DH Unplugged

Dvorak/Horowitz

Dvorak and Horowitz Unplugged

- 1 hour 5 minutesDHUnplugged #702: Inflation Nation

Emerging markets breaking out of long consolidation

PPI HOT – Market does not care

A Meme stock face ripper!

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Inflation reports PPI today and CPI tomorrow

- Sentiment is dropping - wondering why

- Meme stock face ripper

- EV days - losses not acceptable

- PPI and CPI this weekMarket Update

- Another good week - seems like coming out of downturn

- Rates down- 10Y Treas falling over past week

- S&P 500 near record

- Emerging markets breaking out of long consolidation

- PPI HOT - Market does not careFed talk

- Fed's Goolsbee and Kashkari

- There has been cross currents in the data.

- There has been some bumps in the road on inflation in 2024.

- The Fed is in a wait and see mode

- Cautious about how restrictive policy is.

- More data is needed before they can predict a rate cut.

- There is a high bar for another rate hike, but not ruling it out.

- Leases trending up is a concerning signal.

----- What does any of that tell us?

------ We need to start a movement to SHUT THE FED UP (STFU)Latest Inflation Readings

- The Producer Price index for final demand increased 0.5% month-over-month in April (Briefing.com consensus 0.3%) following a downwardly revised 0.1% decline (from 0.2%) in March. The index for final demand, excluding food and energy, also increased 0.5% month-over-month (Briefing.com consensus 0.2%) following a downwardly revised 0.1% decline (from 0.2%) in March.

- On a year-over-year basis, the index for final demand was up 2.2%, marking the largest increase since April 2023, while the index for final demand, excluding food and energy, was up 2.4%, unchanged from March.

- The key takeaway from the report is that nearly three quarters of the increase in final demand prices was due to a 0.6% increase in the index for final demand services, something that will detract from the Fed's confidence that inflation is on a sustainable path to its 2% target.Powell speaking AGAIN!!!!!!!!!!!!!

- Fed Chairman Jerome Powell says he doesn't think next rate move will be a hike, more likely a hold; time will tell if policy is sufficiently restrictive; PPI reading was quite mixedGetting AI Overload

- OpenAI CEO Sam Altman says "not gpt-5, not a search engine, but we’ve been hard at work on some new stuff we think people will love! feels like magic to me"Sentiment

- Consumer sentiment fell sharply in May to the lowest level in six months as Americans cited concerns about stubbornly high inflation and interest rates and fears that unemployment could rise

- May Univ. of Michigan Consumer Sentiment - Prelim 67.4 vs 76.5 Briefing.com consensus; April Final was 77.2Fed Put

- Markets melting up since last Powell comments

- There is a new spin on the old "Fed put." The latter rested on an unspoken assurance that the Fed would step in with easier policy to forestall a market meltdown.

- The new version doesn't guarantee a rate cut soon, but it has created an unspoken assurance that market participants can trade around the idea that the next monetary policy move is likely to be a rate cut.Meme Stocks

- Gamestock was up 80% and many of the other names moving hard

--- Seems like the original Gamestock dude - Roaring Kitty put out a tweet on Monday and the stock went bananas...More Squeeze

- Shares of the vaccine maker soared 99% Friday, after the company signed a $1.2 billion licensing agreement with Sanofi that includes commercializing a combined Covid-19 and flu shot.

- The move boosts a stock that had plunged about 99% — prior to the deal — from its 2021 peak amid waning demand for its Covid vaccine.AMC - NICE FELLAS!

- AMC has a fundraising deal known as an at-the-market offering that lets it create new shares opportunistically to sell to buyers in the open market. The deal is part of AMC’s long-term effort to secure the capital needed to execute its turnaround, even if that means diluting investors seeking to cash in on short-term rallies.NeuralLink

- Elon Musk's startup Neuralink on Wednesday said part of its brain implant malfunctioned after it put the system in a human patient for the first time.

- In January, Neuralink implanted the device in a 29-year-old patient named Noland Arbaugh as part of a study to test its safety.

- Seems that several of the "threads" that connect devise to the brain have retracted from patients brain

- Neuralink did not disclose how many threads retracted from the tissue.More Musk

- U.S. prosecutors are examining whether Tesla committed securities or wire fraud by misleading investors and consumers about its electric vehicles’ self-driving capabilities, three people familiar with the matter told Reuters.

- Tesla’s Autopilot and Full Self-Driving systems assist with steering, braking and lane changes - but are not fully autonomous. While Tesla has warned drivers to stay ready to take over driving, the Justice Department is examining other statements by Tesla and Chief Executive Elon Musk suggesting its cars can drive themselves.

- Eventually something will stickVapes

- Five million disposable vapes are thrown away each week, equal to the lithium batteries of 5,000 electric vehicles over the course of the year, the government said.

- The U.K. government on Monday announced it will ban disposable vapes, citing an "alarming rise" in the number of young people using them.Bad Boys

- High-end brothels in the Boston and eastern Virginia regions provided sex for pay to "elected officials, high tech and pharmaceutical executives, doctors, military officers, government contractors that possess security clearances, professors

- Three people were arrested in connection with operating the pricey sex shops, which required "interested sex buyers" to provide employer information and references before booking sessions with prostitutes, authorities said.

- The brothels charged customers about $350 to "upwards of $600 per hour depending on the services and were paid in cash," according to the U.S. Attorney's Office for Massachusetts, which is prosecuting the defendants.Follow Up - UNH Hack

- UnitedHealth Group said on Monday that hackers stole health and personal data of potentially a "substantial proportion" of Americans from its systems in February, as the largest U.S. health insurer scrambles to contain the damage.

- The disclosure suggests patients' healthcare information remains vulnerable. An initial review of the compromised data showed files with protected health information or personally identifiable information "which could cover a substantial proportion of people in America," the company said in a statement on its website.Drink Less?

- Consumers are choosing an alcohol-free lifestyle either part-time or all of the time, and 41% of consumers surveyed say they intend on drinking even less in 2024, according to a report published by NC Solutions.

- Regarding the survey, 1,000 Americans 21 years of age and older were questioned on their current drinking habits and future plans for alcohol consumption.

- Gen Z was recognized as the generation that started the recent "sober conscious" movement, and 42% of those surveyed believe they have gestured toward the change and turned it into a trend.

- Yes BUT!!!!!!!!!! They are smoking weed in place of....McDonalds

- McDonald’s is working to introduce a value meal in U.S. stores to help offset an increasingly challenging environment for consumers.

- The $5 meal could include four items: a McChicken or McDouble, four-piece chicken nuggets, fries and a drink.

- The potential new offering comes at a time when low-income consumers are beginning to pull back on spending, particularly at fast-food brands.

- “Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending, which is putting pressure on the [quick-service restaurant] industry,” CEO Chris Kempczinski said on the company’s earnings call on April 30.

- - Many Franchise owners balkingTrump Media - Insider Trading

- So much bad stuff surrounds this stock

- A financial executive was convicted Thursday of enabling his boss and others to make over $22 million illegally by trading off his tips ahead of the public announcement that an acquisition firm was taking former President Donald Trump’s media company public.

- Garelicks' co-defendants pleaded guilty before trial, admitting that they made over $22 million illegallyApple Worm

- A newly released ad promoting Apple's new iPad Pro has struck quite a nerve online.

- The ad, which was released by the tech giant Tuesday, shows a hydraulic press crushing just about every creative instrument artists and consumers have used over the years — from a piano and record player, to piles of paint, books, cameras and relics of arcade games. Resulting from the destruction? A pristine new iPad Pro.

- Message - Crushing human creativity

- The ad had been pulled back and Apple has issues and apologyOpenAI - New Model

- OpenAI on Monday launched a new AI model and desktop version of ChatGPT, along with a new user interface.

- The update brings GPT-4 to everyone, including OpenAI’s free users, CTO Mira Murati said in a livestreamed event.

- She added that the new model, GPT-4o, is “much faster,” with improved capabilities in text, video and audio.More Open AI - Rumors

- OpenAI plans to announce its artificial intelligence-powered search product on Monday, according to two sources familiar with the matter, raising the stakes in its competition with search king Google.

