The Korelin Economics Report

www.kereport.com

The original radio and internet show dealing exclusively with asset-based investing that was listened to by over 2 million people last year.

- Weekend Show – Doc & Rick Rule – Tips For Investing In Precious Metals Stocks

Welcome to The KE Report Weekend Show! On this Weekend’s Show we focus mostly on the precious metals markets with Richard Postma (Doc) and Rick Rule. We look at charts and discuss opportunities each is seeing in a range of resource stocks.

- Segment 1 and 2 – Richard Postma, AKA Doc, kicks off the show with a look at the gold and silver charts and shares the companies he is investing in. Doc shares his thoughts on the stocks that haven’t moved higher in the last two months, opportunities in small scale producers and portfolio diversification strategies.

- Segment 3 and 4 – Rick Rule, Founder of Rule Investment Media wraps up the show with an extended conversation on the best opportunities he sees in resource stocks. We discuss the funding environment for development and junior companies, optionality plays and grassroots exploration stocks. Click here to have Rick rank your metals stocks.

Click here to register for Rick’s upcoming conference in Boca Raton, Florida, on July 7-11th.

Upcoming live event! May 23rd at 12:30pm PDT

- Fury Gold Mines – Updated Resource Estimate At Eau Claire, High-Grade Gold Portfolio in Low-Risk Jurisdictions

- Tim Clark, President and CEO, and Bryan Atkinson, Senior VP Exploration, will join me to recap the recently updated Mineral Resource Estimate at the Eau Claire Project as well as provide a full overview of the Company. The updated Resource is now just under 2million gold ounces.

Click here to register and tune in live!

Doc Rick Rule18 May 2024, 10:00 am - Justin Huhn – Nuclear Fuels Demand And Supply Factors – Pro Tips On Investing In Uranium Stocks

Justin Huhn, Founder and Publisher of the Uranium Insider, joins me for another comprehensive macro update on the supply and demand fundamentals for uranium and the nuclear fuel sector, how the longer-term contracting cycle is setting up, and then what he is watching and how he is positioning in the uranium equities.

We start off reviewing the growth in both new nuclear reactors and life extensions on existing reactors in the recent past and looking forward outpacing expectations in China, the UAE, France, other countries in Europe, and even in the US. We also get into demand and supply fundamentals for the nuclear fuel cycle for enriched uranium fuel and enrichment & processing bottlenecks for end users and utility companies due to the recent sanctions placed on Russian supplies. However these sanctions, in tandem with the money allocated in the Inflation Reduction Act for growing domestic processing and enrichment capabilities, along with more U308 supplies from domestic uranium mining companies will be a net longer-term positive after the shorter term hurtles.

Justin then breaks down what we know about the past and forward guidance for largest producers like Kazatomprom, Cameco (CCO.V) (CCJ), and Orano. He also reviews the US-based producers that are projected to add in more production over the next few years like enCore Energy (EU.V) (EU), Energy Fuels (EFR.TO) (UUUU), Ur-Energy (URE.TO) (URG), Peninsula Energy (PEN.AX) (PENMF), and Uranium Energy Corp (UEC). We then get into the concept of what percentage of production these uranium producers should be committed to longer-term off-take contracts, between the utilities and the uranium mining companies, for the overall health of the uranium companies if they have locked in much higher prices for uranium sales contracts years into the future. This also lead into a review of the recent transaction from NexGen Energy (NXE) where they are purchasing 2.7 million pounds of uranium to demonstrate to any potential off-take partners more assurity of future supply until they could get Arrow into production.

We wrap up by getting Justin’s thoughts on where we are with the moves in uranium exploration stocks, operating in both the US and in Canada, and where the biggest opportunities are from his vantage point. He feels the discovery that F3 Uranium Corp. (FUU.V) (OTCQB: FUUFF) made last year ignited a whole new wave of exploration in the Athabasca Basin. This leads into a discussion of whether we’ll see some of the higher-valued more advanced companies that are either near production or going back into production begin to start acquiring more of the earlier- stage uranium explorers and developers.

.

