Weather Co. and Atmospheric G2 released Sunday showed that the temperature forecast for next month is expected to be colder than average in the East, specifically from Florida to Maine as well as certain parts of the Great Lakes.

- POLAR VORTEX?

- Already prices are fading....Booze Bummer

- The U.S. surgeon general issued a new advisory warning Friday about the link between alcohol consumption and increased cancer risk, and pushed for policy changes to help reduce the number of alcohol-related cancers.

- U.S. Surgeon General Dr. Vivek Murthy said there is a "well-established" link between drinking alcohol and at least seven types of cancer, including breast, colorectum, esophagus and liver. For cancers including breast, mouth and throat cancers, increased risk may start around one or fewer drinks per day, according to his office.

- As part of the advisory, the surgeon general called for policy changes that could help reduce alcohol-related cancer. He pushed for alcohol labels to be more visible and include a warning about the increased risk of cancer, to reassess recommended limits for alcohol consumption based on the latest research and expand education to increase general awareness that alcohol consumption increases cancer risk.

Madoff $$$

- The 10th and final distribution from a fund for victims of the late Ponzi scheme king Bernie Madoff began Monday, the Department of Justice said.

- The last disbursement, of more than $131 million, is being sent to more than 23,000 victims worldwide. When it is completed, more than $4.3 billion will have been distributed by the fund to more than 40,000 victims in nearly 130 countries

- The largest portion of the fund for Madoff's victims, about $2.2 billion, came from a civil forfeiture recovery from the estate of Jeffry Picower, a now-dead Madoff investor, the DOJ said.

- Another $1.7 billion came from JPMorgan Chase as part of a deferred prosecution agreement with the DOJ in January 2014. JPMorgan Chase and its predecessor institutions had served as the primary bank through which Madoff operated his scheme, the DOJ has previously said.Weird Reports

- Both General Motors and Ford Motor on Friday reported their best annual U.S. new vehicle sales since 2019, prior to impacts from the coronavirus pandemic and yearslong supply chain problems.

- GM reported 2024 sales of more than 2.7 million vehicles, up 4.3% from a year earlier. The automaker sold 2.9 million units in 2019.Meanwhile

- Tesla bombs

- Tesla posted its fourth-quarter vehicle production and deliveries report on TK. Here are the key numbers:

----Total deliveries Q4 2024: 495,570

---- Total production Q4 2024: 459,445

-----Total annual deliveries 2024: 1,789,226

------Total annual production 2024: 1,773,443

- Results for the quarter represented the first annual drop in delivery numbers for Tesla, a decline from 484,507 in the fourth quarter of 2023. For the full year, deliveries fell from 1.81 million in 2023.

- Analysts had expected Tesla to report deliveries in the quarter of 504,770

- Stock dropped on the news....

--- Remember when ELON first bought Twitter and shares of Tesla tanked as concern that he was going to lose focus on the car company in favor of Twitter?

--- Could the same thing be happening now?More Odd Car News

- Short seller Hindenburg Research on Thursday accused Carvana of a running an “accounting grift for the ages” in a bombshell report — sending shares of the used-car retailer tumbling.

- Its report — titled “Carvana: A Father-Son Accounting Grift for the Ages” — accused the Tempe, Arizona-based company of insider trading and accounting manipulation.

- “Our research uncovered $800 million in loan sales to a suspected undisclosed related party, along with details on how accounting manipulation and lax underwriting have fueled temporary reported income growth — all while insiders cash out billions in stock,” the short seller alleged.Banks - Fighting Back

- The biggest banks are planning to sue the Federal Reserve over the annual bank stress tests

- Then, the Federal Reserve announced in a statement that it is looking to make changes to the bank stress tests and will be seeking public comment on what it calls "significant changes to improve the transparency of its bank stress tests and to reduce the volatility of resulting capital buffer requirements."

- The Fed said it made the determination to change the tests because of "the evolving legal landscape," pointing to changes in administrative laws in recent years. It didn't outline any specific changes to the framework of the annual stress tests.

- So the banks are making the rules?Medical Bills and Reporting

- Today, the Consumer Financial Protection Bureau (CFPB) finalized a rule that will remove an estimated $49 billion in medical bills from the credit reports of about 15 million Americans.

- The CFPB’s action will ban the inclusion of medical bills on credit reports used by lenders and prohibit lenders from using medical information in their lending decisions. The rule will increase privacy protections and prevent debt collectors from using the credit reporting system to coerce people to pay bills they don’t owe.

- So, good news?Still at it...

- Shares of Chinese tech heavyweight Tencent Holdings tumbled 5.3% in Hong Kong after the company was added to a list of "Chinese military companies" by the U.S. Department of Defense.

- Other Chinese companies added to the list included battery maker CATL, which is part of the supply chain for automakers such as Ford and Tesla.Presidential Stuff

What????

- President-elect Trump at press conference says he is not ruling out using economic or military force to take control of Greenland or The Panama Canal

-- OH, and we are going to change the name of the Gulf of Mexico to the Gulf of America (maybe Change the Pacific Ocean to West American?)

- Indiana - change to Cowboyana?

--- In fact - almost every state is named for an Indian word or non-American reason...

--- See-> https://www.bia.gov/as-ia/opa/online-press-release/origin-names-us-statesA little trivia with the inauguration just a few days away at this point...

- Historical question: What was and who gave the shortest and longest Inaugural address?Shortest - George Washington's second inaugural address, delivered in 1793, is the shortest inaugural address in U.S. history, consisting of only 135 words

Longest - William Henry Harrison's 1841 inaugural address was the longest, consisting of 8,455 words.

---- Harrison died a month after his inauguration from pneumonia, which was likely caused by exposure to bad weather on Inauguration Day.Biden Giving More Away

- President Joe Biden on Sunday signed the Social Security Fairness Act, bipartisan legislation that clears the way for teachers, firefighters, policeman and other public sector workers who also receive pension income to receive increases in their Social Security benefits.