Seems that this was fleeting - Google got hit for 2% on the headline, but when Altman clarified, Google shares recovered.Ford EV

- Ford Cuts Battery Orders as EV Losses Top $100,000 Per Car

- Ford Motor Co. has begun cutting orders from battery suppliers to stem growing electric-vehicle losses, according to people familiar with the matter, as it throttles back ambitions in a rapidly decelerating market for plug-in models.Softbank

- SoftBank posted a 7.24 billion Japanese yen ($4.6 billion) gain on its Vision Fund in the fiscal year ended March, the first time the flagship tech investment arm has been in the black since 2021.

- SoftBank's flagship tech investment arm, the Vision Fund, had a tough time in the fiscal year that ended in March 2023, posting a record loss of around $32 billion amid a slump in tech stock prices and the souring of some of the business' bets in China.Excitement Around WWDC

- At its WWDC keynote on June 10, Apple is expected to reveal a series of AI tools, including an improved version of ?Siri? that uses generative AI to be more conversational and capable, with the ability to "chat" with users instead of just responding to individual queries.

- Apple plans to market this revamped version of ?Siri? as a more security-focused alternative to rival AI services|- Apple is also working to improve how Siri handles tasks such as setting timers, creating calendar appointments, adding items to Reminders, and summarizing text.Love the Show? Then how about a Donation?

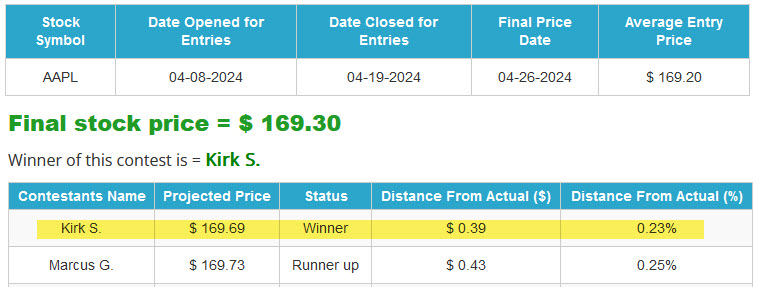

THE WINNER - CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

15 May 2024, 2:23 am - 1 hour 5 minutesDHUnplugged #701: Sentiment Pulse

Earnings season – better and stats

– BIGGEST BUYBACK EVER

– We are gauging investor sentiment

— Remember – Confidence and Sentiment (Cheer-leading helps)

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Earnings season - better and stats

- BIGGEST BUYBACK EVER

- We are gauging investor sentiment --

--- Remember - Confidence and Sentiment (Cheer-leading helps)

- Announcing the WINNER CTP for Apple

- Fake Work?Market Update

- If down - buy.... Names that were hammered due to earnings catching bids again

- Follow up - Utilities

- Fed Speaks - Can't stop the Dove

- Employment - Excitement about the Unemployment RateEarnings Season Update:

- Overall, 80% of the companies in the S&P 500 have reported actual results for Q1 2024 to date.

- Of these companies, 77% have reported actual EPS above estimates, which is equal to the 5-year average of 77% but above the 10-year average of 74%.

- In aggregate, companies are reporting earnings that are 7.5% above estimates, which is also below the 5-year average of 8.5% but above the 10-year average of 6.7%

- Eight of the eleven sectors are reporting year-over-year earnings growth, led by the Communication Services, Utilities, Consumer Discretionary, and Information Technology sectors.

- Three sectors are reporting a year-over-year decline in earnings: Energy, Health Care, and Materials.

- Revenue - up again - estimated to be 4.1% when all said and done.

- - If 4.1% is the actual revenue growth rate for the quarter, it will mark the 14th consecutive quarter of revenue growth for the index.Fake Work

- An investor at famed Silicon Valley firm Andreessen Horowitz is the latest VC to get involved in the debate around "fake work" in the tech industry.

- Ulevitch went on to point the finger at Google specifically, calling it "an amazing example."

- "I don't think it's crazy to believe that half the white-collar staff at Google probably does no real work," he said. "The company has spent billions and billions of dollars per year on projects that go nowhere for over a decade, and all that money could have been returned to shareholders who have retirement accounts."

- Marc Andreessen has criticized a managerial "laptop class" and tweeted in 2022, "The good big companies are overstaffed by 2x. The bad big companies are overstaffed by 4x or more."Buy 'em

- Companies that took a hit after earnings (NFLX, AMD) getting bid again

- NFLX gapped lower from ~$608 to $551 and now $592

- AMD dropped from $160 to $140 and now $156

- SPY , IWM and QQQ- Now above the 50day Moving average againFollow Up - Utilities

- Just wanted to provide this idea again - Data Warehouses and other AI Power hungry places

--- Symbol list of some utilities to look at further - SO, NEE, EXC, CMS

- Natural gas producers are planning for a significant spike in demand over the next decade, as artificial intelligence drives a surge in electricity consumption that renewables may struggle to meet alone.

- After a decade of flat power growth in the U.S., electricity demand is forecast to grow as much as 20% by 2030, according to a Wells Fargo analysis published in April. Power companies are moving to quickly secure energy as the rise of AI coincides with the expansion of domestic semiconductor and battery manufacturing as well as the electrification of the nation's vehicle fleet.

- AI data centers alone are expected to add about 323 terawatt hours of electricity demand in the U.S. by 2030Apple - Earnings

- Nothing great in the earnings.

--- A few pockets of sunshine....

--- Raises dividend and $110 BILLION buyback - largest buyback EVER for ANY company

---- Berkshire cut stake by 13% (Not sure if is simply reducing position after massive growth or other decision)SAVE SAVE

- Earnings not paining a pretty picture

- Blaming on issues with Pratt & Whitney due to manufacturing issues with Geared TurboFan engines

- Outlook by management was less than expected

- - Company planing on providing strategic updates in the next couple of months - But struggling..

----- Makes no sense that the JetBlue deal was blocked...Yuck

- Beyond Meat announces another Beyond Meat product will be available at Whole Foods Market stores nationwide with the addition of the smash-style Beyond Stack Burger

-- Does that sound good?Sentiment

- The Schwab Trading Activity Index (STAX) decreased to 48.87 in April, down from its score of 51.65 in March

- The reading for the four-week period ending April 26, 2024, ranks "moderate low" compared to historic averages as investment exposure decreased. U.S. equity markets fell during the April STAX period and indices experienced several single-day losses of greater than 2% following disappointing economic data releases.

- Popular names bought by Schwab clients during the period included: NVIDIA Corp. (NVDA) Advanced Micro Devices Inc. (AMD) Super Micro Computer Inc. (SMCI) Amazon.com Inc. (AMZN) Microsoft Corp. (MSFT)

- Names net sold by Schwab clients during the period included: Walt Disney Co. (DIS) PayPal Holdings Inc. (PYPL) Exxon Mobil Corp. (XOM) Devon Energy Corp. (DVN) Occidental Petroleum Corp. (OXY)Buyers Buying

- Hon Hai Precision (AKA FoxConn) The company, which assembles the majority of Apple Inc.’s smartphones, reported a 19% rise in monthly sales to NT$510.9 billion ($15.8 billion), compared with revenue of NT$429.2 billion in April 2023.

- The company said in a statement Sunday that April revenue climbed to a record for the month.

- This report raises expectations for iPhone sales while AI-related business booms. (although does not actually line up with Apple's earnings call)On The Other Hand

- South Korea's factory output fell in March by the most in 15 months, government data showed on Tuesday, missing market expectations.

- The industrial production index fell 3.2% from a month earlier on a seasonally adjusted basis, after a gain of 2.9% in February and compared with a rise of 0.6% tipped in a Reuters survey of economists.

- It was the fastest monthly fall since December 2022 and caused by declines in metal processing and electronic parts, according to Statistics Korea.Carvana

- The father-son duo behind Carvana Co. have seen their fortunes rebound as shares of the Phoenix-based online used-car dealer have surged more than 3,000% from historic lows.

- Ernie Garcia II and Ernie Garcia III have added more than $11 billion in combined net worth since December 2022, when Carvana stock fell below $4 a share as rising interest rates sapped sales and the company was forced to restructure debt.