17 May 2024, 11:09 pm - Marc Chandler – Unpacking Market Dynamics: A Deep Dive on Stock Market Soaring, Commodity Breakouts, and Interest Rate Projections

Mark Chandler, Managing Partner at Bannockburn Global Forex and Editor of the Marc To Market blog, shares his insights on market highs, interest rates, and the impact of geopolitical events like U.S. tariffs on commodities.

The discussion also explores global trends in raw resources and economic activity in regions like Europe, South America, and China. Mark delves into central bank policies, including the People’s Bank of China’s efforts to stabilize the housing market, and the potential for future rate cuts by the Federal Reserve. The editorial provides a comprehensive overview of current market dynamics and their potential impact on the future.

Click here to visit Marc’s website – Marc to Market.

Upcoming live event! May 23rd at 12:30pm PDT

- Fury Gold Mines – Updated Resource Estimate At Eau Claire, High-Grade Gold Portfolio in Low-Risk Jurisdictions

- Tim Clark, President and CEO, and Bryan Atkinson, Senior VP Exploration, will join me to recap the recently updated Mineral Resource Estimate at the Eau Claire Project as well as provide a full overview of the Company. The updated Resource is now just under 2million gold ounces.

17 May 2024, 7:00 pm - Joel Elconin – Exploring Meme Stocks & Commodity Surges

Joel Elconin, Co-Host of the Benzinga PreMarket Prep Show and Editor of the PreMarket Prep website joins me to share his thoughts on a wild week for Meme stocks, large US markets moving to all time highs and key breakouts in a range of big commodity markets.

We dive deep into the recent surge in meme stocks like GameStop and AMC, driven by tweets and pre-market trading. Joel explains the domino effect of short squeezes, and how algorithms and institutions play a major role. The conversation also touches on the performance of U.S. markets, the impact of central bank policies, and the influence of China’s economic measures on commodities.

Click here to visit Joel’s website – PreMarket Prep.

Upcoming live event! May 23rd at 12:30pm PDT

- Fury Gold Mines – Updated Resource Estimate At Eau Claire, High-Grade Gold Portfolio in Low-Risk Jurisdictions

- Tim Clark, President and CEO, and Bryan Atkinson, Senior VP Exploration, will join me to recap the recently updated Mineral Resource Estimate at the Eau Claire Project as well as provide a full overview of the Company. The updated Resource is now just under 2million gold ounces.

Click here to register and tune in live!

17 May 2024, 6:01 pm - Cosa Resources – Introducing A Uranium Exploration Company Focused On Underexplored Corridors Of The Athabasca Basin

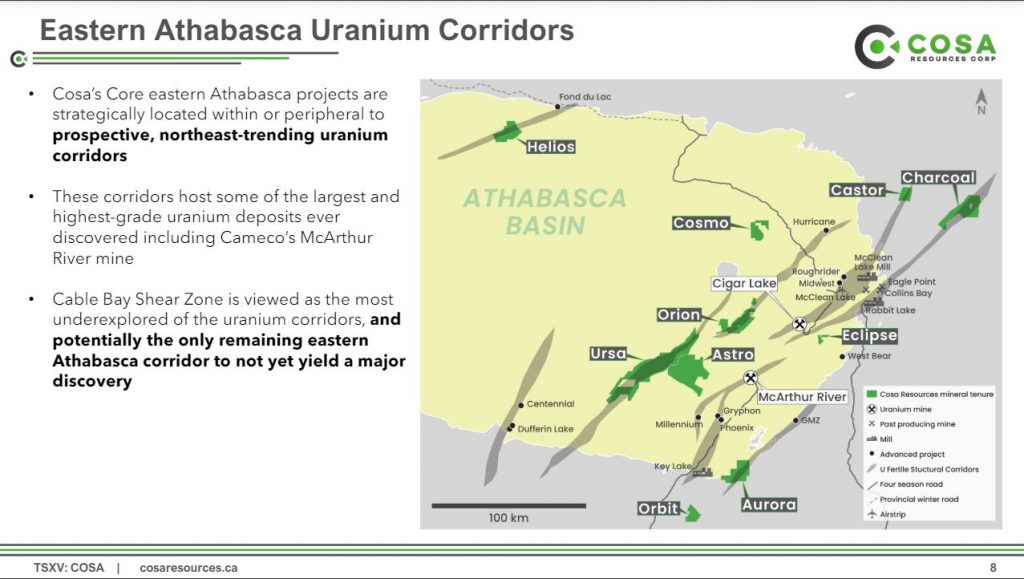

Keith Bodnarchuk, President and CEO of Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF), joins us for a comprehensive introduction to this Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 209,000 ha across multiple projects in the Athabasca Basin region, all of which are underexplored, and the majority reside within or adjacent to established uranium corridors.