- The benefit boost comes as the new law repeals two provisions — the Windfall Elimination Provision, or WEP, and the Government Pension Offset, or GPO — that have been in place for more than four decades.

- The WEP reduces Social Security benefits for individuals who receive pension or disability benefits from employment where Social Security payroll taxes were not withheld. As of December 2023, that provision affected about 2 million Social Security beneficiaries.Melania

- Amazon Prime Video has exclusively licensed an upcoming documentary film for both theatrical and streaming release that will give viewers an unprecedented, behind-the-scenes look at First Lady Melania Trump," an Amazon spokesperson said Sunday.

- "Filming began in December 2024, with an anticipated release in the second half of 2025. Prime Video will be sharing more details on the project as filming progresses and release plans are finalized. We are excited to share this truly unique story with our millions of customers around the world," the spokesperson said.Hack

- Chinese state-sponsored hackers broke into the U.S. Treasury Department earlier this month and stole documents from its workstations, according to a letter to lawmakers that was provided to Reuters on Monday.

- The hackers compromised a third-party cybersecurity service provider and were able to access unclassified documents, the letter said, calling it a "major incident."

- According to the letter, hackers "gained access to a key used by the vendor to secure a cloud-based service used to remotely provide technical support for Treasury Departmental Offices end users. With access to the stolen key, the threat actor was able override the service's security, remotely access certain Treasury DO user workstations, and access certain unclassified documents maintained by those users."

- Is this still part of that SolarWinds hack from a couple yeas back?Love the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup - FINAL

(ERIC)

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

8 January 2025, 3:25 am - 56 minutes 58 secondsDHUnplugged: 2024 Da’ Best

Another year is in the record books….

Let’s not forget about the not-so boring election,

Hacks, beached and outages and PEAK NVDA!

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? Thank you for all who gave to the Thanksgiving Holiday Campaign...

Checking out the early CTP Cup Standings

HAPPY NEW YEAR!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Love the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup - Up and Running

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

1 January 2025, 2:00 am - 1 hour 5 minutesDHUnplugged #733: Santa Quantum!

Shutdown….. AVERTED

Mergers – Auto Industry big move

Lots of Trump Talk

The Market’s new favorite stocks

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? Thank you for all who gave to the Thanksgiving Holiday Campaign...

Warm-Up

- Shutdown..... AVERTED

- Mergers - Auto Industry big move

- Lots of Trump Talk

- Deli Stock Scheme - Update

- Holiday Tidings!- Markets

- S&P 500 Equal weight down 6% MTD, Small Caps down 8%

- The New favs? Quantum Computing Stocks - Santa Like them.....

- Index inclusion has become a thingChecking out the early CTP Cup Standings

EVERYONE IS IN! - 7 Contestants....

Fed Meeting Dec 18th

- Fed freaked out markets

- All of a sudden they are projecting that inflation is not going to come down to their 2% level into 2026

- DJIA was donw 1000 points and it was an ugly day overall.

- Onc day later, PCE comes out not too far aay from assumptions and market takes off

- Just goes to show thatDJIA - Records?

- Follow up - it was 10 days and the last time that happened was 1974Meanwhile - XMAS Rally

- Once big day down, then a test and BOUNCE

- Most of the Fed Day losses have been wipe out - still much damage in December

--- Once again - Mega cap holding things up

---- EVEN though 10Yr >4.6% - this is an important price point... Failed couple of times before.Quantum Computing Stocks

- Ever since Alphabet (Google) announced that they made progress, been some crazy moves on a few names - with YTD returns

-- D-Wave Quantum Inc QBTS (825%)

-- Rigetti Computing Inc RGTI (1,050%)

-- Quantum Computing Inc QUBT (1,900%)

-- Defiance Quantum ETF QTUM (51%)

-- IONQ Inc IONQ (240%)

---(none seem to be making any money - actually losing a ton)More Quantum

- Willow's speed is almost incomprehensible — according to Google, it's able to perform a computation in under five minutes that would take one of today's fastest supercomputers 10 septillion years to solve. Ten septillion is 10,000,000,000,000,000,000,000,000 years.

- Concern has turned to the potential for this technology to break down crypto (or other) cryptography.

--- It may take years - but this could be something we need to watch as a byproduct, the need for better security from quantum hacksAuto Merger

- Japanese automakers Nissan and Honda on Monday announced they had entered into official talks to merge and create the world's third-largest automaker by sales.

- The deal would aim to share intelligence and resources and deliver economies of scale and synergies while protecting both brands

- Nissan's strategic partner Mitsubishi has been offered the chance to join the new group and will take a decision by the end of January 2025.

- Lots of things to iron out before this deal gets doneIndex Traders - Hang on...

- Huge moves to reset these days

- Companies are competing to get to NASDAQ and NYSE to gain inclusion as they know share prices will potentially pop

- Palatntir is banking on that as they said in their recent announcement and one reason was to get inclusion in the NASDAQ 100

- These kind of index changes has buig impacts on stocks

- - ALSO, there should be some movement over the next month as there will be re-balancing going on as 2024 big run for markets/stocksTrump Talk/Plans

- Trump said he will not let the canal fall into the 'wrong hands'

- Trump accused Panama of charging excessive fees to use the canal

- Panama's President Mulino defends canal's independence and fees

- US handed over control of the canal in 1999

- Talk that we could take it back

- Twitter: "Every square meter of the Panama Canal and the surrounding area belongs to Panama and will continue belonging (to Panama)," Mulino said in his statement, which was released on X.

--------Trump then responded to Mulino: "We'll see about that!"More Talk

- "I told the European Union that they must make up their tremendous deficit with the United States by the large scale purchase of our oil and gas. Otherwise, it is TARIFFS all the way," Trump posted on his Truth Social platform.