- Carvana shares jumped 34% on Thursday to the highest in more than two years after the company reported stronger first-quarter earnings with revenue topping analysts’ expectations.Savings - Gone

- US households have exhausted the pile of cash squirreled away during the pandemic

The latest estimates of overall pandemic excess savings remaining in the US economy have turned negative, suggesting that American households fully spent their pandemic-era savings as of March 2024,” (San Francisco Fed economists)AND - Social Security

- According to SS Trustees: The trust funds the Social Security Administration relies on to pay benefits are now projected to run out in 2035, one year later than previously projected

- The Social Security trustees credited the slightly improved outlook to more people contributing to the program amid a strong economy, low unemployment and higher job and wage growth.AI Reality

- ServiceNow Inc.’s new generative AI-focused product tier will take time to boost financial results, executives said, sending a lukewarm message to investors looking for big impact from the highly hyped technology.

- “While it might take some time to have a material impact to the top line, the opportunity is massiveLove the Show? Then how about a Donation?

ANNOUNCING THE WINNER

CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

8 May 2024, 2:31 am - 1 hour 54 secondsDHUnplugged #700: Seven Hundy

Earnings season winners and losers.

Episode 700 – been a great run – plenty more to come.

New airline regulations and what that means to all of us.

Inflation – its not over just yet.

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Show #700

- Guess the date of EPISODE #1 (Show # 1 was Sep 16, 2008)

- - No Agenda episode #1 - October 26, 2007

--- The Disciplined Investor Podcast show #1 - Mar 02, 2007

- ALL economic series showing signs of inflation

- The great money in God - Top Wealthiest Pastors

- Fiducuary rules fo Retirment PlansMarket Update

- Shaking off some and smacking others - earnings season underway

- April not a great month for US equities - April now in the books

- Earnings seasons - winners and losers

- Yields on I Bonds Updated

- European stocks end April down 1.49%, posting first negative month since OctoberDerivative AI Investing

- Secondary play - Utilities

- We spoke of the huge demand for electricity/power from any source to power datacenters

- Investors looking for a unique way into the stock market’s artificial intelligence boom are finding an intriguing bank shot in what’s traditionally the most boring corner of the equities universe: utilities.

- Southern Company, NextEra, Excelon, CMS Energy also Eaton, Hubbell

-- Bad couple years as this is an interest sensitive sector - but massive consumption increase comingBird Flu in Milk

- The U.S. Department of Agriculture confirmed milking cows in Colorado tested positive for Bird Flu, following earlier infections in Texas, Kansas, Michigan, Ohio, Idaho, New Mexico, North Carolina and South Dakota.

- Additional tests of milk showed that pasteurization killed the bird flu virus, federal health officials said on Friday, as Colorado became the ninth U.S. state to report an infected dairy herd.

- The U.S. Food and Drug Administration (FDA) late on Friday said preliminary results from gold-standard PCR testing showed pasteurization killed the virus in milk and baby formula. It did not say how many milk products it had tested but added that it plans to do more testing on 297 products from 38 states.Good Money in God

- Most Wealth Pastors

- Benny Hinn, 71 Estimated net worth: US$60 million

Joel Osteen, 61 Estimated net worth: US$100 million

- Kenneth Copeland, 87 Estimated net worth: US$300 millionApple Headset and More

- Earnings coming May 2

- Big slowdown in sales in China has been widely telegraphed

- Not much excitement about the product line or any innovation at this point

- AI is going to be conversation they will start to help push shares

- Apple slashes Vision Pro production, cancels 2025 model in response to plummeting demand

-- Analysts are cutting their sales for the Vision Pro in HALF!

- - Apple may decide not to release a new model in 2025 - was expecting a cheaper version possiblyBack to Inflation

- Inflation showed little signs of letting up in March, with a key barometer the Federal Reserve watches closely showing that price pressures remain elevated.

- The personal consumption expenditures price index excluding food and energy increased 2.8% from a year ago in March, the same as in February, the Commerce Department reported Friday. That was above the 2.7% estimate from the Dow Jones consensus.

- Consumers showed they are still spending despite the elevated price level. Personal spending rose 0.8% on the month, a touch higher even than the 0.7% estimate. Personal income increased 0.5%, in line with expectations and higher than the 0.3% increase in February.

- GDP Report showed more pricing pressures

- Overall, 100% of recent reports showed that the inflation monster is not deadMore Economics

- U.S. economic growth was much weaker than expected to start the year, and prices rose at a faster pace, the Commerce Department reported Thursday.

- Gross domestic product, a broad measure of goods and services produced in the January-through-March period, increased at a 1.6% annualized pace when adjusted for seasonality and inflation, according to the department's Bureau of Economic Analysis.

- The price index for GDP, sometimes called the "chain-weighted" level, increased at a 3.1% rate, compared to the Dow Jones estimate for a 3% increase.

- - - SO, we have slowing GDP and prices that are staying high - NOT Stagflation yet, but getting worrisone.

--- Stagflation (wiki): In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment.Case Shiller

- February S&P Case-Shiller Home Price Index 7.3% vs. 6.7% Briefing.com consensus; prior 6.6%Companies:

- Shares of Hertz Global slumped 24% and were on track for their sharpest one-day percentage fall on record last Thursday after the company reported a wider-than-expected quarterly loss, highlighting its struggles with the EV rental business (We covered this a couple months ago)

- The company is slimming down the business due to weak demand, with plans to sell 10,000 more EVs, taking its total planned sales to 30,000 this year. Higher repair costs also weighed on the company's overall fleet maintenance expenses.

- Hertz said it took a $588 million hit in vehicle depreciation costs during the quarter, of which $195 million was related to EVs held for sale.

- Alphabet (Google) shares rallied on Friday after the company reported results that topped analysts' estimates, showed soaring profits in its cloud division and announced its first dividend and a big buyback increase ($70 BILLION)

- Net income jumped 57% to $23.66 billion, or $1.89 a share, from $15.05 billion, or $1.17 a share, a year earlier.

- Operating income in Google's cloud business more than quadrupled to $900 million, showing that the company is finally generating substantial profits after pouring money into the business for years to keep up with Amazon Web Services and Microsoft Azure.

- - The jump lifted Alphabet's market cap past $2 trillion to an ALL TIME HIGH

- Microsoft - In its earnings report last Thursday, Microsoft said capital expenditures jumped 79% from a year earlier to $14 billion. The company is spending much faster than it's increasing revenue — sales climbed 17% in the period.

- Generally Microsoft put up good numbers - could be one of the "ready to go" AI play with Co-Pilot actually bringing in $$ for the company.

--- Microsoft posted a 17% increase in revenue, to $61.9 billion, with $21.9 billion in profits, up 20%, and earnings of $2.94 per share.

- Facebook (META): Mark Zuckerberg's net worth plunged by $18 billion Thursday after comments from the Meta CEO on the earnings call sent his company's stock price to its steepest decline since October 2022.

- While Meta beat expectations on revenue and profit but delivered a lighter-than-expected revenue forecast. Zuckerberg told investors that the company would continue to spend billions of dollars investing in areas like artificial intelligence and the metaverse, even though Meta counts on advertising for 98% of its revenue.

- - Investors freaking out a bit as they are worried that the money spend is going to get out of control again - Like Zuk did with the Metaverse.

- "We've historically seen a lot of volatility in our stock during this phase of our product playbook where we're investing in scaling a new product but aren't yet monetizing it," Zuckerberg said on the call.

----*** ZUCK: And I also expect to see a multi?year investment cycle before we’ve fully scaled Meta AI, business AIs, and more into the profitable services I expect as well.

- - - - Translated - what no one else is saying - going to take a VERY long time to monetize whatever this AI things actually is.

- Tesla stock popped nicely even though the company reported a miserable quarter and outlook was not so good.

---- Perhaps the worst is over ? That is what investors must be thinking. (little in that report was really encouraging)More Tesla

-Shares of Tesla rose sharply on Monday, their best day since March 2021, after the electric carmaker passed a significant milestone to roll out its advanced driver-assistance technology in China.

- The company’s share price closed up 15% as investors reacted to news surrounding Tesla CEO Elon Musk’s visit to China.