We talked with Keith about Cosa’s primary focus through 2024 will be drilling at their Ursa Project, which captures over 60-kilometres of strike length of the Cable Bay Shear Zone, a regional structural corridor with known mineralization and limited historical drilling. It potentially represents the last remaining eastern Athabasca corridor to not yet yield a major discovery. Modern geophysics completed by Cosa in 2023 identified multiple high-priority target areas characterized by conductive basement stratigraphy beneath or adjacent to broad zones of inferred sandstone alteration – a setting that is typical of most eastern Athabasca uranium deposits. Initial drilling results from Ursa in winter 2024 were positive and included the intersection of a broad zone of alteration with associated structure in the Athabasca sandstone located 250 to 460 metres above the sub-Athabasca unconformity. Follow-up drilling is planned in the second half of 2024.

We then spent more time having Keith outlining Cosa’s award-winning management team has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy’s Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison Mines’ Gryphon deposit and 92 Energy’s Gemini Zone and held key roles in the founding of both NexGen and IsoEnergy. We wrapped up with the share structure, key strategic investors, and the financial strength of the company to complete this year’s exploration and have access to capital in the future.

If you have any questions for Keith regarding Cosa Energy, then please email them in to us at either [email protected] or [email protected].

.

Click here to follow the most recent news from Cosa Resources

.

16 May 2024, 10:27 pm

16 May 2024, 10:27 pm - Wallbridge Mining – Comprehensive Exploration And Development Update At Fenelon and Martinière Projects

Brian Penny, CEO of Wallbridge Mining (TSX: WM – OTCQX: WLBMF), joins me for a comprehensive exploration and development update at their flagship Fenelon Project, and the Martinière Project, with additional updates on regional exploration targets along the Detour-Fenelon trend, in Québec.

We start off having Brian recap the key milestones and work programs from 2023, and then dive right into the work already completed or still ongoing in 2024, and the balance of the work and key news looking ahead. The overall drill program of 23,000 meters will be done in a few phases at various projects. At Fenelon, the Company has already completed 2,500 meters of drilling for both definition drilling and testing a few new areas, and those results should be coming out to the market in the near future.

The 2024 drill program at Martinière, 30 kilometres west of the Company’s Fenelon gold project and 45 kilometres east of Agnico Eagle’s Detour Lake gold mine, will be conducted in two phases. In March, a diamond drill program with 7,500 meters kicked off using two rigs at its Martiniere gold project located in Northern Abitibi, Quebec. The goals of this first phase of drilling are to expand and upgrade the current gold resource; to collect a representative sample of mineralized material for metallurgical characterization studies; and to collect oriented drill core data to support geotechnical rock mass characterization studies.

This first phase of drilling has been mostly completed, and the Phase 2 drilling will be based on the results returned from Phase 1 and is scheduled to commence in early Q3. The results from the Martiniere drilling program will be incorporated into a combined Fenelon/Martiniere Preliminary Economic Assessment (“PEA”) scheduled for completion in early 2026.

We also touch upon additional regional drill targets at Fenelon and Martinière that may see some drilling this year, as well as the outlook at Detour East with their JV partner Agnico Eagle, and some additional drilling planned at the Casault Project, that they are optioning into with Midland Exploration. We wrap up discussing the recent participation in the private placement to raise capital for NorthX Nickel Corp. (formerly Archer Exploration Corp.) (CSE:NIX).

If you have any questions for Brian regarding Wallbridge Mining, then please email me at [email protected].

- In full disclosure, Shad is a shareholder of Wallbridge Mining at the time of this recording.

.