- Who did he tell exactly?

-- Where does he come up up with this stuff?

- According to U.S. figures, the country's goods and services trade deficit with the European Union was $131.3 billion in 2022. The U.S. was the biggest recipient of EU goods in 2023, accounting for 19.7% of its exports. (Maybe we should make something that people want to buy?)Greenland - Again?

- “For purposes of National Security and Freedom throughout the World, the United States of America feels that the ownership and control of Greenland is an absolute necessity,” Trump said in a statement on Truth Social.Fraud?

- The Consumer Financial Protection Bureau on Friday sued the operator of the Zelle payments network and the three U.S. banks that dominant transactions on it, alleging that the firms failed to properly investigate fraud complaints or give victims reimbursements.

- "The nation's largest banks felt threatened by competing payment apps, so they rushed to put out Zelle," CFPB Director Rohit Chopra said in a statement. "By their failing to put in place proper safeguards, Zelle became a gold mine for fraudsters, while often leaving victims to fend for themselves."Govy Shutdown

- President Joe Biden signed a bill into law Saturday that averts a government shutdown, bringing a final close to days of upheaval after Congress approved a temporary funding plan just past the deadline and refused President-elect Donald Trump’s core debt demands in the package.

- Even though there is a desire for cutting costs by the Trump team, President-Elect Trump wanted to raise or suspend the debt ceiling in the latest bill.

- US Governtment debt is $36 Billion Now...123% Debt to GDPWhat is with the drones?

- The Federal Aviation Administration on Wednesday temporarily banned drone flights over 22 areas across New Jersey amid complaints of strange and often bright drones in the night sky.

- "At the request of federal security partners, the FAA published 22 Temporary Flight Restrictions (TFRs) prohibiting drone flights over critical New Jersey infrastructure," the FAA said in a statement to CNBC.

- The TFRs will last until Jan. 17 and cover large parts of central and northern New Jersey, including Elizabeth, Camden and Jersey City, the second most populous city in the Garden State.Deli Duo

- Father, son plead guilty in $100 million New Jersey deli stock scheme

- The Cokers and Patten each admitted their roles in the scheme to artificially boost the stock price of Hometown, whose only real business asset was the Your Hometown Deli in Paulsboro, as well as the shares of a shell company then known as E-Waste.

- Hometown's stock price rose by more than 900% as a result of the scheme. The price of E-Waste rose by nearly 20,000%.

- The scam, which ran from 2014 through September 2022, involved coordinated trading of the stocks of both companies, creating a false impression of demand for their shares, which traded on OTC Marketplace.

- The defendants during the conspiracy gained control of the companies' management and shares, with the aim of using them as vehicles for reverse mergers with privately held companies. Both companies ended up being merged in such deals with private firms.Lilly - Another Benefit of Zepbound

- The Food and Drug Administration approved Eli Lilly's blockbuster weight loss drug Zepbound for treating patients with the most common sleep-related breathing disorder, the drugmaker announced Friday, expanding its use and possibly its insurance coverage in the U.S.

- The weekly injection is now cleared for patients with obesity and moderate-to-severe obstructive sleep apnea, which refers to breathing interrupted during sleep due to narrowed or blocked airways.

- An estimated 80 million patients in the U.S. experience the disease, according to Eli Lilly. Roughly 20 million of those people have moderate-to-severe forms of the disease, but 85% of cases go undiagnosed, the company told CNBC earlier this year.TEMU Competition

- Two weeks before Black Friday, Amazon quietly added a new section to the top of its mobile app. Called Haul, it's a mobile-only area for ultra-low-price items, primarily shipped directly from China.

- Haul is Amazon's answer to the booming popularity of apps such as PDD Holdings' Temu and fast-fashion retailer Shein. Amazon told CNBC that Haul has had millions of unique customer visits since it launched in November.

- Like Temu, Haul offers items at bargain prices, such as sneakers for $9.98, kitchenware for $5.99 and phone cases for $2.99.

--- H&C Clients own Akazon as well as PDD - TEMU OwnerPepsi

- Multi-Year lows

- Frito-Lay segment not doing well- packaged foods not doing well

- Interesting chartBankruptcy

- The Container store filed for reorg

- The Container Store said this doesn't mark the end of the retailer. The company said it filed for voluntary protection under Chapter 11 in the bankruptcy court for the Southern District of Texas as it plans to "implement a recapitalization transaction to bolster its financial position, fuel growth initiatives, and drive enhanced long-term profitability."

- Need to stop this practice as it breeds poor management.

---- If bankrupt, management is out and no pre-bancrupcy bonuses2025 predictions?

- Stock market

- Bond Yields?

- Bitcoin?

- Gold?Next week - we have a great show lined up - by our good friend Ryan Rediske -

HAPPY NEW YEAR!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Love the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup - Up and Running

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

25 December 2024, 2:00 am - 1 hour 1 minuteDHUnplugged #732: Fanning the Flames

Kissing Ass is good for the wallet

Fed is about to meet and make a rate decision

Time’s Person of the Year!

Whistleblower found dead

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? Thank you for all who gave to the Thanksgiving Holiday Campaign...

Warm-Up

- Kissing Ass is good for the wallet

- Fed is about to meet and make a rate decision

- Person of the Year!