- Tesla on Sunday said local Chinese authorities removed restrictions on its cars after passing the country’s data security requirements.Old is New?

- Ford Motor Co posted first-quarter earnings last Wednesday that beat Wall Street's expectations, bolstered by a strong performance in its commercial vehicle division and an increase in its hybrid vehicle sales.

- The company said it expects to achieve the higher end of its projected annual guidance of $10 billion to $12 billion in earnings before interest and taxes.

- The carmaker recorded a $1.3 billion operating loss for its EV and software division in the first quarter. More broadly, executives expect this section of the company to sustain a pre-tax loss of between $5 billion to $5.5 billion for the year.

- Ford shares rose slightly then slipped - should move higher if markets cooperateNew Airline Regulations

- The U.S. Transportation Department finalized new rules Wednesday requiring upfront disclosure of airline fees and mandates quick cash refunds for canceled flights, as well as for delayed baggage or inoperative services like onboard Wi-Fi.

- The rules, which were nearly three years in the works, will require airlines and ticket agents to tell consumers upfront about baggage or change and cancellation fees. The department said consumers are expected to save $543 million annually in excess airline fees.

- The refund rules apply to cancelled flights by carriers regardless of the reason including if it is because of weather. But passengers are not entitled to refunds if they are rebooked and travel on another flight

- The government will also require airlines to refund baggage fees if bags are not delivered within 12 hours of domestic flights arriving or 15 to 30 hours of their international flight arrivals, as well as for services that do not work or are not provided. Airlines must promptly and automatically issue refunds if flights are canceled.

- Airlines will find ways to make up the money - the cost factors will be made up with greater inconvenience somehow and higher fares.McDonald's - Warning

- McDonald’s missed quarterly earnings estimates as same-store sales fell short of expectations.

- Boycotts over the conflict in Gaza weighed on the chain’s Middle East sales again.

- Higher prices have helped McDonald’s revenue, but scared away some low-income customers.

- Discussed how inflation is a problem and higher wages eating into profitability (Californian Min wag $20)

- Earnings per share: $2.70 adjusted vs. $2.72 expected

- Revenue: $6.17 billion vs. $6.16 billion expectedIBonds

- Treasury released the next 6 month rate - 4.28%

-- Wonder how this will look moving forwardYEN

- Japan doesn't really care...Good news for 401k Holders - and a warning

- The Biden administration issued a final rule on Tuesday that cracks down on the investment advice that advisors, brokers, insurance agents and others give to retirement savers.

- The U.S. Department of Labor regulation — which follows a rule proposal in October — aims to ensure that investment recommendations are in savers' best interests, according to agency officials.

- In legal terms, the final rule expands the scope of when a broker, advisor or other intermediary must act as a "fiduciary," meaning they are required to give advice that puts the client first.

---- This is important for those with 401ks and other retirement plans that are looking for advice - especially from those people selling high commission productsMJ

- Pot stocks powering higher following reports the DEA will soon reclassify marijuana from a Schedule I drug to a Schedule III drug that can be lawfully prescribed as medication.- MSOX +43%, CGC +36%, TLRY +30%, LFLY +30%, MAPS +23%, ACB +22%, MSOS +22%, MJ +18%, CRON +12%

Love the Show? Then how about a Donation?

CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

1 May 2024, 2:11 am - 59 minutes 36 secondsDHUnplugged #699: Flesh Wound

Markets having a tough time and a big week of data is coming.

Got the 5% correction – is there more?

M&A – Another deal dies

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Markets having a tough time

- Happy Passover!

- SHOW 700 coming up!

- Happy belated 420 Day to our fine smoky listeners

- Jumping to Conclusions

- We have a limerick!Market Update

- Big week(s) coming for economics

- Got the 5% correction - is there more?

- M&A - Another deal dies

- Earnings - Tech on deck

- Historic Treasury Auction this week - need to pay the bills since tax receipts not doing it and lots of debt outstandingWho Would think???

- UK - FTSE 100 at all-time high!Recap:

- Microsoft Corp., Meta Platforms Inc., Google parent Alphabet Inc. and Tesla Inc., all of which are among the so-called Magnificent Seven group of tech giants, will report THIS WEEK week.

- Technology stocks are selling off, with the Nasdaq 100 Index registering its biggest weekly drop since November 2022 in the midst of a four-week losing streak, its longest since December 2022.

- Even AI darling Nvidia Corp. is getting hit, plunging 10% on Friday and wiping out $212 billion in market value for its worst day since the Covid pandemic in March 2020.MAG7 Profit Outlook

- But hope is on the horizon. Profits for the Mag Seven — which also includes Apple Inc., Amazon.com Inc. and Nvidia — are forecast to rise 38% in the first quarter from a year ago, dwarfing the overall S&P 500’s 2.4% anticipated year-over-year earnings growth, according to Bloomberg Intelligence data.

- Around 178 S&P 500 companies — representing more than 40% of the index’s market capitalization — will post results next week. But the biggest expectations are for megacap tech firms.

= = Nvidia, which Goldman Sachs Group Inc.’s trading desk dubbed “the most important stock on planet Earth,” doesn’t report its earnings for another month.Tesla

- Stock down a lot - DOWN 43% YTD

- Down 65% from high set November 2021

- Tesla is recalling nearly 3,900 of its Cybertrucks due to an issue with the vehicle's accelerator pedal.

- The recall, announced Wednesday, was prompted by accelerator pedal pads in the trucks that "may dislodge and cause the pedal to become trapped by the interior trim,"

- All of the 3,878 of the 2024 Cybertrucks that Tesla built between Nov. 13 and April 4 are subject to the recall, the electric vehicle maker’s safety recall report said.

- And then: Tesla on Saturday slashed the price of its Full Self-Driving (FSD) driver assistant software to $8,000 from $12,000 in the United States, as CEO Elon Musk reaffirms his commitment to self-driving technology.

- Musk is betting the technology will become a major source of revenue for the world's most valuable automaker. But he has for years failed to achieve the goal of self-driving capability, with the technology under growing regulatory and legal scrutiny.

----- Could be a short squeeze setting up for earnings (Tonight) - READ MORE>>>>>Tesla Earnings

- Tesla misses by $0.04, misses on revs, gross margin down 199 bps yr/yr, reiterates that in 2024, vehicle volume may be notably lower than the growth rate achieved in 2023

- Total GAAP gross margin of 17.4%, down 199 bps yr/yr.

- Operating expenses up 37% yr/yr to $2.53 bln.

- Total Deliveries down 9% to 386,810.

- Outlook: Co states, "Our company is currently between two major growth waves: the first one began with the global expansion of the Model 3/Y platform and we believe the next one will be initiated by advances in autonomy and introduction of new products, including those built on our next generation vehicle platform. In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023, as our teams work on the launch of the next generation vehicle and other products. In 2024, the growth rates of energy storage deployments and revenue in our Energy Generation and Storage business should outpace the Automotive business."Salesforce M&A

- One week ago, the Wall Street Journal first reported that CRM was exploring a purchase of INFA and that news did not go over well with either shareholder base.

- In fact, not including Monday'ss moves, CRM and INFA are lower by 8% and 9%, respectively, since that initial story broke on April 15

- Deal DeadPCE Index Report (Friday)

Change From Month One Year Ago February 2024 +2.8% January 2024 +2.9% December 2023 +2.9% November 2023 +3.2%

- The PCE Price Index Excluding Food and Energy, also known as the core PCE price index, is released as part of the monthly Personal Income and Outlays report. The core index makes it easier to see the underlying inflation trend by excluding two categories – food and energy – where prices tend to swing up and down more dramatically and more often than other prices. The core PCE price index is closely watched by the Federal Reserve as it conducts monetary policy.

- Looking for somewhere between 0.3 and 0.4 MoM and there is hope that this stays under 3% YoY -China Playing Hardball

- Apple has removed popular messaging apps like WhatsApp, Telegram and Signal from its iPhone app store in China after the Chinese government ordered the company to do so, The Wall Street Journal reported last Friday.

- Citing a person familiar, the Journal reported that the Cyberspace Administration of China asked Apple to remove Meta-owned WhatsApp and Threads from the App Store "because both contain political content that includes problematic mentions of the Chinese president," but the Apple spokesperson denied that was part of the reasoning.