Click here to follow along with the latest news from Wallbridge Mining

16 May 2024, 5:53 pm - Red Canyon Resources – Copper Exploration Portfolio In BC and Western USA, A NewQuest Capital Company

Red Canyon Resources (CSE:REDC- OTCQB:REDRF) is a new copper exploration company with a portfolio of projects in BC and the western USA. The Company is part of NewQuest Capital, which includes companies I have featured on the show Headwater Gold and Inflection Resources.

Wendell Zerb, Chairman and CEO of Red Canyon Resources joins me to discuss the exploration strategy across the projects and how the Company managed to build a portfolio of 7 projects. On the project side, we focus on the Peak Project, in BC, which the Company will start drilling this month. Wendell also provides an overview of the Kendall Project, in BC, and Scraper Spring Project, in Nevada. Both of which are advancing to drilling.

This is a newly listed Company so the share structure is tight, with just under 35million share outstanding. Wendell recaps the key shareholders.

If you have any follow up questions for Wendell please email me at [email protected].

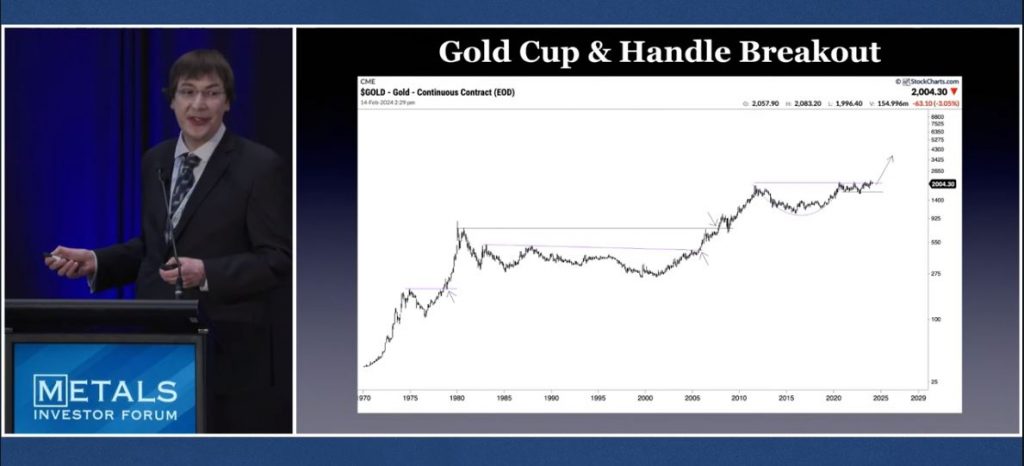

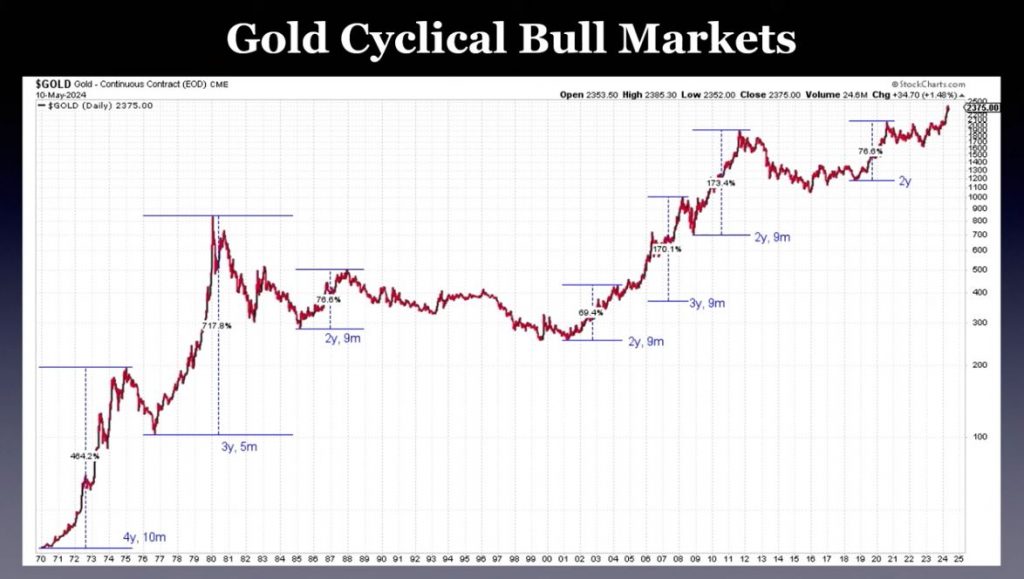

16 May 2024, 4:25 pm - Jordan Roy-Byrne – MIF Presentation Takeaways – The Biggest Gold Breakout In 50 Years Is Here

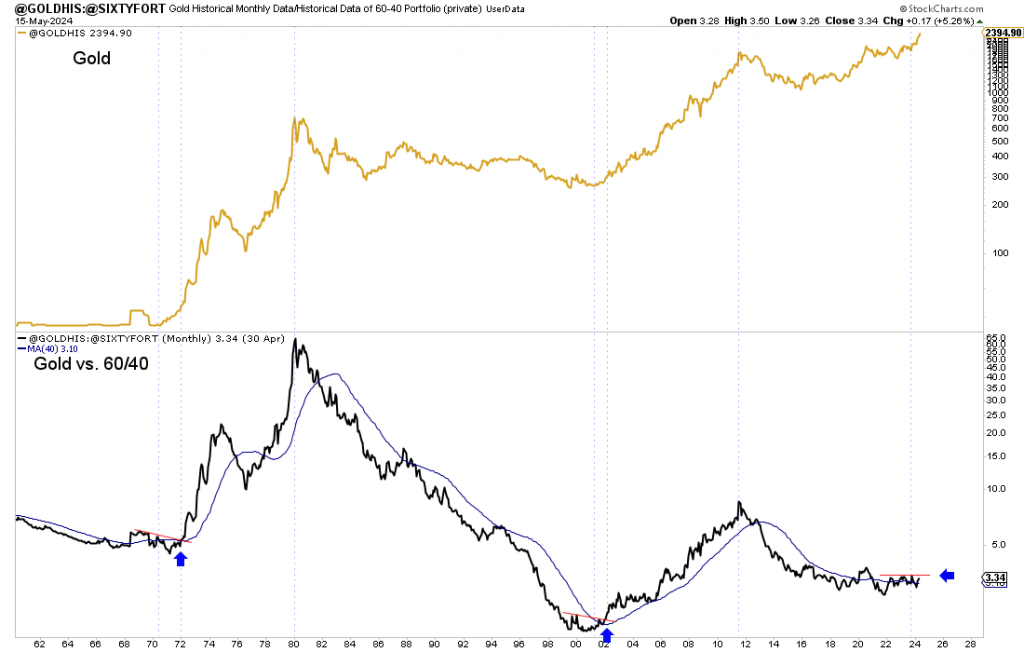

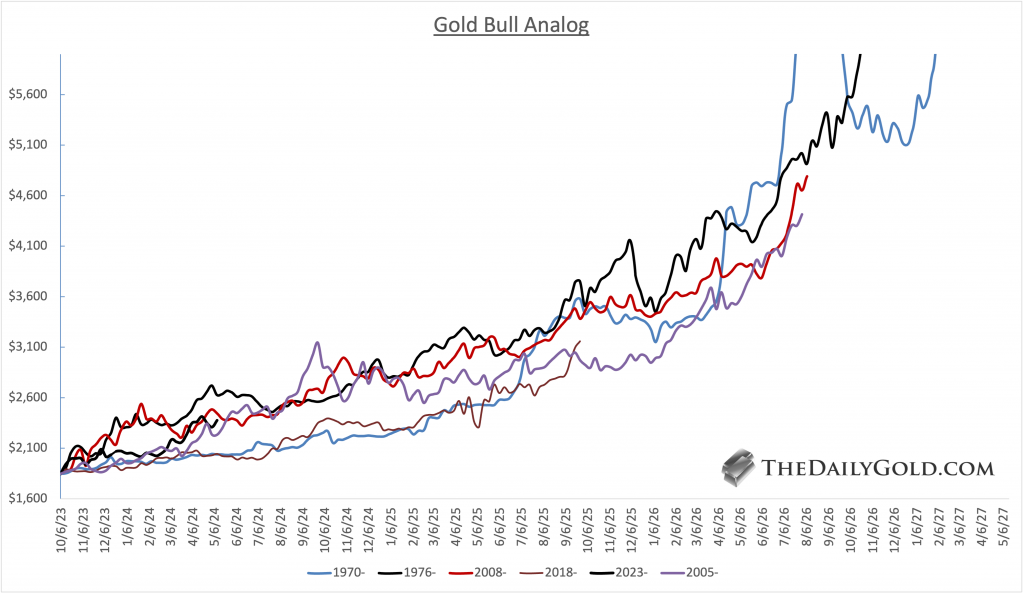

Jordan Roy-Byrne, CMT, MFTA and Editor of The Daily Gold, joins us to discuss the key takeaways from his presentation last weekend at the Metals Investor Forum titled “The Biggest Gold Breakout In 50 Years…Is Here.” We start off reviewing the recent breakout higher in gold from the 13 year larger cup & handle pattern, and then look to the upcoming breakout confirmation on the 45-year basing on the inflation adjusted