- Whistleblower found dead- Markets

- Odd - DJIA down for 7 days, NASDAQ can't be stopped (TSLA pushing this time - once again a reason to look at market cap weightings)

- Fanning the flames - A new name into NASDAQ 100

- Earnings - A few interesting data points

- Social Security benefits increase

- Yes and No, Inflation and No Inflation

- Not since... 2018 or 1978?Reminder - the CTP Contestants for 2024 CTP Cup

Michael Bowling

Kirk Saathoff

Eric Harvey

Chad Laajala

Tim Dewey

Paul Kinder

Anson Brady (2023 CTP Cup Winner)

---Emails have gone out...Fed Meeting Dec 18th

- 89% probability of a 0.25% rate cut

- Fed has its back to the wall - markets are dictating

- No reason to believe that they need a cut, although the would not want to worry markets or surprise them in any way

- All reporting shows that they will do the cut, back off a little as to the amount of potential cuts coming in recognition of the fact that the economy is still running wellDJIA - Records?

- The DJIA has been down for 8 days in a row and that has not happened since 2018.

- If the DJIA declines today, that would take us back to the 1970's, 1978 to be exact when there was a 9 day decline.

- But, that is the DJIA, the NASDAQ an SP500 have been holding up.

- Moreover, the fall for the DJIA this month is less that 3%, so not much damage done to the index itself.Another Sinkhole Warning

- SP500 equal weighted is down more than 3% for the MTD.

- SP500 up slightly MTD

- NASDAQ 100 up moer than 5%

- Small-caps down 3%BUT - Wait....

- A measure of wholesale price rose more than expected in November, adding fuel to the belief that progress in bringing down inflation has slowed, the Bureau of Labor Statistics reported Thursday.

- On an annual basis, PPI rose 3%, the biggest advance since February 2023.

- This is after an inline CPI number.

- Rates are on the rise for bonds, as expected

--- Mark this date - inflation could make a comeback in 2025 and totally offside the fed (And they are fanning the flames )AND Consumers are Spending

- November Retail Sales 0.7% vs. 0.5% consensus; prior revised to 0.5% from 0.4%But - ISM Composite - Rolling Over

CHIPS

- Shares of Broadcom popped more than 21% Friday morning, pushing the company’s market cap beyond $1 trillion for the first time. It will be Broadcom’s best trading day on record if the move holds until the closing bell.

The move comes after the company reported fourth-quarter results that beat Wall Street’s expectations for earnings and showed strong artificial intelligence revenue growth.

- Broadcom reported $14.05 billion in revenue for the fourth quarter, up 51% year over year but shy of the $14.09 billion expected by analysts according to LSEG. In Broadcom’s semiconductor solutions group, which includes its AI chips, revenue increased 12% to $8.23 billion from $8.03 billion a year ago.More Chips

- US planning on restricting AI Chips around the world

- Planning on closing China's backdoor access

-Washington plans rules limiting semiconductor shipments to some countries accused of supplying Beijing

- NVDA, MSFT, GOOG, GOOGL, AMD, INTC, SMHNuclear - getting some traction

- SMRs - Small Nuclear Reactors

- Small modular reactors, with a power capacity of 300 megawatts or less, are about a third the size of the average reactors in the current U.S. fleet. The goal is to build them in a process similar to an assembly line, with plants rolling out of factories in just a handful of pieces that are then put together at the site.

- Only three SMRs are operational in the world (China and Russia)

- Keep an eye on the news for utilities that will be moving into nuclear - demand is high - theme for 2025EVEN More Nukes

- GE Vernova is aiming to deploy small nuclear reactors across the developed world over the next decade, staking out a leadership position in a budding technology that could play a central role in meeting surging electricity demand and reducing carbon dioxide emissions.

- GE Vernova is the spinoff of General Electric's former energy business. The company's stock has more than doubled since listing on the New York Stock Exchange last April

- The U.S. government wants to triple nuclear power by 2050 to shore up an electric grid that is under growing pressure from surging power demand. But large nuclear projects, in the U.S. at least, are notoriously plagued by multi-billion dollar budgets, cost overruns, delayed construction timelines and, sometimes, cancellations.Tech Wars

- Geopolitical tensions are brewing globally over the cutting of subsea cables — critical infrastructure powering cross-border internet connectivity — in the Baltic Sea.

- The severing (a week or so ago) of the cables prompted warnings of "sabotage" and potential "hybrid" warfare targeting key infrastructure in the West amid further escalations in the ongoing war in Ukraine.

- Last week, two undersea cables were severed in the Baltic Sea, raising suspicions that subsea communication systems may be the latest target of sabotage against the West, as it clashes with Russia over the country's invasion of Ukraine.

-One of the cables disrupted was C-Lion1, which links Finland and Germany and is owned by Cinia, a Finnish state-controlled IT firm. Spanning nearly 1,200 kilometers (730 miles), it is the only direct connection of its kind between Finland and Central Europe.

-The other cable damaged was one connecting Lithuania and Sweden, BCS East West Interlink.

--- Both are either mostly or fully repaired already and had alternative routes to move data when was cut....Musk - SpaceX

- Valuation rockets higher

- SpaceX is in discussions to sell insider shares that could boost the value of Elon Musk’s rocket and satellite company to around $350 billion, according to people familiar with the matter.

- That would be a significant premium to a previously mulled valuation of $255 billion as reported by Bloomberg News and other media outlets just last month. It would also cement SpaceX’s status as the most valuable private US company.

- Earlier this year SpaceX did a tender at a valuation of ~ $211 billionKissing Ass

- We have seen this before - and now it is a smart move as a little brown nose goes a long way

- Softbank CEO Masayoshi Son will announce a $100 billion investment in the U.S. over the next four years during a Monday visit to President-elect Donald Trump's residence Mar-a-Lago in Palm Beach, Florida.

- Tim Cook had dinner with Presedent-Elect TrumpPerson of the Year!

- Time Magazine has named Donald Trump as their person of the year for the second time.

- Trump was first named person of the year in 2016 after winning the US presidential election.