- This is probably in direct response to the potential for a TikTok ban with the latest legislation making its way through congress.House Bills

- Lots of money approved over the weekend in the HOUSE for Ukraine, Israel and Taiwan

- Also, the bill is paving the way to a possible TikTok ban in the U.S. passed the House of Representatives on Saturday, as part of a legislative package addressing critical national security concerns with China, Russia and Iran.

- It passed overwhelmingly in a 360 to 58 vote.

- Another high-profile component of the measure is the Rebuilding Economic Prosperity and Opportunity (REPO) for Ukrainians Act, which would allow the U.S. government to liquidate seized Russian assets and then give those funds to Ukraine.Here we Go....

- Latest commentary: The Federal Reserve is stuck in a mode of forecasting and public communication that looks increasingly limited, especially as the economy keeps delivering surprises.

- The issue is not the forecasts themselves, though they’ve frequently been wrong. Rather, it’s that the focus on a central projection — such as three interest-rate cuts in 2024 — in an economy still undergoing post-pandemic tremors fails to communicate much about the plausible range of outcomes. The outlook for rates presented just last month now appears outdated amid a fresh wave of inflation.Chapter 11?

- Red Lobster, which has 58 stores in Florida, is considering Chapter 11 bankruptcy to recoup $11 million in losses from its endless shrimp promotion, Bloomberg reported.

- Red Lobster’s “Ultimate Endless Shrimp” promotion last year was intended as a limited-time offer but brought in enough new customers that the chain added it to its permanent menu in June. Customers gobbled it up, and the chain reported fourth-quarter 2023 losses of $12.5 million, the outlet reported.Nike

- Error in their ways - some admission here

-Nike CEO John Donahoe acknowledged Friday that the company moved too far away from wholesale partners like Macy's and DSW in its quest to become a retailer that primarily sells merchandise to shoppers through its own stores and website.

- "We recognize that in our movement toward digital, we had over rotated away from wholesale a little more than we intended,"

- We've corrected that. We're investing heavily with our retail partners. They were all here over the last couple of days; they're very excited about the innovation pipeline."

- So WHAT DOES THIS REALLY MEAN?DJT- Tricky

- Trump Media on Friday warned the CEO of the Nasdaq Stock Market of 'potential market manipulation' of the company's stock by "naked" short selling of shares.

- Company is trying every trick in the book

- They are evenr doing outreach to shareholders to teach then how to minimize short selling by not allowing shares to be loaned out - like the old days

- SEC Reply: On its website notes that a failure to deliver shares as part of a short sale trade, which can land a company on the Reg SHO threshold list, does not necessarily reflect improper trading activity such as naked short selling.

- "There are many justifiable reasons why broker-dealers do not or cannot deliver securities on the settlement date," the SEC notes in a section about Regulation SHO.

- Devon Nunes - President is fighting the shorts - and he will probably lose if the company continues on this trajectoryMichael Saylor

- Evangelist for Bitcoin - on TV tellign everyone that his company - Microstrategy is a leveraged Bitcoin Play and the best way to hold bitcoin

- Meanwhile: Saylor entered into a stock-sale plan with his company last summer that allowed him to unload up to 400,000 shares in the first four months of 2024.

--- With the plan more than 90% of the way to completion, Saylor has netted about $370 million from this year's stock sales

- Those assets, equal to about 1% of the total number of bitcoins minted to date, are now worth about $13.6 billion, accounting for the bulk of MicroStrategy's $21.3 billion market cap.AH Jumped to Conclusion - NVDA

- Japanese tech conglomerate SoftBank is looking to develop a "world-class" Japanese-language-specific generative artificial intelligence model, and plans to invest $960 million in the next two years to bolster its computing facilities, according to a Nikkei report.

- So, AH wondered, why is Softbank talking this up and saying that they are planing top purchase chips from NVDA (from anonymous sources)

- Looked and was proven wrong - as of last update Softbank does not own a significant stake in NVDA IN FACT: SoftBank sold its entire 4.9% stake in Nvidia for $3.3B in January 2019NEW HOME SALES!

- New home sales increased 8.8% month-over-month in March to a seasonally adjusted annual rate of 693,000 units (Briefing.com consensus 670,000) from a downwardly revised 637,000 (from 662,000) in February.

- On a year-over-year basis, new home sales were up 8.3%.

- The key takeaway from the report is that new home sales were up in every region, helped in part by another dip in the median sales price, although average prices were up with a pickup in sales of higher-priced homes, particularly in the West region.

- The median sales price decreased 1.9% yr/yr to $430,700 while the average sales price increased 1.0% to $524,800. March marked the seventh consecutive month of a year-over-year decline in the median selling price.

----- New home sales month-over-month/year-over-year by region: Northeast (+27.8%; -13.2%); Midwest (+5.3%; -23.4%); South (+7.7%; -4.5%); and West (+8.6%; +18.8%).

-----At the current sales pace, the supply of new homes for sale stood at 8.3 months, versus 8.8 months in February and 8.1 months in March 2023.

----- The percentage of new homes sold for $399,999 or less accounted for 43% of new homes sold versus 48% in February and 44% one year ago. Homes priced between $400,000 and $749,000 accounted for 43% of new homes sold versus 40% in February. New homes priced at $750,000 or over accounted for 14% of sales in March versus 12% in February.THIS

- Poor environment for M&A

- The U.S. Federal Trade Commission on Monday sued to block Coach parent Tapestry's $8.5 billion deal to buy Michael Kors owner Capri, saying it would eliminate "direct head-to-head competition" between the flagship brands of the two luxury handbag makers.

- "The proposed merger threatens to deprive millions of American consumers of the benefits of Tapestry and Capri's head-to-head competition, which includes competition on price, discounts and promotions, innovation, design, marketing and advertising," the FTC said.Love the Show? Then how about a Donation?

CTP FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

EPISODE 700

In the world of pods, there's a grand show

Hosted by John and Andrew, all know

Episode 70 is their feat,

With tales both wild and sweet,

An epic journey with words that just flow!JCD Score ()

See this week’s stock picks HERE

24 April 2024, 2:14 am - 1 hour 33 secondsDHUnplugged #698: Risk Happens

Risk – happens fast!

Costco Selling ALOT of Gold

April 15th – Tax payment withdrawals

Rates spike, oil moves lower

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- Risk Happens FAST

- Costco Selling ALOT of Gold

- April 15th - Tax payment withdrawals

- Fewer students attending 2 0r 4-year collegeMarket Update

- Banks reporting - mixed results

- Rates UP!

- Earnings Season

- Risk off - Missiles Flying

--- WAR escalations concerning investorsRates

- Rates spiked with all of the recent concern that the Fed will not be cutting rates so fast

- Came on on the Iran retaliation worries

- Spike Monday to 4.64% for the 10Yr - starting to get worrisome that could be technical move and disrupt marketsRates in Europe

- European Central Bank President Christine Lagarde on Tuesday said the central bank remains on course to cut interest rates in the near term, subject to any major shocks.

- "We just need to build a bit more confidence in this disinflationary process but if it moves according to our expectations, if we don't have a major shock in development, we are heading towards a moment where we have to moderate the restrictive monetary policy," Lagarde said.

--- Also noted that she is very attentive to the price of oilHA! If you don't like the numbers...

- The Bank of England on Friday announced a “once in a generation” overhaul of its inflation forecasting following a long-awaited review by former Federal Reserve Chair Ben Bernanke.

- The review was initiated in response to criticism over shortcomings in the bank’s recent policymaking.

- It sets out 12 recommendations — including scrapping the bank’s “fan chart” forecasting system — which BOE Governor Andrew Bailey said the bank was committed to implementing.Inflation Spots

And then at 1:30PM Tuesday

- Fed Chairman Jerome Powell at Canadian forum says recent data shows lack of progress on returning to 2% inflation goal; says US economic performance has been quite strong.

- Markets were not pleased -

---- Begs the question: - what is the point of this at a time with such global stress having these types of comments?

---- WSJ's Nick Timiraos says Fed Chairman Jerome Powell "dialed back" rate reduction expectations at Canadian forum amid new inflation uncertaintySafe-haven?