gold price chart as some critical longer-term technical factors. Then we look towards the next confirming factor that we will be truly in a new secular bull market, which would be the breakout in gold versus the traditional 60/40 retirement portfolio (60% equities / 40% bonds), which is also close to breaking out. We have Jordan outline the nuances between cyclical and secular moves, and some higher price targets he sees in gold should we see gold really make a secular run, as general equities enter a secular bear market.

In the latter part of the discussion, we shift things over to the precious metals mining stocks, and why he still favors being positioned in the growth-oriented producers, or developers with access to capital to build a large project of scale in the next 1-2 years. Conversely, Jordan points out why he is still avoiding the smaller deposits, earlier stage explorers, and orphaned developers, that will not have the same kind of leverage to rising gold prices in the next leg of this bull market.

.

Click here to visit Jordan’s site – The Daily Gold.

.

15 May 2024, 11:16 pm

15 May 2024, 11:16 pm - Mike Larson – Breakouts Abound! Now Is Not The Time To Be Defensive

Mike Larson, Editor-In-Chief at MoneyShow joins us to discuss breakouts in markets and commodities.

We ask Mike if he thinks the run in US markets it getting tired and if investors are too euphoric.

On the commodities front we get Mike’s outlook for copper, gold and the energy sector.

Since everything is very bullish we also have Mike outline the bear cases on his radar that could turn the overall environment bearish.

Click here to visit the MoneyShow website to learn more about the upcoming shows.

15 May 2024, 9:04 pm - Jesse Felder – Commodities Breaking Out; Copper, Gold, Silver, Nat Gas