- Last Thursday, The Republican president-elect is rang the opening bell at the New York Stock Exchange to commemorate the honor alongside several of his family members.NASDAQ 100 In and Out

- MicroStrategy is in! Talk about fanning the flames

--- MicroStrategy is a money-losing software company that is largely a leveraged bitcoin play. It's sold stock and debt to buy up more and more of the cryptocurrency. Its market cap is at $82 billion.

- On the way out? Moderna and Super Micro Computer are among the smallest Nasdaq 100 members.

- Palatir is also a name that is in the mix to be added to NAZ100Whistleblower found Dead

- A 26-year-old former OpenAI researcher, Suchir Balaji, was found dead in his San Francisco apartment in recent weeks, CNBC has confirmed.

- Balaji left OpenAI earlier this year and raised concerns publicly that the company had allegedly violated U.S. copyright law while developing its popular ChatGPT chatbot."

- "The manner of death has been determined to be suicide,"

- The San Francisco Police Department said in an e-mail that on the afternoon of Nov. 26, officers were called to an apartment on Buchanan Street to conduct a "wellbeing check." They found a deceased adult male, and discovered "no evidence of foul play" in their initial investigation, the department said.Earnings

- Adobe shares fell 13% on Thursday and headed for their steepest drop since March after the software vendor issued disappointing revenue guidance.

- Sales in the fiscal first quarter will be between $5.63 billion and $5.68 billion, Adobe said in its fourth-quarter earnings report late Wednesday. Analysts on average were expecting revenue of $5.73 billion

- Analysts at TD Cowen downgraded the stock to hold from buy, while Wells Fargo kept its buy rating following what it called a "frustrating '24" for the company. The stock is now down 20% for the year

- AI hype/hope unrealizedSocial Security Benefits Benefit?

- Last month, the House of Representatives on Nov. 12 passed the Social Security Fairness Act by an overwhelming 327 to 75 majority.

- The proposal would eliminate rules that reduce Social Security benefits for those who also receive income from public pensions, roughly around 2.8 million people.

- Senate needs to vote - but this would be adding to the deficit and that is not a popular side right now.

- Needs to rush this along so that Biden can pass itInteresting

- The U.K. is drawing up measures to regulate the use of copyrighted content by tech companies to train their artificial intelligence models.

- The British government on Tuesday kicked off a consultation which aims to increase clarity for both the creative industries and AI developers when it comes to both how intellectual property is obtained and then used by AI firms for training purposes.Love the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup - Up and Running

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

18 December 2024, 3:14 am - 1 hour 1 minuteDHUnplugged #731: Stacking $$$

Big – Run – Crypto Pops and Drops

Stacking the Admin with $$$ Peeps

HUGE Baseball Deal

Equifax Class Action – Finally a payout?

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? Thank you for all who gave to the Thanksgiving Holiday Campaign...

Warm-Up

- Big - Run - Crypto Pops and Drops

- Stacking the Admin with $$$ Peeps

- Baseball Deal

- Equifax Class Action - Finally a payout?Markets

- Employment Report

- This week's CPI and PPI Data

- Santa Rally - Could be just be a couple weeks away- - Trump Limericks (AI)

ANNOUNCING the CTP Contestants for 2024 CTP Cup

Michael Bowling

Kirk Saathoff

Eric Harvey

Chad Laajala

Tim Dewey

Paul Kinder

Anson Brady (2023 CTP Cup Winner)

---Emails have gone out...Regarding AMD

- BofA Securities downgraded Advanced Micro Devices (AMD) to Neutral from Buy, lower CY25/26 pf-EPS by 6%/8%ta $4.43/55.51, about -13%/-23% below consensus 55.09/57.11. Two factors:

1) Higher competitive risks in Al against best-of-breed NVDA's dominance, and growing cloud preference for custom chips from MRVL/AVGO. limiting AMD's market share gain potential, and

2) Potential for 1H'25E PC processor correction, after ~4O% HoH surge in AMD's 2H'24E client PC sales. Shares are down 3%.Oracle Earnings

- Oracle (ORCL -8%) is lower following its Q2 (Nov) earnings report last night.

- The company reported a slight EPS miss, its second miss in the past three quarters.

- Revenue rose 8.6% yr/yr to $14.06 bln, but that was also a bit light of analyst expectations.

- The Q3 (Feb) adjusted EPS guidance of $1.47-1.51 was also lower than expected.

- Oracle guided to Q3 revs of +7-9% (+9-11% CC), which we compute as $14.21-14.48 bln, which was also light, partly due to FX.Google Chip

- Releases the Willow quantum computing chip

- Google has unveiled a new chip which it claims takes five minutes to solve a problem that would currently take the world's fastest super computers ten septillion – or 10,000,000,000,000,000,000,000,000 years – to complete.

- However experts say Willow is, for now, a largely experimental device, meaning a quantum computer powerful enough to solve a wide range of real-world problems is still years - and billions of dollars - away.MLB Deal

- The Mets on Sunday agreed to sign Juan Soto to a 15-year, $765 million contract, multiple sources said, by far the largest pact in Major League Baseball history.

- The deal, which the Mets have not confirmed because it’s pending a physical, contains a $75 million signing bonus, an opt-out after five seasons and no deferred money.

- The Mets will have the ability to void Soto’s opt-out clause after the 2029 season if they boost the average annual value of the final 10 years of his deal from $51 million to $55 million, according to a source.

- In that case, the overall deal would be for 15 years and $805 million

- Right and Left Fielder - with .288 Batting average

- In 2024, he hit 41 homers and had 129 walks. It was his fourth season with at least 25 home runs and 125 walks. That's fourth-most in MLB history, behind only Barry Bonds (10 such seasons), Babe Ruth (10) and Ted Williams (eight).China - Back in the Spotlight

- Disinflation again and profits slowing - China's inflation drops

- China's producer price index declined for the 26th month. Producer inflation fell by 2.5% year on year in November...