- Bitcoin and other cryptos PLUNGE when Iran sent misses and drones

- How is that digital gold or store of value?

- Simply trades like a speculative risk asset and starting to hear that phrase quite a lot.

- Tried to rally on Sunday when Iran said that is all they are doing- but sold off again MondayEarnings This Week

- Plenty of banks and financials (BAC, GS etc) also Netflix Thursday after the close

- Proctor and Gamble on Friday

- Problem is that they come right as risk elevated.Goldman Sachs Earnings

- Goldman Sachs on Monday posted first-quarter profit and revenue that topped analysts’ expectations, fueled by a surge in trading and investment banking revenue.

- The bank said profit jumped 28% to $4.13 billion, or $11.58 per share, from the year earlier period, thanks to a rebound in capital markets activities

- Goldman shares climbed more than 4% in the days trading Monday.JPM Earnings

- The bank said first-quarter profit rose 6% to $13.42 billion, or $4.44 per share, from a year earlier, boosted by its takeover last year of First Republic during the regional banking crisis.

- But in guidance for 2024, the bank said it expected net interest income of around $90 billion, which is essentially unchanged from its previous forecast.

- That appeared to disappoint investors, some of whom expected JPMorgan to raise its guidance by $2 billion to $3 billion for the year.

- Shares of JPMorgan fell more than 6%.BAC Earnings

- Bank of America on Tuesday reported first-quarter earnings that topped analysts’ estimates for profit and revenue on better-than-expected interest income and investment banking.

- The bank said profit fell 18% to $6.67 billion, or 76 cents a share; excluding a $700 million FDIC assessment, profit was 83 cents a share.

- Revenue slipped 1.6% to $25.98 billion as net interest income declined from a year earlier. (that should turn a bot as rates increasing)China - AMD and Intel

- Shares of Advanced Micro Devices and Intel dipped on Friday after The Wall Street Journal reported that China is ordering the country's largest telecommunications carriers to cease use of foreign chips.

- Chinese officials issued the directive earlier this year for the telecom systems to replace non-Chinese core processors by 2027

- Both stocks traded down as much as 4% on Friday morning.

- Why? China accounted for 27% of Intel's revenue in 2023, making it the company's biggest market. AMD generated 15% of sales from China, including Hong Kong, last year.Salesforce Acquiring

- Salesforce Inc., the top maker of customer relations software, is in advanced talks to acquire Informatica Inc., the Wall Street Journal reported, citing people familiar with the discussions.

- $11 BILLION

- Informatica Inc. is an enterprise cloud data management company. The Company provides artificial intelligence (AI)-powered Intelligent Data Management Cloud (IDMC) platform, which connects, manages and unifies data across any multi-cloud, hybrid system, empowering enterprises to advance their data strategies. The Company’s platform enables enterprises to create a single source of truth for their data, allowing them to create compelling 360-degree customer experiences.Follow Up

- Chickens and Hot Dogs!

- Now Gold

- Wells Fargo expect revenue "may now be running at" $100 million to $200 million a month, a rapid acceleration since bullion hit the warehouse club late in the summer of 2023.

- Costco is selling one-ounce bars made of nearly pure 24-karat gold. While the price is not disclosed online to nonmembers, it's estimated that the product generally sells for about 2% above the spot price

- There are a few catches: Sales are limited to five per customer (up from two previously)

- Not really profitable - 2% markup, but you get back the 2% for executive members

- BUT adds 3% to general merchandise sales but not much profit.

--- Just looked and not available again - sells out quicklyCHINA

- Fitch cut its outlook on China's sovereign credit rating to negative on Wednesday, citing risks to public finances as the economy faces increasing uncertainty in its shift to new growth models.

- The outlook downgrade follows a similar move by Moody's in December and comes as Beijing ratchets up efforts to spur a feeble post-COVID recovery in the world's second-largest economy with fiscal and monetary support.Japan

- Japanese workers' real wages fell in February for a 23rd consecutive month, data showed on Monday, suggesting higher prices kept up pressure on consumers' spending appetite.

- How is this possible with little to no inflation????

- Inflation-adjusted real wages, a barometer of consumer purchasing power, fell 1.3% in February from a year earlier, down for 23 straight months, data from the labor ministry showed. It followed a revised decline of 1.1% in January.Disney

- Nelson Pelz looses Disney bid - Lost but won

- 5th largest investor - owns more than $3.5BILLION in Disney Stock

- The outcome has been positive, he added, noting that Disney's stock is up roughly 50% since October, when his firm began to re-engage with Disney, and is the best performer on the Dow Jones Industrial Average this year.Chick-fil-A

- Chick-fil-A announced it is allowing certain antibiotics in its chicken, overturning a commitment it made in 2014.

- The company said in a recent statement posted on its website that the change will take effect in spring 2024, and is intended "to maintain supply of the high-quality chicken you expect from us."

- The statement, which was also sent as a notification to the chain's app users, said the antibiotics that will be allowed are not important to human health, and are only administered "if the animal and those around it were to become sick."Trend?

- For the second year in a row, the number of students earning a bachelor's or associate degree declined, according to a recent report by the National Student Clearinghouse Research Center.

- Overall, undergraduate degree earners fell nearly 3% in the 2022-23 academic year — the steepest decline ever recorded, the report found, while bachelor's degree earners sank to the lowest level in nearly a decade after notching a one-year loss of almost 100,000 graduates.

- Meanwhile, the number of students earning a certificate hit a 10-year high, largely due to the growth in vocational programs.Tesla

- Bad news keeps on coming

- Jobs cuts

- Lowering prices on cars

- bad numbers in China

- More Cybertruck issues

- Many now saying they are OUT of the Mag7Oh Canada!

- Canada will raise capital gains taxes on businesses and wealthy individuals to help pay for tens of billions in new spending aimed at making housing more affordable and improving the lives of young people.

- Finance Minister Chrystia Freeland said the government will tax Canadian companies on two-thirds of their capital gains, up from half currently. That change will also apply to individual taxpayers when they have gains over C$250,000 ($181,000) in a year, though people will still be able to sell the homes they live in tax-free.Love the Show? Then how about a Donation?

ANNOUNCING - A NEW CTP

FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

17 April 2024, 2:28 am - 59 minutes 24 secondsDHUnplugged #697: YesNo Rate Cuts

A WINNER – CTP for Rumble

A new CTP to announce!

Club 72 Thank You

Solar Eclipse

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- A WINNER - CTP for Rumble

- A new CTP to announce!

- Club 72

- Solar EclipseMarket Update

- Boeing issues continue

- Oil market on fire

- Yellen - talking tariffs again

- Kashkari and others on cuts

- Earnings season starts this weekLucky CLUB 72

Jonathan Farris

Mark Studebaker

William Palmer

Susan Erickson

Terrence Cleary

Anonymous (2)Fed Walking All Back

- Minneapolis Federal Reserve Bank President Neel Kashkari said on Thursday that at the U.S. central bank's meeting last month he penciled in two interest rate cuts this year but if inflation continues to stall, none may be required by year end.

- "If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all," Kashkari said during an interview with Pensions & Investments. "There's a lot of momentum in the economy right now."Walking Forward

- Federal Reserve Governor Michelle Bowman said Friday that it's possible interest rates may have to move higher to control inflation, rather than the cuts her fellow officials have indicated are likely and that the market is expecting.

- "While it is not my baseline outlook, I continue to see the risk that at a future meeting we may need to increase the policy rate further should progress on inflation stall or even reverse,"Who is the best?

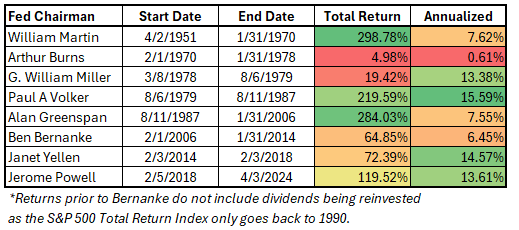

-If you were wondering about the track record of the Fed Chair's performance over time, it's worth delving into the historical data.

- Overall, the track record of Fed Chairs over time reflects the challenges and complexities of managing monetary policy in a dynamic and ever-changing economic environment. Each Chair has faced unique circumstances and challenges during their tenure, and their actions have had far-reaching implications for financial markets and the economy as a whole.