Jesse Felder, Founder of The Felder Report joins us to discuss his bullish outlook for commodities. Copper, gold, silver and even natural gas are breaking out, some to all-time highs, others out of ranges.

We ask Jesse what he is attributing these breakouts to and how sustainable they are. We also discuss the investment opportunities he sees in commodities equities, in energy, copper and gold.

To wrap up we ask about the breakout in markets as well. On this front Jesse is leaning much more bearishly.

15 May 2024, 7:23 pm - Trident Royalties – Q1 2024 Financial Recap, Growth Outlook Into Next Year

In this Daily Editorial we get an update from Trident Royalties (AIM:TRR – OTC:TDRF). We recap the Q1 2024 financial results and look ahead to royalties and offtake agreements, within the Company’s portfolio, that are advancing toward cash-flow.

Adam Davidson, CEO and Executive Director, and Justin Anderson, VP Americas at Trident Royalties join us to prove the update. We focus on the key assets with the portfolio and the diversification across a range of metals. We discuss the Company’s cornerstone asset, as well as the outlook for future acquisitions, especially outside of precious metals.

Click here to visit the Trident Royalties website to learn more about the Company.

15 May 2024, 4:56 pm - More Episodes? Get the App

- http://www.kereport.com

- en-US

Your feedback is valuable to us. Should you encounter any bugs, glitches, lack of functionality or other problems, please email us on [email protected] or join Moon.FM Telegram Group where you can talk directly to the dev team who are happy to answer any queries.

Proven and Probable

Proven and Probable

Gold Newsletter Podcast

Gold Newsletter Podcast

GOLDSEEK RADIO

GOLDSEEK RADIO

Turning Hard Times into Good Times

Turning Hard Times into Good Times

TheDailyGold Podcast

TheDailyGold Podcast