- Sunday announcement - China's leaders on Monday pledged "more proactive" fiscal measures and "moderately" looser monetary policy next year to boost domestic consumption, according to an official readout of a key policy meeting that outlined upcoming economic priorities.

Hing Kong markets flying again and several stocks on the move

- PDD 11% NIO 15% FUTU 23% NTES 11% BABA 8.5% BIDU 9.6%Just in...(Started in 2017)

- The Equifax Data Breach Settlement Agreement says any remaining funds in the Consumer Restitution Fund will be distributed to Settlement Class Members with valid claims.

- You have a valid claim and are eligible for an additional payment. It will be sent to you by electronic pre-paid card. (Email just arrived....)Employment Report

- The latest employment data likely cemented another interest-rate reduction by the Federal Reserve later this month but did little to clarify the monetary-policy outlook for 2025.

- 4.2% Unemployment Rate

- 4.5% wage growth

- Better than though additions to the payrolls

- Overall, it looks like it was a reasonably good report - HOWEVER - some cracks beneath the surface with minority jobsFed Meeting Dec 18th

- 89% probability of a 0.25% rate cut

- Fed has its back to the wall - markets are dictating

- No reason to believe that they need a cut, although the would not want to worry markets or surprise them in any way

- All reporting shows that they will do the cut, back off a little as to the amount of potential cuts coming in recognition of the fact that the economy is still running wellTrump Cabinet $$$$

- 11 picks are billionaires

- $340 billion total net worth

--- Big chunk is Musk

- Wealthiest administration in US History - by a long shot

-- 3 more billionaires in the works

- "CORRUPT ELITE" of Biden admin was only worth a total $118 BillionTrump News (Get used to it)

- Now Trump says that he will not try to replace Jerome Powell

- On Meet The Press he said: "No, I don't think so. I don't see it,"

- "I think if I told him to [go], he would. But if I asked him to, he probably wouldn't," Trump told Welker.Trump EV Action

- Donald Trump's transition team is considering canceling the U.S. Postal Service's contracts to electrify its delivery fleet, as part of a broader suite of executive orders targeting electric vehicles, according to three sources familiar with the plans.

--- WHY????

- Osh Kosh and Ford are the main providers of the EV trucks for the Postal Service.

---Multi Billion $$ contractsLast One

- Trump aides contact Google, Meta, Snap over online drug sales

- President-elect Donald Trump's transition team has invited five major tech companies, including Google , Microsoft and Meta Platforms to a meeting in mid-December about dealing with online sales of drugs

- This looks like non-prescription/illegal drug salesRetail Sales - Roundup

- Final Tally - Record-breaking sales reported

- Amazon saw the strongest growth on Black Friday

- Americans spent roughly $10.8 billion online on Black Friday

- Shein, Temu also post strong resultsUNH

- Interesting how this is all becoming a thing

--- Erupted into a real awakening about the health insurance industry

- NYPD at press conference says person of interest named Luigi Mangione is in custody for murder of UNH executive Brian Thompson

- Murder charges filed

TikTok

- Court upholds requirement for the divestment

- A federal appeals court upheld a law requiring China-based ByteDance to sell the popular social media app TikTok or face an effective ban in the United States

- The U.S. Court of Appeals in Washington, D.C., rejected TikTok’s argument that the ban is unconstitutional and violates the First Amendment rights of the 170 million Americans who use the app.

- Unanimous RulingBribery!

- A subsidiary of top global consulting firm McKinsey & Company agreed to pay nearly $123 million to settle claims that it bribed government officials in South Africa, the U.S. Department of Justice said Thursday.

- Federal prosecutors also unsealed a 2022 guilty plea by Vikas Sagar, a former senior partner at McKinsey who worked in the subsidiary's South Africa office.

- The subsidiary, McKinsey Africa, paid bribes to officials at two state-controlled utility companies in South Africa between 2012 and 2016 in order to secure lucrative consulting contracts, the DOJ said in a press release.

- Reminds of the Adani situationBad Sandwich?

- A new lawsuit accuses Subway of "grossly misleading" customers by advertising sandwiches that contain at least three times more meat than it delivers.

- According to a proposed class action filed on Monday in federal court in Brooklyn, Subway ads for its Steak & Cheese sandwich show layers of meat piled high, reaching about as high as the surrounding hero bread.

- In reality, according to several photos in the complaint, the fast-food chain's sandwiches are far more bread than filling.

- Similar lawsuits filed in the same court by the plaintiff's law firm against McDonald's, Wendy's and Taco Bell were dismissed last year.

- Subway previously defended for more than four years against a lawsuit claiming its "footlong" sandwiches were too short.

--------------That lawsuit was dismissed in 2017.

No Sleep

- A new stock exchange launching next year is on track to offer nearly round-the-clock trading on business days, pending final regulatory approvals

- The 24X National Exchange will debut in the second half of 2025, with trading from 4:00 a.m. ET to 7:00 p.m. ET on weekdays, the Stamford, Connecticut-based platform said. That can be expanded to 8:00 p.m. ET on Sunday through 7:00 p.m. ET on Friday, with a one-hour pause each day, once the exchange clears some final hurdles with the Securities and Exchange Commission.- - More Musk

- Elon Musk lost his bid to have his $56 billion 2018 pay package reinstated

- A Delaware judge upheld her January ruling in a case brought by shareholders that said the process leading to approval of the pay package was “deeply flawed.”End Of Year - What to do with OLD stock picks?

Love the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup - Up and Running

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

TRUMP (AI) Limerick

There once was a man named Trump,

Who governed with flair and a stump.

With tweets quite unfiltered,

And policies tilted,

He sure made the headlines all jump!There once was a man named Trump,

Whose ego was known to be plump.