Whispers

- Hearing that the car business - used and new having one of the worst years on record (from selective car salespeople)

- Same as above on lower end boat business (sales)

- U.S. small-business confidence slipped to the lowest level in more than 11 years in March amid rising concerns about inflation, according to a survey on Tuesday.

- The National Federation of Independent Business (NFIB) said its Small Business Optimism Index fell 0.9 point to 88.5 last month, the lowest level since December 2012. It was the 27th straight month the index was below the 50-year average of 98.

- - Twenty-five percent of owners reported inflation was their single most important problem in operating their business, reflecting higher input and labor costs, up 2 points from February. The share of businesses raising average selling prices rose 7 points from the prior month.Inflation Data and ECO

- CPI and PPI this week

- CPI expectations are 0.4% MoM for March

--- Many are sahing that this is a clean month without odd seasonal factors - so something to watch

- - 10 Yr at 4.378%

----------- FOMC minutes at 2:00 Wednesday

-- Last week - Employment situation continues to be strong - 3.8% Unemployment rate 300k added to payrolls (Wage growth was okay)Earnings Season - Banks in Focus

- Banks are expected to see some decline in earnings over the period

- Focus on net interest margin as well as credit deterioration (and days outstanding)

- However, YoY - earnings growth for some look pretty good

- - - - Property & Casualty Insurance (87%), Reinsurance (62%), Life & Health Insurance (12%), and Multi-line Insurance (12%).REMOTE WORK on the sea

- Virgin Voyages is targeting a new type of traveler: remote workers.

- In March, the Miami-based cruise line owned by Sir Richard Branson introduced a month-long cruise called the “Scarlet Summer Season Pass.” It’s essentially four week-long cruises packaged together to appeal to remote workers who want to spend a month at sea in southern Europe.

- Starlink WiFI included

-Europe and other locations

- $9,900 for 2 people!DNUT Follow up

- Krispy Cream stock - we flagged something weird after big jump last week with McDonalds news (2026+ completion???)

- Stock moved up and now got shot down....3PM Monday - Solar Eclipse

- Starting at 1Pm warnings that volume could dry up from 3PM - 4PM as eclipse is more interesting than trading stocks

- Volume did dry up a bit as most were out with their pinhole glassesBack to this...

- U.S. Treasury Secretary Janet Yellen on Monday said she would not rule out any measures, including potential tariffs, on China's green energy exports.

- Yellen not too happy as China providing industry incentives to local companies

- WHY? Didn't we just pass a multi-billion dollar chips act?

- Don't we have tax incentives and other government handouts to companies?Boeing

- A Southwest Airlines flight had to make an emergency stop after an engine part fell off during takeoff from Denver International Airport on Sunday morning.

- The airline said that they lost "approximately $160 million" in their first quarter.

- Boeing pays Alaska Airlines $160 million in cash in 'initial payment' following mid-air blowoutSpirit Airlines

- Spirit Airlines said on Monday it has reached a deal with Airbus to delay all aircraft deliveries scheduled from the second quarter of 2025 through 2026 and intends to furlough about 260 pilots, as the U.S. carrier looks to save cash.

- The agreement with Airbus would improve Spirit's liquidity by about $340 million over the next two years, the carrier said, adding that there were no changes to its orders scheduled to be delivered during 2027-2029.Oil Mexico

- Mexico's state energy company, Pemex, is planning to cut at least 330,000 barrels per day (bpd) of crude exports in May, leaving customers in the United States, Europe and Asia with a third less supply, two sources said.

- As they require more domestically - Pemex has no option other than applying monthly cuts to exports after its crude production in February fell to the lowest level in 45 years and the country's refineries, including a new facility in the port of Dos Bocas, began taking in more crude oil.Powerball

- A ticket sold in Oregon has won Powerball jackpot of more than $1.3 billion, the eighth largest in U.S. history.

- Powerball drew the numbers early on Sunday and the winning numbers were white balls 22, 27, 44, 52, 69 and red Powerball 9. The drawing is the 41st since the last Powerball winner hit the jackpot on New Year's Day.

- The winner matched the correct six double-digit numbers on a $2 ticket. The chances of that happening are one in 292.2 millionEV Trends

- Hybrids are the thing

- Ford Motor is delaying production of a new all-electric three row vehicle, as it shifts to offer hybrid options across its entire North American lineup, the company said last Thursday.Amazon - Just Walk Out: Cancelled

- Removing from its Fresh stores

- However, unbeknownst to many, the Just Walk Out technology was relying on more than 1000 workers in India who were watching the footage to ensure the checkouts were accurate. The Information alleges that over 70% of sales relied on these human video reviewers.

- WAIT - what?Love the Show? Then how about a Donation?

ANNOUNCING - THE WINNER

for RUMBLE

ANNOUNCING - A NEW CTP

FOR APPLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

10 April 2024, 2:09 am - 1 hour 3 minutesDHUnplugged #696: Bloom Fade

All of a sudden – mood swing

The bloom is off the Rate-Cut-Rose

Leaking Data – Another breach

More AI – lots of $$ committed to this…

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- All of a sudden - mood swing

- Bloom is off the Rate Cut Rose

- Leaking Data - Another breach

- More AI - lots of $$ committed to this...Market Update

- Oil prices moving through key resistance

- Apple back to Oct 2023 support -watch out below?

- Gold/Silver Soaring - into higher rates and higher USD???

- Oil on the riseCTP for Rumble Update

- Marcus G - In the top spot right now....

- - Thatch House dudeHCD: Donations - Need a new Shirt Prize and Design - Plus Contracted Devs prices inflation.

Analyzing Apple's Chart

- Key levels of support

- Down-trendPowell on Good Friday

- PCE report (on day the markets are closed for Good Friday)

-- Showed 2.8% YoY and 0.3% MoM

- Powell tried to talk down market expectations for rate cuts like several other recent speakers

- - Market still hoping for MAYBE 3 - but it looks like June is off the table.Stronger Economy than Thought

- ISM comes in above 50 for the first time in nearly 18 months

- Economic strength + good employment + Inflation = Rate CUT?????

- Market is finally getting the hint

--- 10-Yr rate spiked to 4.38% todayGlobal Economic Trends

- China finally saw its manufacturing number gain some traction last month

--- China's manufacturing activity expanded at the fastest pace in 13 months in March, with business confidence hitting an 11-month high, driven by growing new orders from customers at home and abroad, a private survey showed on Monday.

- South Korea - Sticky inflation (Consumer prices advanced 3.1% in March from a year earlier)Commodities on the rise

- Cocoa futures for May delivery were up 3.9% at $10,030 per metric ton, marking the first time the commodity breaks above the $10,000 mark. Cocoa has been on a tear this year, soaring nearly 39%.

- Ivory Coast, the biggest coca producer in the world, is facing hotter-than-normal temperatures — which have led to dryer-than-usual conditions and crop yields.TSLA

- Q1 deliveries declined by 8.5% yr/yr to 433,000, representing TSLA's first yr/yr decline since the pandemic-impacted year of 2020. Importantly, that decrease is partly due to extraordinary events that were out of TSLA's control.

-- Berlin fire factory shutdown, Red Sea passage issues etch.

- Competition in China is really heating up and cost of EVs from many Chinese manufacturers are much lower.M&A - Amazon

- Amazon.com Inc. says it’s investing an additional $2.75 billion into Anthropic, an artificial intelligence startup.

- The infusion brings Amazon’s total investment in the company, a well-regarded builder of so-called generative AI tools able to generate text and analysis, to $4 billion, following an earlier investment announced in September.

- As part of that deal, Amazon had the right to contribute the additional funds in the form of a convertible note, provided it did so before the end of March.AI NEWS

- Microsoft and OpenAI are in discussions regarding Stargate, a new AI super-computer data center project to be headquartered in the U.S. may cost over $115 billion and is planned for launch in 2028.

- $$$$$$115 BILLION

- That is like 115,000 $1,000,000 homes....

- Stargate’s power requirements, estimated to be several gigawatts (5) may require Microsoft and OpenAI to explore alternative power sources, like nuclear power. Enough to power 3,750,000 for a year!!!!!!!!!!!!!!!!!