With bluster and flare,

He'd claim he was fair,

But left many folks in a slump!See this week’s stock picks HERE

11 December 2024, 3:22 am - 1 hour 4 minutesDHUnplugged #730: Spend Spend Spend

Very Business friendly cabinet

Market rotation continues – now it is back into the big-caps

Consumers – WOW! – Spend Spend Spend

Black Friday and Cyber Monday updates

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? Thank you for all who gave to the Thanksgiving Holiday Campaign...

Warm-Up

- Very Business friendly cabinet

- Market rotation continues - now it is back into the big-caps

- Consumers - WOW! - Spend Spend Spend

- Black Friday and Cyber Monday updatesMarkets

- November - the best month of the year!

- New highs and predictions for a 5% December

- USD is on the rise - bond yields ease.

- Bitcoin can't seem to breach $100kANNOUNCING the CTP Contestants for 2024 CTP Cup

Michael Bowling

Kirk Saathoff

Eric Harvey

Chad Laajala

Tim Dewey

Paul Kinder

Anson Brady (2023 CTP Cup Winner)Saying goodbye to legend - Art Cashin

- Pillar of the exchange

- He was on the TDI Podcast - LINKMarshall Law

- South Korean President Yoon declares martial law:

- Says through martial law he will rebuild a free and democratic country

- Government administration has been paralyzed because of opposition party conducts

- Says he will eradicate pro-North forces and protect constitutional order

- Marshall Law lifted - but a good amount of confusion remainsConsumers on a Rampage

- Adobe said that in the U.S., consumers made a record-breaking $10.8 billion of purchases, up 10.2% on last year.

- Cyber Monday sales reached $13.5 bln, ahead of initial expectations

- Quick Amazon vs Costco Story - Looking for UPS backup - Same model on Amazon (Cyber Monday Deal) $179 - Costco $129

- Buy now, pay later plans helped finance purchases, driving 8.8% more in online spend than last year

- But... Not so much IN-STORE: Overall, store traffic on Black Friday was down 3.2%, with footfall down 7% in the Midwest, 2.1% in the Northeast, 3.5% in the South and 3.2% in the WestRetail

- Consumer discretionary stocks are on fire

- People are buying - alot of stuff

- Abercrombie & Fitch issued strong holiday guidance last week after posting its sixth straight quarter of double-digit sales growth and another quarter of results that topped expectations.

- Gap issued good guidance as well

- RTH ETF - (Retail) all time high (Amazon, Costco, Home Depot, WalMart etc)On the Other hand....

- Electronics provider Best Buy on Tuesday cut its full-year sales forecast as it missed Wall Street's quarterly revenue expectations and a fresh batch of iPhones and AI-enabled laptops weren't enough to drive higher sales.

- The consumer electronics retailer said it now expects full-year revenue to range from $41.1 billion to $41.5 billion, compared to prior guidance of $41.3 billion to $41.9 billion.

- It expects full-year comparable sales to decline by between 2.5% and 3.5%, compared to its prior expectations of a 1.5% to 3% drop.Year Top Date Scorecard

AI

- Amazon announced it would invest an additional $4 billion in Anthropic, the artificial intelligence startup founded by ex-OpenAI research executives.

- The new funding brings the tech giant's total investment to $8 billion, though Amazon will retain its position as a minority investor, according to Anthropic, the San Francisco-based startup behind the Claude chatbot and AI model.

- Amazon Web Services will also become Anthropic's "primary cloud and training partner,"

- Amazon does not have a seat on Anthropic's board.AI - Immigration

- A signature campaign promise of President-elect Donald Trump is to initiate mass deportations of undocumented residents of the United States.

- At a Sept. 12 campaign stop in Tucson, Arizona, Trump promised to "begin the largest mass deportation mission in the history of our country."

- Incoming (selected) Boarder Czar

- Talk of using AI for Mass Deportation - Facial Rec and whatAI AI

- Elon Musk is asking a federal court to stop OpenAI from converting into a fully for-profit business.

- Attorneys representing Musk, his AI startup xAI, and former OpenAI board member Shivon Zilis filed for a preliminary injunction against OpenAI on Friday. The injunction would also stop OpenAI from allegedly requiring its investors to refrain from funding competitors, including xAI and others.Musk - Poor Elon

- Tesla chief executive Elon Musk's record-breaking $56bn (£47bn) pay award will not be reinstated, a judge has ruled.

- The decision in the Delaware court comes after months of legal wrangling and despite it being approved by shareholders and directors in the summer.

- Judge Kathaleen McCormick upheld her previous decision from January, in which she argued that board members were too heavily influenced by Mr Musk.One More AI

- At AWS re:Invent, Amazon Web Services, Inc. (AWS), an Amazon.com, Inc. company (NASDAQ: AMZN), today announced that Twelve Labs, a startup that uses multimodal artificial intelligence (AI) to bring human-like understanding to video content, is building and scaling its proprietary foundation models on AWS.

- Twelve Labs will use AWS technologies to accelerate the development of its foundation models that map natural language to what's happening inside a video.

- This includes actions, objects, and background sounds, allowing developers to create applications that can search through videos, classify scenes, summarize, and split video clips into chapters.More Threats

- This will be a standard for the next few year so get used to it

- BRICS

- President-elect Donald Trump on Saturday threatened 100% tariffs against a bloc of nine nations if they act to undermine the U.S. dollar.

- His threat was directed at countries in the so-called BRIC alliance, which consists of Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran and the United Arab Emirates.

--- YET he is all on on Bitcoin? How is that not undermining the US Dollar.DJIA - Best month in a year

- WOW! Banks popped, small caps, mid caps and pretty much every asset class

- Emerging markets lagged as the USD moved higher

- Rates moved downLove the Show? Then how about a Donation?

2024 - DH Closest to The Pin Cup Coming Soon!

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

See this week’s stock picks HERE

4 December 2024, 3:32 am - 1 hour 7 minutesDHUnplugged #729: We Are All Turkeys

Where are all the smokers these days?

DOGE – making promises.

We are all turkeys – just gullible for every comment and promise.

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

DONATIONS ? OHHH - the new shirt design is coming along...

Twitter - How you like the AI generated cover art? (May need to come to DHUnplugged to see all)

Warm-Up

- Where are all the smokers these days?

- DOGE - making promises

- High level indictment

- We are all turkeys - just gullible for every comment and promiseMarkets

-#endthefed making the rounds

- Treasury Secretary?

- Target earnings surprise

- Black Friday - will that boost retail?

- New Phrase - Mullet MarketThanksgiving - What is going to be on the Dvorak table?

ANNOUNCING the CTP Winner for Carvana

Mullet Market

- No, the fish...

- Steady benchmarks in the front, crypto party in the backNetflix Again

- Netflix notches 70 million monthly active users on ad-supported plan

- 250 million subs and 70 million on ad plan

- Didn't we used to call this TV? Made a full circle except that ad-based also has a monthly fee

- Over 50% of the new sign ups are ads based plansSmokers

- Retail cigarette sales in China have been growing for the past 4 years, reaching 2.44 trillion sticks in 2023, data from Euromonitor showed. The research group forecasts that sales will continue to increase annually, hitting 2.48 trillion by 2028.

- Euromonitor added that growth has coincided with the increasing popularity of "slim" cigarettes, often advertised as "low-tar," and various types of flavored cigarettes.

- Between 2019 and 2023, annual worldwide sales of cigarette sticks fell by about 2.7% to 5.18 trillion, according to Euromonitor data.

At more than 300 million, China has the most cigarette smokers in the world, making up nearly a third of the world's total smokers, according to the World Health Organization.Topic of Discussion

- #endthefed

- Do you think that Musk and Trump and the new gang will try to end the Fed?

- Elon endorsed the idea of the President being able to intervene on monetary policy.

- Seems like that will undermine the independence and then the confidence in the Fed

-- Going to be some fireworks with Powell saying he will not resign and cannot be firedDOGE - Dept of Government Efficiency

- Still a hardy har name - like saying Penis when in 3rd grade

- Incoming Department of Government Efficiency wants to create new mobile application for Americans to file taxes for free with IRS, according to Washington Post (Intuit and HR Block down on this...)

- Explain how a government agency that does not exist is making these kinds of statements.

--- Thought: Make these statements and either buy or short stocks? (Again we are all turkeys - hopefully not going to be led to slaughter)Higher rates

- Rates are running higher after the election - actually up to the election ran up from 3.6% to 4.6% and nor in the range

- DoubleLine Capital CEO Jeffrey Gundlach said Thursday interest rates could shoot higher as the Republicans ended up controlling the House, securing a governing trifecta that gives President-elect Donald Trump free rein to spend as he pleases.

- Pre-election: "If the House goes to Republicans, there's going to be a lot of debt, there's going to be higher interest rates at the long end, and it'll be interesting to see how the Fed reacts to that," Gundlach said

- If the Trump administration extends the 2017 tax cuts or introduces new reductions, it could add significant amount to the nation's debt in the next few years, worsening the already troublesome fiscal picture.Yeah Right....

- Vocal critic of Putin, Vladimir Shklyarov, 39, died after falling from the fifth floor of an apartment building on Saturday.

- The fall was said to have been ‘accidental’.

- Local reports suggest he was trying to escape from his apartment - after his ex-wife locked him in there at his request to stop him from buying drugs.OH WOW

- India's Adani Group saw shares of its companies plunge Thursday after its billionaire chairman Gautam Adani was indicted in a New York federal court over his alleged involvement in an extensive bribery and fraud operation.

- The 62-year-old billionaire and the seven other defendants have been accused of paying over $250 million in bribes to Indian government officials to secure solar energy contracts that could generate more than $2 billion in profits.

- That is something.....Target

- Target missed third-quarter earnings and revenue estimates and cut its full-year guidance.

- Target struggled to drive sales even after reducing prices on thousands of items.

- The results come a day after Walmart beat Wall Street expectations and hiked its outlook.

- The big-box retailer reversed course and cut its full-year profit guidance, just three months after hiking that forecast.

- It said it expects full-year adjusted earnings per share to range from $8.30 to $8.90.

- That’s lower than the $9 to $9.70 per share range that it shared in August and below the $9.55 a share expected by analysts, according to StreetAccount.

---- That means that things are slowing down at a veryAdvanced Auto Parts

- What happened to this amazing business?

- Advance Auto Parts is closing more than 700 locations to shore up the company’s finances following another dismal earnings report.

-The car parts retailer, which has about 5,000 stores, said Thursday that the closures are part of its “strategic plan to improve business performance.”

- Stock was a darling as high as $240 in January 2022 - now trades near $40RFK Jr

- Maybe he has some residual from the brain work form 2010 that gave him brain fog and had trouble with word retrieval and short-term memory

- ANYWAY - word on the street is that he could recommend removing fluoride from the water system.

- On the good side of this - Dental supply company Henry Schein (HSIC) is up on the idea as this could lead to a boom in dental visits.Jersey Mikes - Feel good story...

- Blackstone buys company

- Valued at 8 Billion

- CEO bought the sub shop at 17 with the help of his football coachWalmart

- Earnings last week - wow company firing on all cylinders

- This notion that the consumer is hurting looks like a way just to sandbag earnings (Lowes, Home Depot)

- Company is upbeat on consumer spending

- Takes us back to the inflation discussion into the future.Black Friday

- Once again we are here - what do we buy?

- Black Friday has long been a cornerstone of the global shopping calendar.

- In 2023, Black Friday sales in the U.S. totaled $9.8 billion.

- This year, projections indicate sales will reach $10.8 billion, a 9.9% increase from 2023.