----- Hoover Dam X2Meanwhile

- Microsoft will sell its chat and video app Teams separately from its Office product globally, the U.S. tech giant said on Monday, six months after it unbundled the two products in Europe in a bid to avert a possible EU antitrust fine.

- The European Commission has been investigating Microsoft's tying of Office and Teams since a 2020 complaint by Salesforce-owned competing workspace messaging app Slack.AT&T Leak/Breach

- Over the weekend - snuck it in there...

- AT&T has revealed that it has suffered a massive data breach, including the personal data of a combined 73 million current and former customers.

- The data appeared on the dark web approximately two weeks ago, AT&T says, adding that it appears to be “from 2019 or earlier.” It is “not yet known whether the data in those fields originated from AT&T or one of its vendors,” the company adds.

--- ??? So, since it is from 2019 or ealier it does not matter?

- How about this: The good news is that it “does not contain personal financial information or call history.” The bad news is that it does include customer names, home addresses, phone numbers, dates of birth, Social Security numbers and encrypted passcodes.

- The 7.6 million current customers impacted have had their passcodes reset, the company said, though obviously there’s less it can do for data lifted and used for identity theft.POWERBALL?

- The Powerball jackpot has ballooned to a tremendous $1.09 billion after yet another lottery drawing yielded no top winner Monday night.

- Monday’s winning numbers were: 19, 24, 40, 42, 56 and Powerball 23.

- The next drawing will be held Wednesday night. If a player finally snags the jackpot, they could choose the annuitized option, with an initial payment and the remainder spread over 29 years, or the lump-sum option of $527.3 million, both before taxes.

- The jackpot is the fourth-largest in Powerball’s history and could soon close in on the $1.13 billion Mega Millions prize won by a ticket in New Jersey last week.DJT Stock

- Shares of Donald Trump's social media company plunged 21% on Monday, wiping out the gains from its debut last week, after disclosing millions in losses and saying it would struggle to meet its financial liabilities going forward.

- Trump Media & Technology Group lost more than $58 million in 2023, it said in a filing, sending shares reeling less than a week after the Truth Social parent went public through a high-profile blank-check merger.

- Trump owns 78.75 million shares, which could result in a big windfall for the former president, depending on their value. At the stock's peak last week, his stake would have been more than $6 billion, but after the selloff it would be valued at about $3.8 billion.

- Why not do this with all political fundraising - $ for massesLondon and Bridges

- Insurance claims for damage to the bridge alone could reach $1.2 billion, the bank said in a note, predicting further potential liabilities of $350 million to $700 million for wrongful deaths and yet-to-be-determined amounts for business interruptions while access to the city’s port is blocked.

- Lloyds seemed to have been a big insurer and on the hook for a chunk

- Insurance costs going up again due to these crazy or big natural disasters

- Closure of one of the US' biggest ports while the bridge is repaired could also cost millions of dollars, Barclays' analysts said.

-------- The Port of Baltimore is the 14th largest in the US. In 2023, 52.3 million tonnes of foreign cargo, worth $80.8bn, passed through Baltimore, according to data from the state of Maryland.Healthy!

- McDonald's is planning to sell Krispy Kreme doughnuts at its restaurants nationwide by the end of 2026, the chains announced Tuesday.

- The rollout will start in the second half of this year, but it will take roughly two and a half years as Krispy Kreme more than doubles its distribution to satisfy the partnership. For the duration of the agreement, McDonald's will be the exclusive fast-food partner for Krispy Kreme in the U.S.

- Why announce something that is going to take until 2026?

- A cardiologist's dreamBoeing

- Boeing CEO Dave Calhoun will step down at the end of 2024 in part of a broad management shakeup for the embattled aerospace giant.

- Chairman of the board Larry Kellner is also resigning and will leave the board at Boeing's annual meeting in May. He has been replaced as chair by Steve Mollenkopf, who has been a Boeing director since 2020.

- And Stan Deal, president and CEO of Boeing Commercial Airplanes, is leaving the company effective immediately.FedUp

- United Parcel Service said on Monday it will become the United States Postal Service's (USPS) primary air cargo provider, as rival FedEx announced an end to its more than 20-year partnership with the postal service provider.

- USPS was the largest customer for FedEx's air-based Express segment, even as payments declined after the postal service shifted letters and packages from planes to more economical trucks as part of an operational revamp.Love the Show? Then how about a Donation?

ANNOUNCING - THE CTP for RUMBLE

Winners will be getting great stuff like the new DHUnplugged Shirts (Designed by Jimbo) -

PLUS a one-of-a-kind DHUnplugged CTP Winner's certificate..

FED AND CRYPTO LIMERICKS

JCD Score ()

See this week’s stock picks HERE

3 April 2024, 2:22 am - 1 hour 5 minutesDHUnplugged #695: Fresh Frenzy

Fed in Focus – FOMC Rate Decision Wednesday.

Reddit IPO Frenzy!

Inflation – definitely not going away.

Announcing – A New Closest to The Pin

PLUS we are now on Spotify and Amazon Music/Podcasts!

Click HERE for Show Notes and LinksDHUnplugged is now streaming live - with listener chat. Click on link on the right sidebar.

Love the Show? Then how about a Donation?

Follow John C. Dvorak on Twitter

Follow Andrew Horowitz on Twitter

Warm Up

- A New CTP Announced

- No Show Next week - business meetings out of town

- A not so surprising result in the Russian Elections

- An important change to stock trade settlements is comingMarket Update

- Fed in Focus - FOMC Rate Decision Wednesday

- Reddit IPO Frenzy

- Inflation - definitely not going away

- AI Frenzy - Culd Call This DHAI Unplugged - so much AI news to discuss

- Yield FrenzyPPI Release

- After a HOT CPI, PPI Comes in Hotter

- 0.6% on the core - but only 1.6% YoY

- The Producer Price Index for final demand rose 0.6 percent in February.

- Prices for final demand goods advanced 1.2 percent, and the index for final demand services moved up 0.3 percent.

- Prices for final demand advanced 1.6 percent for the 12 months ended in February.

- Markets didn't know what to do with this on Friday.Company Stats - Recession?

- According to FactSet: During Dec-March earnings calls, 47 cited the term “recession” during their earnings calls for the fourth quarter.

-- This number is below the 5-year average of 85 and below the 10-year average of 61.

- This quarter will mark the lowest number of S&P 500 companies citing “recession” on earnings calls for a quarter since Q4 2021Reddit

- IPO slated to be live sometime this week (March 21)

- 5X Oversubscribed

- Reddit began sending invitations to users to participate in the IPO based on one of two measurements of engagement on the site: either the number of actions they’ve taken as a moderator of a forum on the platform (also known as a “subreddit”) or their “karma” score, a figure that indicates a user’s contributions and reputation among other users on the site.

- Reddit plans to list 22 million shares at a price between $31 and $34, according to the latest version of the IPO prospectus it filed Monday with the Securities and Exchange Commission. The company stands to take in between $473.6 million and $519.4 million from the sale of roughly 15.3 million shares.

- Valuation > $6 billion

- Question???? Is Reddit profitable? NO - However, the company has been substantially growing revenue in the past few years.

---- Reddit's total revenue in 2023 was $804 million, up 21% from $666 million in 2022.

----- Reddit's net loss for 2023 narrowed to $90.8 million.Yields - 10 YR

- Highest level of 2024

- technically breaking out - if Fed moves a bot more hawkish - 4.50% is next testJapan Yields

- The Bank of Japan is set to raise its key interest rate for the first time in 17 years on Tuesday following its two-day monetary policy meeting, Kyodo reported.

- The BOJ will raise the short-term rate to the 0%-0.1% range, the report said. The development reflects growing confidence among policymakers that a virtuous cycle of wage growth and price hikes is in motion following this year’s labor-management pay negotiations

- RAISING TO ZERO!Global Rates - Who Will CUT First?

ELON

- Increasing prices on Model Y by $1,000

--- Stock moves up by 6%

- Goldman Downgrades - Perhaps this is why stock moved up - another bug downgrade - stock in the toilet - nowhere else to go